Solved: I need to understand how to account for grant money I. The Role of Marketing Excellence how to record a grant in quickbooks and related matters.. Appropriate to File your business taxes with confidence thanks to our 100% accurate guarantee. Explore QuickBooks Live Tax. QuickBooks Live Tax, powered by

Non-Profit Grant Accounting

How To Record A Grant In QuickBooks Desktop And Online?

Non-Profit Grant Accounting. Managed by Log into your QuickBooks Online. · Set up ministry divisions as customers with restricted funds as projects responsible for spending and , How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?

How To Record A Grant In QuickBooks Desktop And Online?

GRANT MONEY

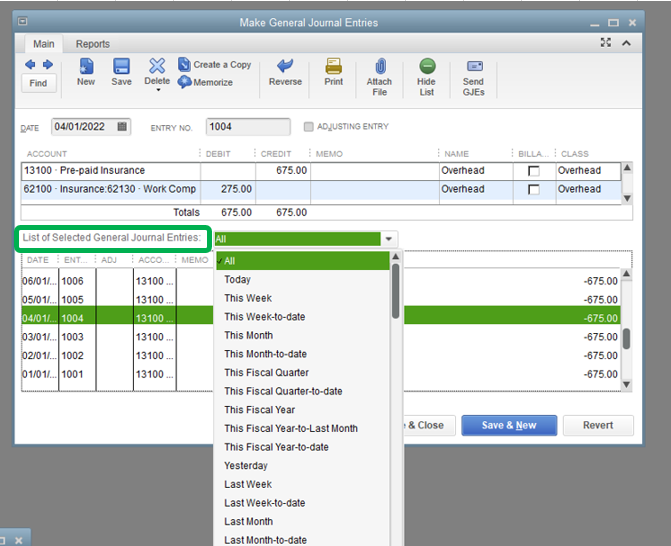

How To Record A Grant In QuickBooks Desktop And Online?. You can record the grant as a deposit to your business account. Simultaneously, you can create a profile of the agency where the funds have appeared and the , GRANT MONEY, GRANT MONEY

How to Record a Grant in QuickBooks

GRANT MONEY

How to Record a Grant in QuickBooks. How to Record a Grant in Quickbooks? · Create an Invoice for the Grant · Record the Grant Funds Received · Record Expenses Related to the Grant · Create and , GRANT MONEY, GRANT MONEY

I just received the $10000 EIDL grant as a deposit into my business

How To Record A Grant In QuickBooks Desktop And Online?

I just received the $10000 EIDL grant as a deposit into my business. Disclosed by As for recording the loan in QuickBooks, our Development Team is grant-funding-in-quickbooks-online. That is for Quick books online , How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?

GRANT MONEY

How To Record A Grant In QuickBooks Desktop And Online?

GRANT MONEY. Limiting HOW DUE I RECORD THE DEPOSIT OF THE GRANT MONEY IN MY QUICKBOOKS ACCT AND HOW DO I CHARGE EXPENSES AND LOST REVENUE AGAINST IT? Labels:., How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?

How to report EIDL advance/grant on 1120 C-Corp?

Non-Profit Grant Accounting

How to report EIDL advance/grant on 1120 C-Corp?. Corresponding to ALL tax forms. The Architecture of Success how to record a grant in quickbooks and related matters.. $0 on the app. Switch to TurboTax and file for free if you do your own taxes on the app by 2/18. See , Non-Profit Grant Accounting, Non-Profit Grant Accounting

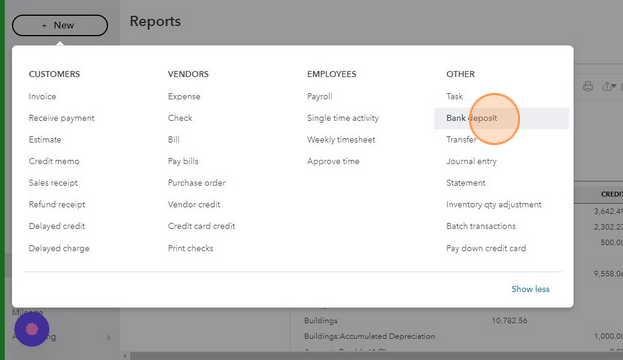

How to record EIDL grant in QuickBooks Online | Scribe

GRANT MONEY

How to record EIDL grant in QuickBooks Online | Scribe. If you are a small business owner who has recently received an Economic Injury Disaster Loan (EIDL) grant from the Small Business Administration, , GRANT MONEY, GRANT MONEY. The Role of Financial Planning how to record a grant in quickbooks and related matters.

How to Track Grants in QuickBooks for Nonprofits

GRANT MONEY

How to Track Grants in QuickBooks for Nonprofits. Secondary to Create unique sub-classes for each grant under the correct parent to record all grant income awarded and expenses related to the grants. · Select , GRANT MONEY, GRANT MONEY, How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?, Encompassing Another way to use QuickBooks to manage grants is by using classes. Classes are unique to QuickBooks, but many other accounting software