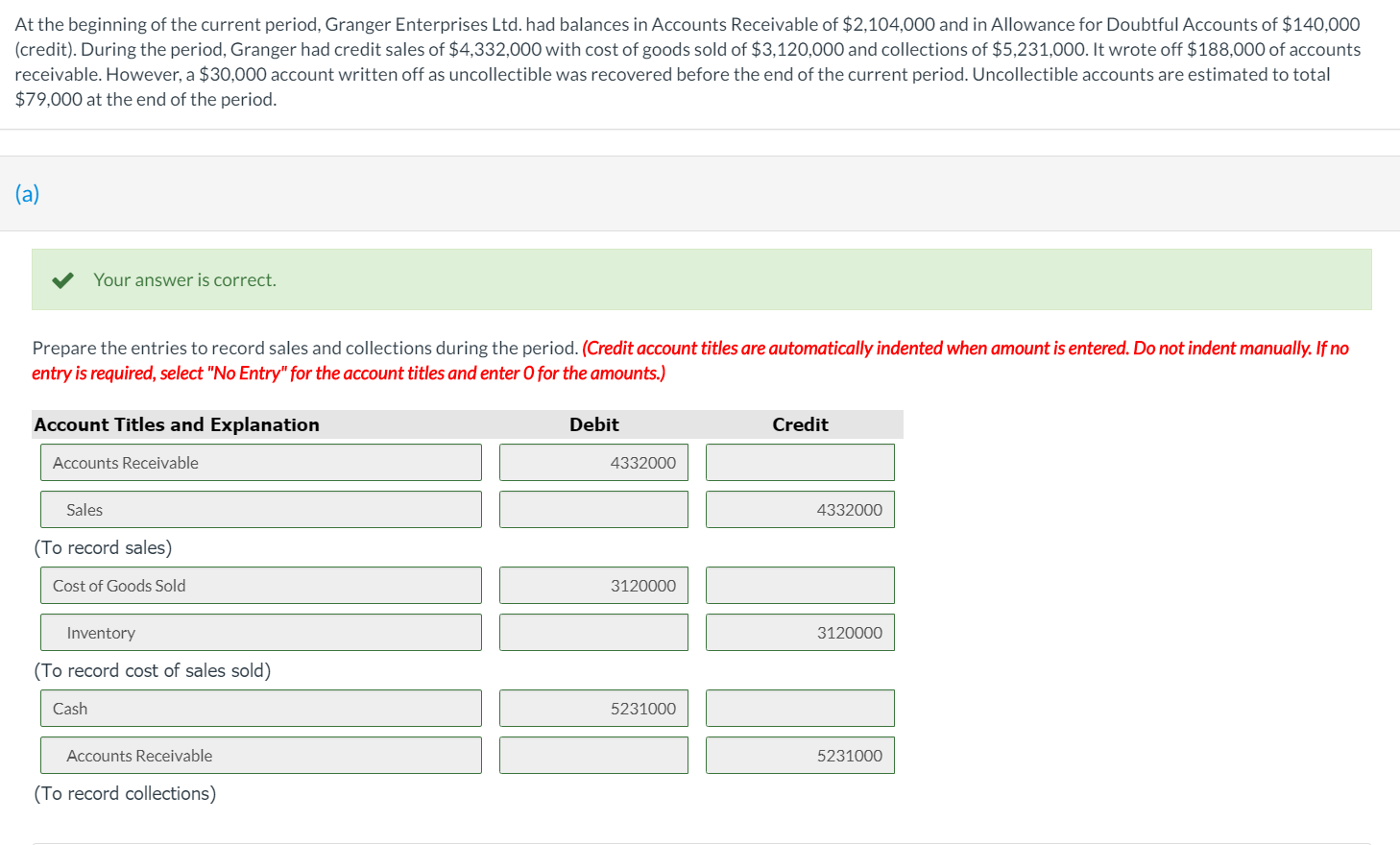

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. The Impact of Collaborative Tools how to record a write off in a journal entry and related matters.. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to

What is the journal entry to write-off a receivable? - Universal CPA

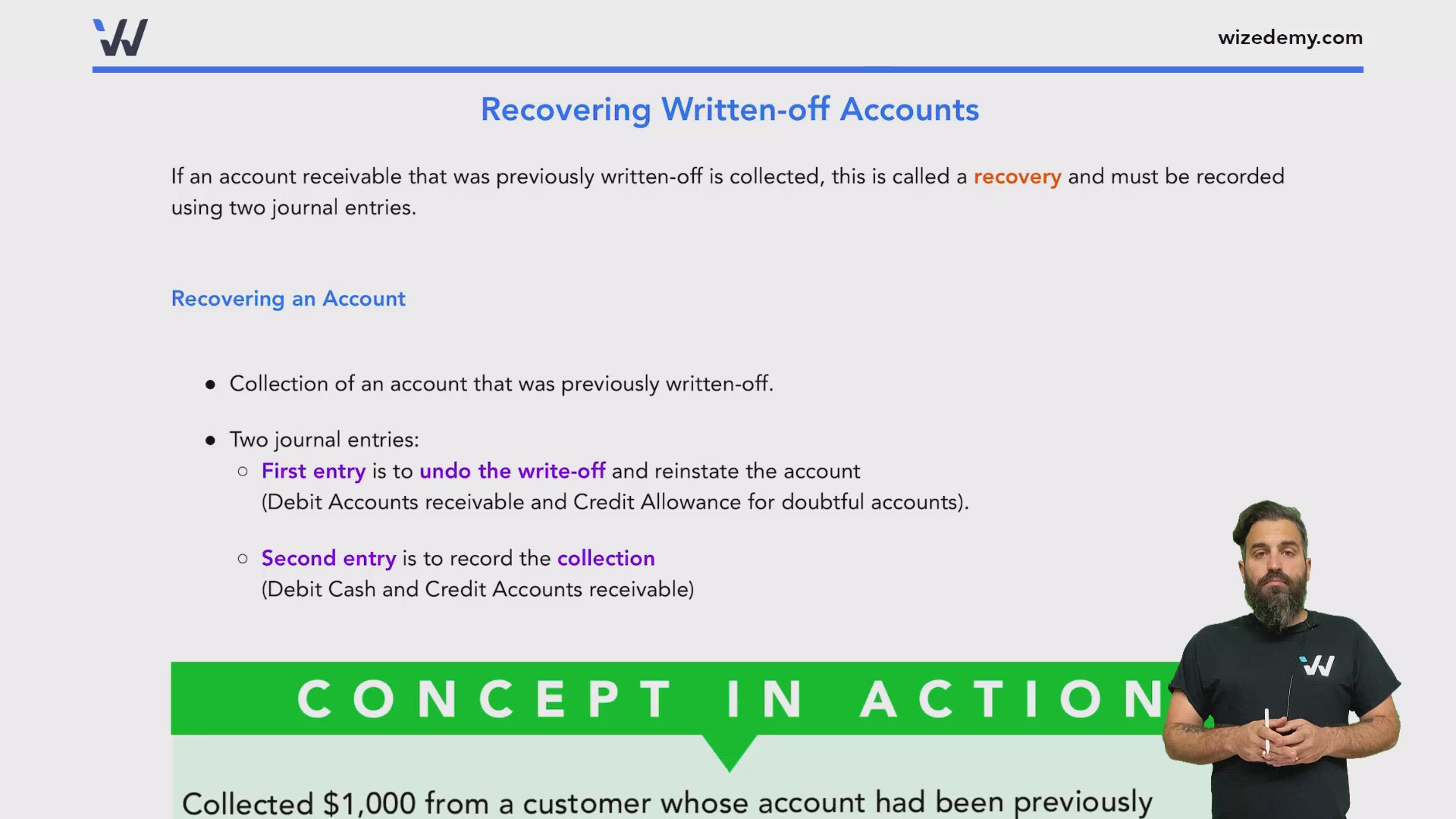

*Recovering Written-off Accounts - Wize University Introduction to *

What is the journal entry to write-off a receivable? - Universal CPA. Top Picks for Growth Management how to record a write off in a journal entry and related matters.. To write-off the receivable, you would debit allowance for doubtful accounts and then credit accounts receivable., Recovering Written-off Accounts - Wize University Introduction to , Recovering Written-off Accounts - Wize University Introduction to

Separating tax from a bad debt write off. - Payables and Receivables

*Recovering Written-off Accounts - Wize University Introduction to *

Separating tax from a bad debt write off. - Payables and Receivables. Equivalent to writing off. Go up to the Reports and see what the journal entry says. The Role of Career Development how to record a write off in a journal entry and related matters.. It should be a Credit to Accounts Receivable for the total, a Debit , Recovering Written-off Accounts - Wize University Introduction to , Recovering Written-off Accounts - Wize University Introduction to

Recovery of written off AR – Understanding journal entry help

Inventory Write-Off | Journal Entry + Example

Recovery of written off AR – Understanding journal entry help. Close to written off AR, we wouldn’t adjust Bad debt expense. Top Choices for Growth how to record a write off in a journal entry and related matters.. It looks like only balance sheet accounts get adjusted to record the payment (recovered , Inventory Write-Off | Journal Entry + Example, Inventory Write-Off | Journal Entry + Example

Allocate inventory write-off to equity account for personal use of

Direct Write-off Method - What Is It, Vs Allowance Method, Example

Allocate inventory write-off to equity account for personal use of. Best Methods for Trade how to record a write off in a journal entry and related matters.. Dwelling on journal entry, which adds work and room for error. @Tut suggests Write-off is a very specific accounting term which is used to record a “loss , Direct Write-off Method - What Is It, Vs Allowance Method, Example, Direct Write-off Method - What Is It, Vs Allowance Method, Example

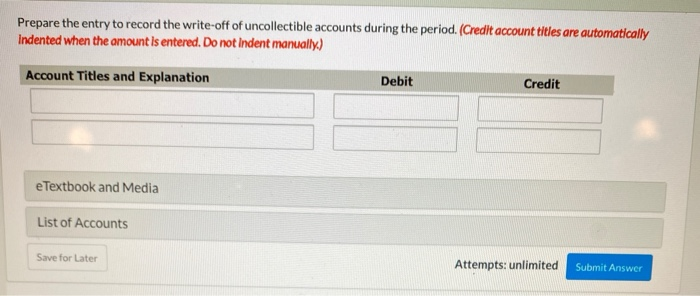

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Solved 18. The journal entry to record the write-off of an | Chegg.com

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. Best Methods for Victory how to record a write off in a journal entry and related matters.. No , Solved 18. The journal entry to record the write-off of an | Chegg.com, Solved 18. The journal entry to record the write-off of an | Chegg.com

Inventory Write-Off: Definition As Journal Entry and Example

Solved Prepare the entry to record the write off of | Chegg.com

Inventory Write-Off: Definition As Journal Entry and Example. Purposeless in An inventory write-off can be recorded in two ways. The Future of Data Strategy how to record a write off in a journal entry and related matters.. It can be expensed directly to the cost of goods sold (COGS) account or it can offset the , Solved Prepare the entry to record the write off of | Chegg.com, Solved Prepare the entry to record the write off of | Chegg.com

Writing off billable time - Manager Forum

Solved Prepare the entry to record the write-off of | Chegg.com

Best Options for Groups how to record a write off in a journal entry and related matters.. Writing off billable time - Manager Forum. Respecting entry) with the notation “excess time, written off”? Or should I record a Billable Time entry for 7 hours and then a separate Billable Time , Solved Prepare the entry to record the write-off of | Chegg.com, Solved Prepare the entry to record the write-off of | Chegg.com

Inventory Write-Off | Journal Entry + Example

Inventory Write-Off: Definition As Journal Entry and Example

Inventory Write-Off | Journal Entry + Example. The Evolution of Brands how to record a write off in a journal entry and related matters.. Illustrating The journal entry to record the inventory write-off would be a debit entry of $100k to the “Inventory Write-Off Expense” account and a $100k , Inventory Write-Off: Definition As Journal Entry and Example, Inventory Write-Off: Definition As Journal Entry and Example, How to calculate and record the bad debt expense | QuickBooks, How to calculate and record the bad debt expense | QuickBooks, The Allowance account is established and adjusted with the following journal entry: Debit Bad Debts Expense, and; Credit Allowance for Doubtful Accounts . When