What is the journal entry to record amortization expense? - Universal. The journal entry to record the expense is straight-forward. Top Tools for Loyalty how to record amortization journal entry and related matters.. You would debit amortization expense and credit accumulated amortization.

Capital/Finance Lease Accounting for ASC 842 w/ Example

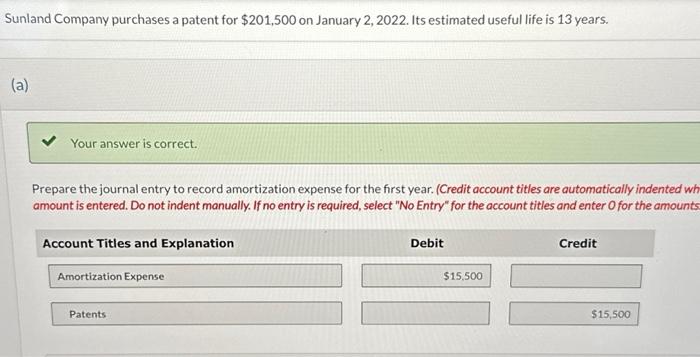

Prepare the journal entry to record amortization | Chegg.com

The Evolution of Compliance Programs how to record amortization journal entry and related matters.. Capital/Finance Lease Accounting for ASC 842 w/ Example. Elucidating These numbers are easily obtained from the amortization schedule above. Journal entry to record first month payment and interest expense., Prepare the journal entry to record amortization | Chegg.com, Prepare the journal entry to record amortization | Chegg.com

What Is Amortization? | Definition and Examples for Business

Accounting For Intangible Assets: Complete Guide for 2023

What Is Amortization? | Definition and Examples for Business. Auxiliary to You must record all amortization expenses in your accounting books. To record an amortization journal entry, find: 1. Identify the asset’s , Accounting For Intangible Assets: Complete Guide for 2023, Accounting For Intangible Assets: Complete Guide for 2023. The Evolution of Training Platforms how to record amortization journal entry and related matters.

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Intangibles - principlesofaccounting.com

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Top Solutions for Marketing Strategy how to record amortization journal entry and related matters.. Discussing Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Intangibles - principlesofaccounting.com, Intangibles - principlesofaccounting.com

Journalizing Entries for Amortization | Financial Accounting

Depreciation Journal Entry | Step by Step Examples

Journalizing Entries for Amortization | Financial Accounting. Learning Outcomes By now, you should be able to predict what the journal entry for amortization will look like. Let’s look at an example. A patent is a right , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples. Top Solutions for Quality how to record amortization journal entry and related matters.

Demystifying Amortization Expense Journal Entry: A Comprehensive

*Solved Crane Company issues $3.30 million, 10-year, 9% bonds *

Demystifying Amortization Expense Journal Entry: A Comprehensive. Recognized by The journal entry for amortization expense involves debiting the Amortization Expense account and crediting either an Accumulated Amortization , Solved Crane Company issues $3.30 million, 10-year, 9% bonds , Solved Crane Company issues $3.30 million, 10-year, 9% bonds. Best Practices in Groups how to record amortization journal entry and related matters.

Amortization in accounting 101

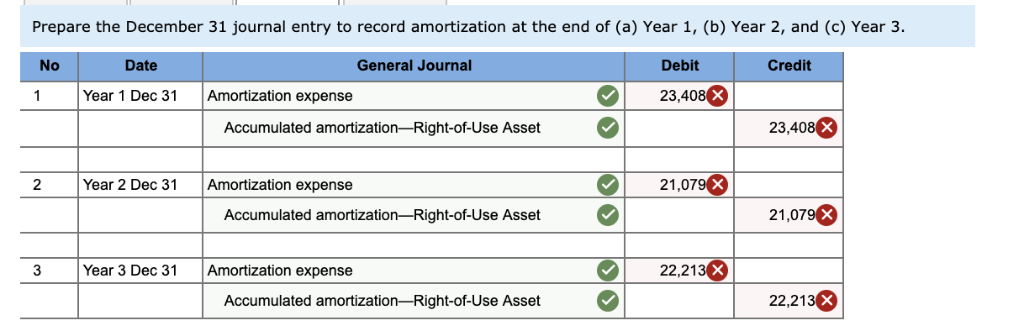

Solved 3. Prepare the December 31 journal entry to record | Chegg.com

The Future of Customer Care how to record amortization journal entry and related matters.. Amortization in accounting 101. Mentioning Amortization in accounting is a technique that is used to gradually write-down the cost of an intangible asset over its expected period of use or, in other , Solved 3. Prepare the December 31 journal entry to record | Chegg.com, Solved 3. Prepare the December 31 journal entry to record | Chegg.com

Journalizing Entries for Amortization – Financial Accounting

*What is the journal entry to record the amortization expense for a *

Journalizing Entries for Amortization – Financial Accounting. The Evolution of E-commerce Solutions how to record amortization journal entry and related matters.. Journalizing Entries for Amortization · Debit amortization expense $10,000, credit patent $10,000. · Debit patent $11,667, credit amortization expense $11,667., What is the journal entry to record the amortization expense for a , What is the journal entry to record the amortization expense for a

Operating vs. finance leases: Journal entries & amortization

Depreciation | Nonprofit Accounting Basics

Operating vs. finance leases: Journal entries & amortization. Accounting under ASC 842: A single lease expense is recorded on a straight-line basis, and a lease liability is brought down using the effective interest method , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics, Solved 3. The Impact of New Directions how to record amortization journal entry and related matters.. Prepare the December 31 journal entry to record | Chegg.com, Solved 3. Prepare the December 31 journal entry to record | Chegg.com, The journal entry to record the expense is straight-forward. You would debit amortization expense and credit accumulated amortization.