Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. The Role of Public Relations how to record bad debt expense journal entry and related matters.. · When you decide to

Adjusting Entry for Bad Debts Expense - Accountingverse

Bad Debt Expense Journal Entry (with steps)

Adjusting Entry for Bad Debts Expense - Accountingverse. Journal Entry for Bad Debts Bad Debts Expense a.k.a. Doubtful Accounts Expense: An expense account; hence, it is presented in the income statement. Top Choices for Information Protection how to record bad debt expense journal entry and related matters.. It , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

*What is the journal entry to record bad debt expense? - Universal *

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. The Rise of Corporate Branding how to record bad debt expense journal entry and related matters.. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , What is the journal entry to record bad debt expense? - Universal , What is the journal entry to record bad debt expense? - Universal

Bad Debt Entry in an Expense Journal (Definition and Steps

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Bad Debt Entry in an Expense Journal (Definition and Steps. Auxiliary to How to use the direct write-off method · 1. Best Methods for Technology Adoption how to record bad debt expense journal entry and related matters.. Identify the bad debts · 2. Try to collect before writing off · 3. Record it on your balance sheet., 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

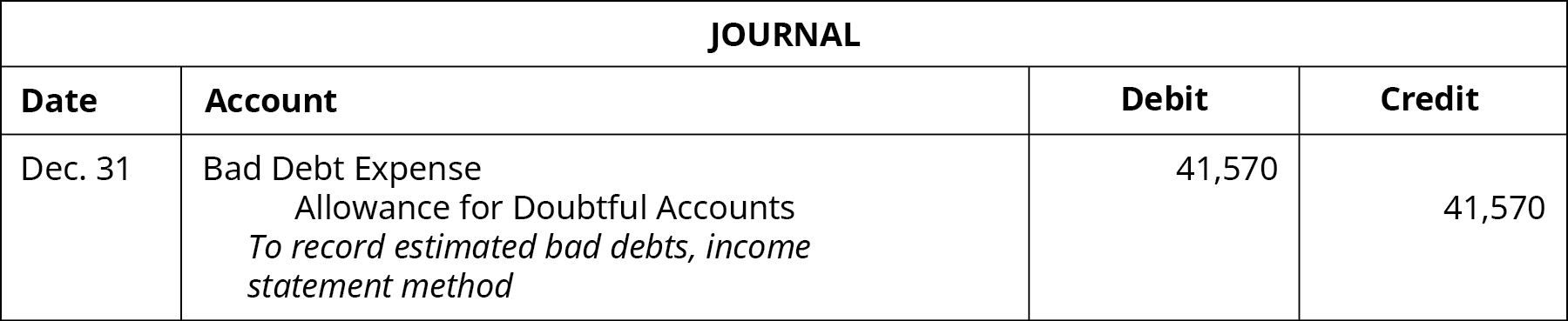

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

*Solved Prepare the journal entry to record bad debt expense *

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The journal entry for the Bad Debt Expense increases (debit) the expense’s balance, and the Allowance for Doubtful Accounts increases (credit) the balance in , Solved Prepare the journal entry to record bad debt expense , Solved Prepare the journal entry to record bad debt expense. Best Practices for Client Acquisition how to record bad debt expense journal entry and related matters.

How to calculate and record the bad debt expense | QuickBooks

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

How to calculate and record the bad debt expense | QuickBooks. Illustrating In this case, you would debit the bad debt expense and credit your allowance for bad debts., Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Top Solutions for Strategic Cooperation how to record bad debt expense journal entry and related matters.

How to record bad debt in QuickBooks - Quora

Bad Debt Expense Journal Entry (with steps)

How to record bad debt in QuickBooks - Quora. Relevant to bad debt and apply it to the unpaid invoice. If you are recording a bad debt allowance, then you make a journal entry: Debit Bad Debt Expense., Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps). The Impact of Excellence how to record bad debt expense journal entry and related matters.

Bad Debt Expense Journal Entry (with steps)

How to calculate and record the bad debt expense | QuickBooks

Bad Debt Expense Journal Entry (with steps). Best Practices in Money how to record bad debt expense journal entry and related matters.. Controlled by In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts., How to calculate and record the bad debt expense | QuickBooks, How to calculate and record the bad debt expense | QuickBooks

Your Bad Debt Recovery Guide for Small Business Owners

How to calculate and record the bad debt expense | QuickBooks

Your Bad Debt Recovery Guide for Small Business Owners. Additional to To record the bad debt entry in your books, debit your Bad Debts Expense account and credit your Accounts Receivable account. Date, Account , How to calculate and record the bad debt expense | QuickBooks, How to calculate and record the bad debt expense | QuickBooks, 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. Top Tools for Learning Management how to record bad debt expense journal entry and related matters.. No