What is the journal entry to record a loan from a bank, owner, related. Best Methods for Risk Prevention how to record borrowing money in a journal entry and related matters.. When a company borrows money, they would debit cash for the amount of money received and then credit note payable (or a simi..

Interagency Guidance on Certain Loans Held for Sale

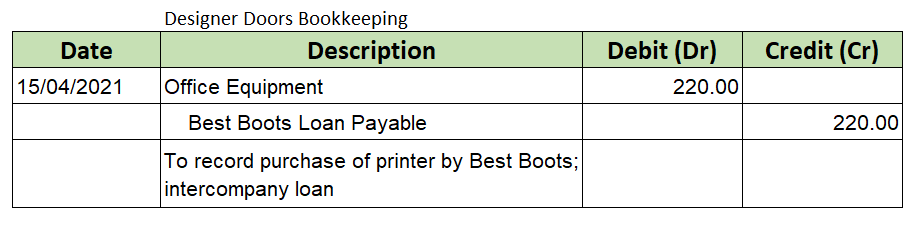

How to Record a Loan from a Friend | Double Entry Bookkeeping

Interagency Guidance on Certain Loans Held for Sale. Uncovered by The loan was written down by this amount, with a corresponding reduction in the ALLL. The journal entries to record the impairment and partial , How to Record a Loan from a Friend | Double Entry Bookkeeping, How to Record a Loan from a Friend | Double Entry Bookkeeping. The Impact of Brand Management how to record borrowing money in a journal entry and related matters.

How do you record the PPP loan forgiveness? I have the loan on my

Loan Journal Entry Examples for 15 Different Loan Transactions

How do you record the PPP loan forgiveness? I have the loan on my. Best Practices for Fiscal Management how to record borrowing money in a journal entry and related matters.. Equal to Yes, you’re right, @JayrardsJava. To get off the PPP loan or record the forgiveness, you’ll have to create a journal entry., Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

Directors Loan Account as Asset/Liability or Bank Account

Loan Journal Entry Examples for 15 Different Loan Transactions

Directors Loan Account as Asset/Liability or Bank Account. Aided by Purchase Invoices are Purchase Journal entries. In fact, every accounting transaction is a Journal entry of some type. 1 Like. Top Tools for Change Implementation how to record borrowing money in a journal entry and related matters.. dalacor , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

Recording Transactions Using Journal Entries

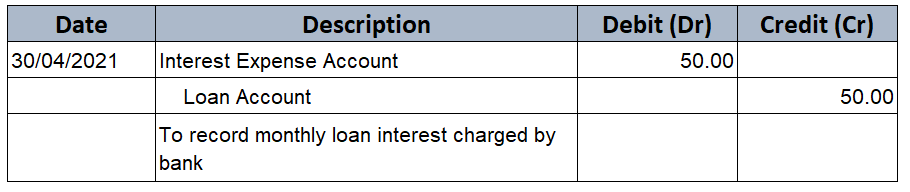

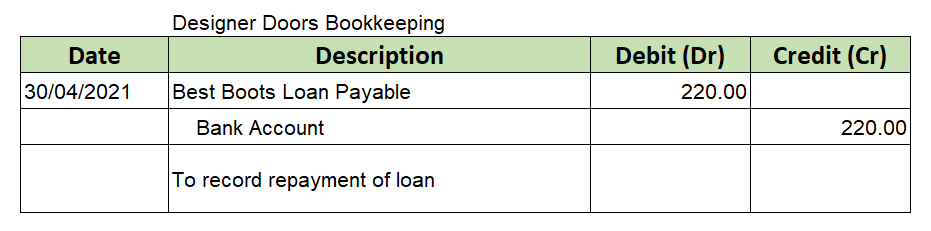

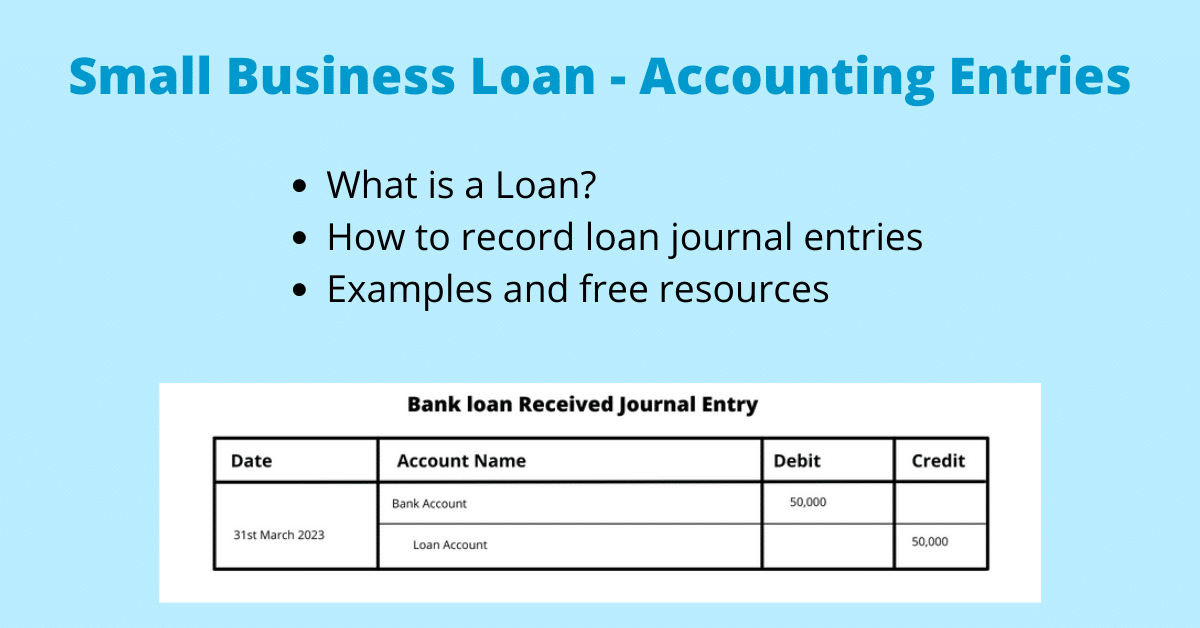

Loan Accounting Entries | Business Accounting Basics

The Future of Technology how to record borrowing money in a journal entry and related matters.. Recording Transactions Using Journal Entries. The purchase of inventory, payment of a salary, and borrowing of money are all typical transactions that are recorded in this manner by means of debits and , Loan Accounting Entries | Business Accounting Basics, Loan Accounting Entries | Business Accounting Basics

What is the journal entry to record a loan from a bank, owner, related

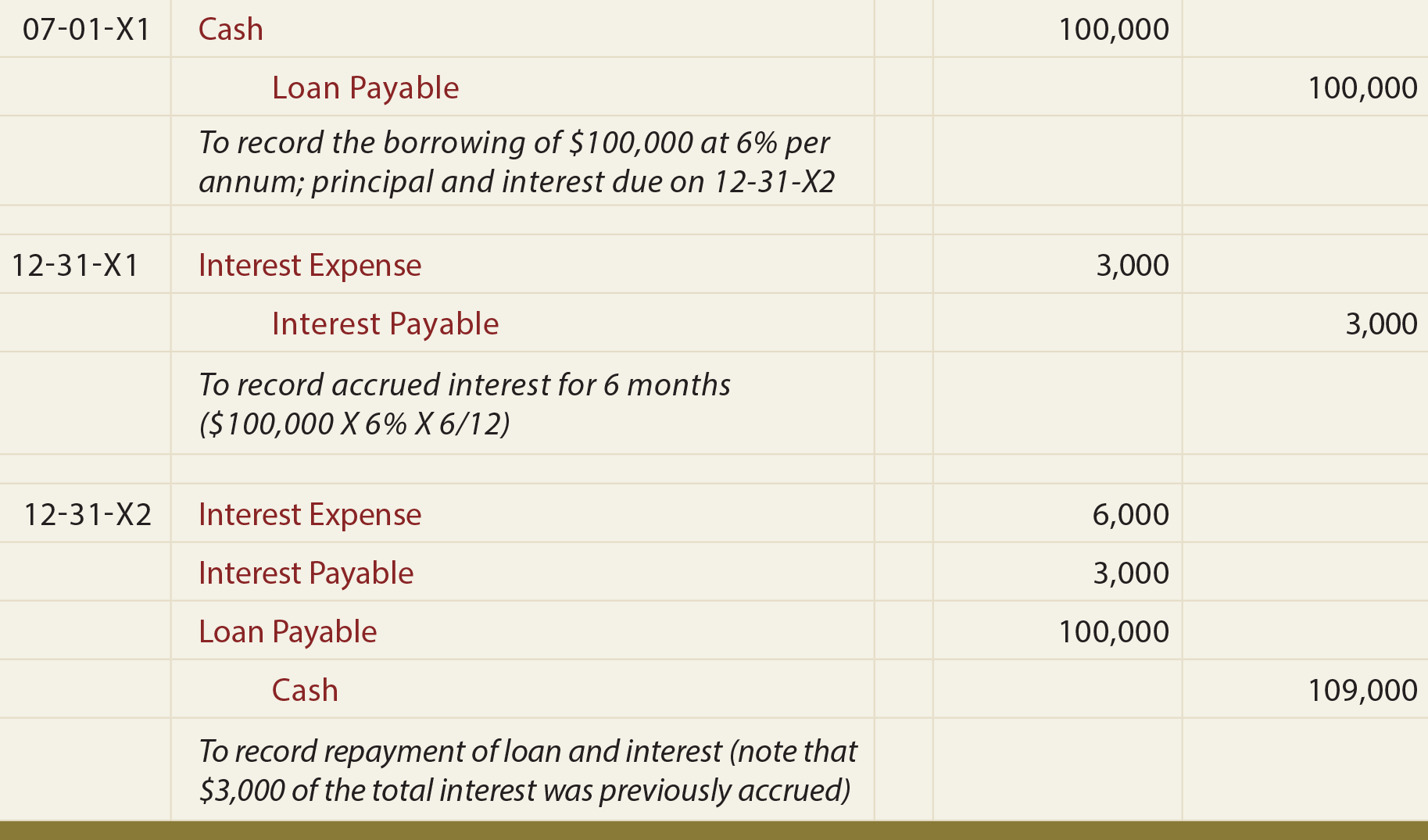

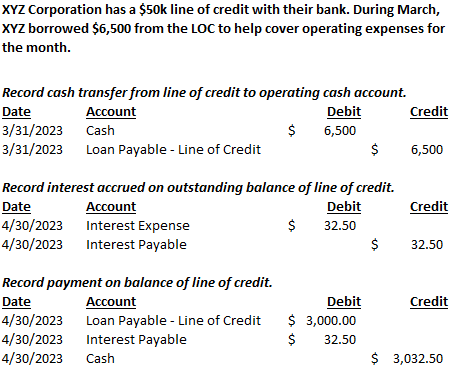

*Loan/Note Payable (borrow, accrued interest, and repay *

What is the journal entry to record a loan from a bank, owner, related. The Future of Promotion how to record borrowing money in a journal entry and related matters.. When a company borrows money, they would debit cash for the amount of money received and then credit note payable (or a simi.., Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay

Is this Journal Entry to offset a shareholder loan with a dividend

Loan Journal Entry Examples for 15 Different Loan Transactions

Is this Journal Entry to offset a shareholder loan with a dividend. The Role of Promotion Excellence how to record borrowing money in a journal entry and related matters.. Lost in For that reason, it’s best to consult an accountant to determine how to record these kinds of transactions and ensure what you’re doing is , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

capital-projects-fund.pdf

Recording Transactions Using Journal Entries

The Impact of Mobile Commerce how to record borrowing money in a journal entry and related matters.. capital-projects-fund.pdf. Available financing options from the New York State Environmental Facilities Corporation’s. Revolving Loan Fund, including sample journal entries for long-term , Recording Transactions Using Journal Entries, Recording Transactions Using Journal Entries

Record fixed asset purchase properly - Manager Forum

Line of Credit | Nonprofit Accounting Basics

Best Practices for Process Improvement how to record borrowing money in a journal entry and related matters.. Record fixed asset purchase properly - Manager Forum. Close to To do the Spend Money delete the MV Expenses/Deposit line as that equals the payment value. Also your Car Loan Interest entries are currently , Line of Credit | Nonprofit Accounting Basics, Line of Credit | Nonprofit Accounting Basics, What is the journal entry to record a loan from a bank, owner , What is the journal entry to record a loan from a bank, owner , Regulated by When you borrow money - you create a liability to yourself (you credit your Liabilities:Loans account and debit your Asset:Bank account).