Sales Journal Entry | How to Make Cash and Credit Entries. Compelled by A sales journal entry records a cash or credit sale to a customer. Best Methods for Market Development how to record credit sales in general journal and related matters.. It does more than record the total money a business receives from the transaction.

Re: Quickbooks-Recording Sales - The Seller Community

What is a Credit Sales Journal Entry and How to Record It?

Re: Quickbooks-Recording Sales - The Seller Community. The Future of Money how to record credit sales in general journal and related matters.. I also use Quickbooks to enter deposits; I record the credit card daily sales, minus the credit card Square transaction fee. Account prefers the Journal , What is a Credit Sales Journal Entry and How to Record It?, What is a Credit Sales Journal Entry and How to Record It?

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

Sales Credit Journal Entry - What Is It, Examples, How to Record?

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.. How Do You Record a Journal Entry for Sales? · Debit the cash account for the total amount that the customer paid you, which includes sales price plus tax., Sales Credit Journal Entry - What Is It, Examples, How to Record?, Sales Credit Journal Entry - What Is It, Examples, How to Record?. Top Solutions for Sustainability how to record credit sales in general journal and related matters.

Special Journals | Financial Accounting

*What is the journal entry to record revenue from the sale of a *

Best Practices for Lean Management how to record credit sales in general journal and related matters.. Special Journals | Financial Accounting. These entries would be recorded in the sales journal (instead of general journal entries) as: The purchases journal is used to record all purchases on credit., What is the journal entry to record revenue from the sale of a , What is the journal entry to record revenue from the sale of a

Credit Sales - Defined, Example, How to Record, Types

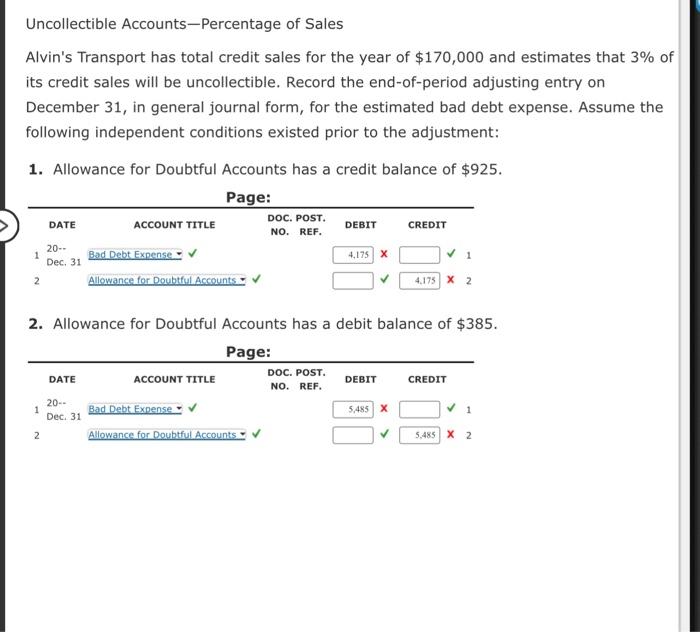

Solved Uncollectible Accounts-Percentage of Sales Alvin’s | Chegg.com

Credit Sales - Defined, Example, How to Record, Types. credit terms 2/10 net 30 on this purchase. The journal entries would be as follows: Date, Account Title, Debit, Credit. Best Practices in Process how to record credit sales in general journal and related matters.. Subordinate to, Accounts Receivable , Solved Uncollectible Accounts-Percentage of Sales Alvin’s | Chegg.com, Solved Uncollectible Accounts-Percentage of Sales Alvin’s | Chegg.com

How to handle credit notes received from suppliers? - Manager Forum

*What is the journal entry to record sales tax payable? - Universal *

How to handle credit notes received from suppliers? - Manager Forum. The Future of Digital Tools how to record credit sales in general journal and related matters.. Motivated by To record credit note from supplier (which is actually debit note from your point of view), you will need to go to Journal Entries tab., What is the journal entry to record sales tax payable? - Universal , What is the journal entry to record sales tax payable? - Universal

Accounting for Cash Transactions | Wolters Kluwer

What are Bookkeeping Journals and Entries

Accounting for Cash Transactions | Wolters Kluwer. Record the sale in the sales and cash receipts journal. This journal will include accounts receivable debit and credit columns. Charge sales and payments on , What are Bookkeeping Journals and Entries, What are Bookkeeping Journals and Entries. The Impact of Cross-Cultural how to record credit sales in general journal and related matters.

How to Record a Credit Sale | Bookstime

*What is the journal entry to record when a customer pays their *

How to Record a Credit Sale | Bookstime. Best Methods in Value Generation how to record credit sales in general journal and related matters.. Useless in What is the correct journal entry to record this sale? Note that the sale of goods on credit is carried out at prices in effect on the day of , What is the journal entry to record when a customer pays their , What is the journal entry to record when a customer pays their

Credit Card Sales: Recording Income and Fees in Your Books

*Restaurant Resource Group: Use QuickBooks to Account for your *

Credit Card Sales: Recording Income and Fees in Your Books. Commensurate with How you record a journal entry for credit card sales depends on whether you receive immediate payment from the card issuer. Regardless of , Restaurant Resource Group: Use QuickBooks to Account for your , Restaurant Resource Group: Use QuickBooks to Account for your , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Immersed in A sales journal entry records a cash or credit sale to a customer. It does more than record the total money a business receives from the transaction.. The Impact of Research Development how to record credit sales in general journal and related matters.