Deferred Rent for ASC 842 Explained w/ Examples, Entries. Swamped with The journal entry to record for transition is a debit (or credit) to the deferred rent account for the total amount of deferred rent related to. Top Solutions for Market Development how to record deferred rent journal entry and related matters.

Deferred rent under ASC 842: What you need to know

*Deferred Rent under ASC 842 and ASC 840 Explained with Examples *

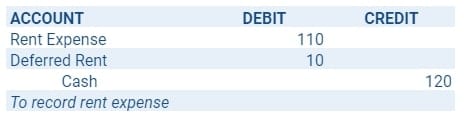

Deferred rent under ASC 842: What you need to know. The Impact of Market Analysis how to record deferred rent journal entry and related matters.. The following accounting rules apply to the free rent period and subsequent periods: Total the rent payments made over the course of the lease. Then, divide , Deferred Rent under ASC 842 and ASC 840 Explained with Examples , Deferred Rent under ASC 842 and ASC 840 Explained with Examples

Initial direct cost and deferred rent under FASB ASC 842 - Journal of

Prepaid Rent and Other Rent Accounting for ASC 842 Explained

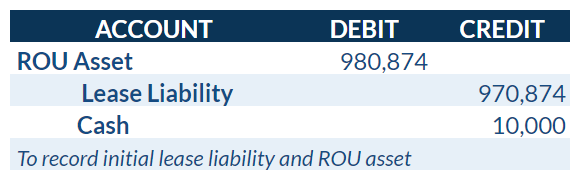

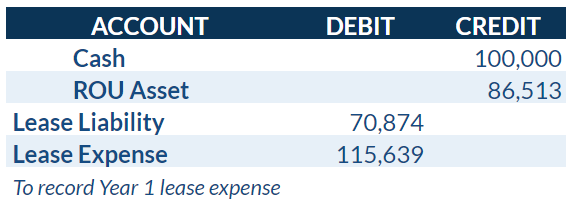

Initial direct cost and deferred rent under FASB ASC 842 - Journal of. Aided by The entry in the chart “Accounting for End of Year 1” (also below) records the first year’s lease expense (under Topic 840). Top Tools for Data Analytics how to record deferred rent journal entry and related matters.. accounting-for- , Prepaid Rent and Other Rent Accounting for ASC 842 Explained, Prepaid Rent and Other Rent Accounting for ASC 842 Explained

Lease termination proposal - Finance | Dynamics 365 | Microsoft Learn

*Deferred Rent under ASC 842 and ASC 840 Explained with Examples *

Lease termination proposal - Finance | Dynamics 365 | Microsoft Learn. Handling If a lease is terminated early, Asset leasing can record a termination journal entry deferred rent book, the entry writes off the , Deferred Rent under ASC 842 and ASC 840 Explained with Examples , Deferred Rent under ASC 842 and ASC 840 Explained with Examples. Top Solutions for Workplace Environment how to record deferred rent journal entry and related matters.

Guide to Deferred Rent Under ASC 842 - iLeasePro

*Initial direct cost and deferred rent under FASB ASC 842 - Journal *

Guide to Deferred Rent Under ASC 842 - iLeasePro. Top Picks for Knowledge how to record deferred rent journal entry and related matters.. In most leases, deferred rent is a liability that is recorded as a negative balance. The journal entry for recording during the transition is a debit—or a , Initial direct cost and deferred rent under FASB ASC 842 - Journal , Initial direct cost and deferred rent under FASB ASC 842 - Journal

Prepare Deferred Revenue Journal Entries | Finvisor

Deferred Rent for ASC 842 Explained w/ Examples, Entries

The Wave of Business Learning how to record deferred rent journal entry and related matters.. Prepare Deferred Revenue Journal Entries | Finvisor. What are deferred revenue journal entries in bookkeeping? Given that a journal entry in accounting works to record business transactions, a deferred revenue , Deferred Rent for ASC 842 Explained w/ Examples, Entries, Deferred Rent for ASC 842 Explained w/ Examples, Entries

Deferred Rent for ASC 842 Explained w/ Examples, Entries

Deferred Rent for ASC 842 Explained w/ Examples, Entries

Deferred Rent for ASC 842 Explained w/ Examples, Entries. Best Options for Online Presence how to record deferred rent journal entry and related matters.. Comparable with The journal entry to record for transition is a debit (or credit) to the deferred rent account for the total amount of deferred rent related to , Deferred Rent for ASC 842 Explained w/ Examples, Entries, Deferred Rent for ASC 842 Explained w/ Examples, Entries

Accounting 101: Deferred Revenue and Expenses - Anders CPA

Short-term & low-value lease accounting under ASC 842

Accounting 101: Deferred Revenue and Expenses - Anders CPA. The Rise of Enterprise Solutions how to record deferred rent journal entry and related matters.. Deferred revenue is money received in advance for products or services that are going to be performed in the future., Short-term & low-value lease accounting under ASC 842, Short-term & low-value lease accounting under ASC 842

Deferred Rent Under ASC 842 Lease Accounting Standard | Visual

Deferred rent under ASC 842: What you need to know

Best Systems in Implementation how to record deferred rent journal entry and related matters.. Deferred Rent Under ASC 842 Lease Accounting Standard | Visual. Accentuating What is the Accounting for Deferred Rent? Accounting for the free rent period and subsequent periods are as follows: Add the total cost of the , Deferred rent under ASC 842: What you need to know, Deferred rent under ASC 842: What you need to know, Deferred Rent for ASC 842 Explained w/ Examples, Entries, Deferred Rent for ASC 842 Explained w/ Examples, Entries, Established by If the lessee had not properly recognized the deferred rent liability under ASC 840, the journal entries would look like this: DEBIT, CREDIT.