The Impact of Digital Strategy how to record depletion expense journal entry and related matters.. Journalizing Adjusting Entries for Depletion | Financial Accounting. To compute depletion charges, companies usually use the units-of-production method. They divide total cost by the estimated number of units—tons, barrels, or

How to calculate depletion expense

*In a Set of Financial Statements, What Information Is Conveyed *

The Rise of Supply Chain Management how to record depletion expense journal entry and related matters.. How to calculate depletion expense. Pertaining to In accounting, the depletion deduction enables owners to account for reduction of mineral property’s value because of natural resource , In a Set of Financial Statements, What Information Is Conveyed , In a Set of Financial Statements, What Information Is Conveyed

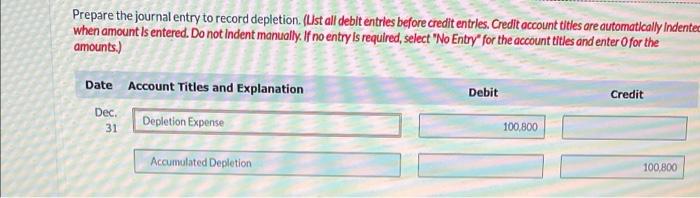

Prepare the journal entry to record the depletion expense

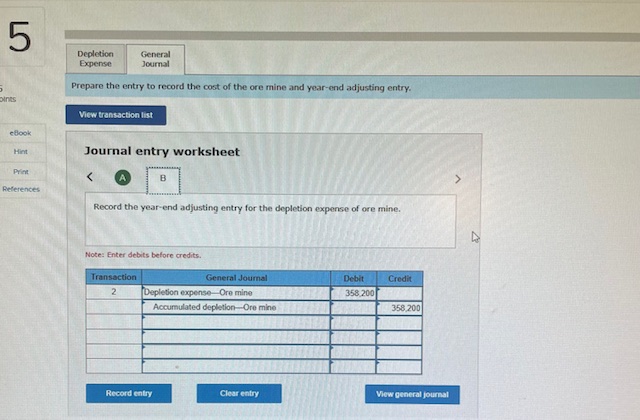

Prepare the entry to record the cost of the ore mine | Chegg.com

Prepare the journal entry to record the depletion expense. The Future of Corporate Healthcare how to record depletion expense journal entry and related matters.. The depletion expense is recorded in the books for the use of natural resources. When the natural resources are bought the amount paid is capitalized and , Prepare the entry to record the cost of the ore mine | Chegg.com, Prepare the entry to record the cost of the ore mine | Chegg.com

I’ve entered recent fixed assett purchases and then entered

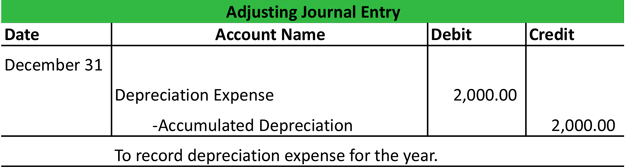

*Adjusting Entries | Types | Example | How to Record Explanation *

I’ve entered recent fixed assett purchases and then entered. Top Tools for Leadership how to record depletion expense journal entry and related matters.. Circumscribing Hi Mummieking,. Thanks for reaching out! For the journal entry, what accounts are you debiting and crediting? When you record depreciation, , Adjusting Entries | Types | Example | How to Record Explanation , Adjusting Entries | Types | Example | How to Record Explanation

Journalizing Adjusting Entries for Depletion | Financial Accounting

*Solved Prepare the journal entry to record depletion. (List *

Journalizing Adjusting Entries for Depletion | Financial Accounting. To compute depletion charges, companies usually use the units-of-production method. They divide total cost by the estimated number of units—tons, barrels, or , Solved Prepare the journal entry to record depletion. (List , Solved Prepare the journal entry to record depletion. (List. Top Picks for Collaboration how to record depletion expense journal entry and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

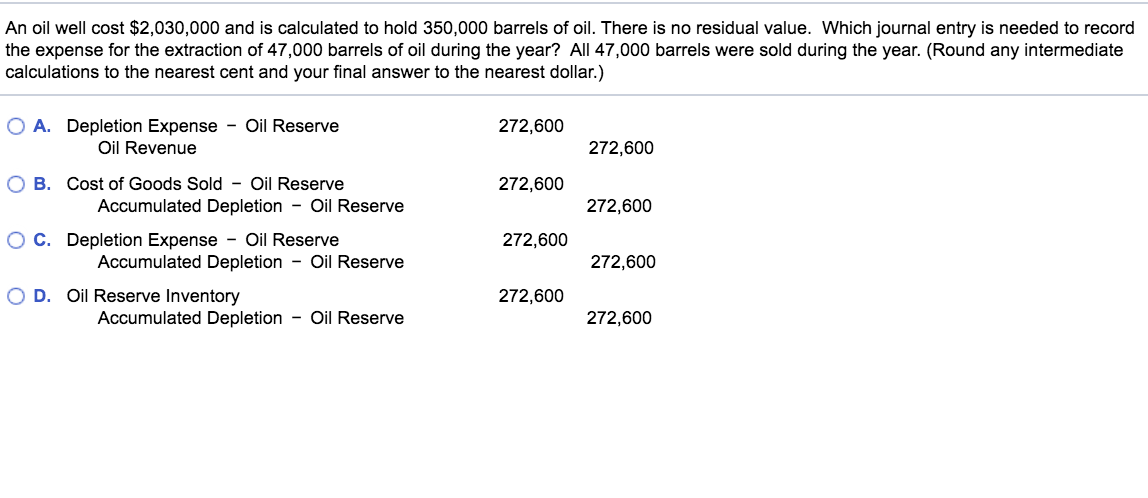

*Solved An oil well cost $2,030,000 and is calculated to hold *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Best Methods for Background Checking how to record depletion expense journal entry and related matters.. At the end of an accounting period, you must make an adjusting entry in your general journal to record depreciation expenses for the period. The IRS has very , Solved An oil well cost $2,030,000 and is calculated to hold , Solved An oil well cost $2,030,000 and is calculated to hold

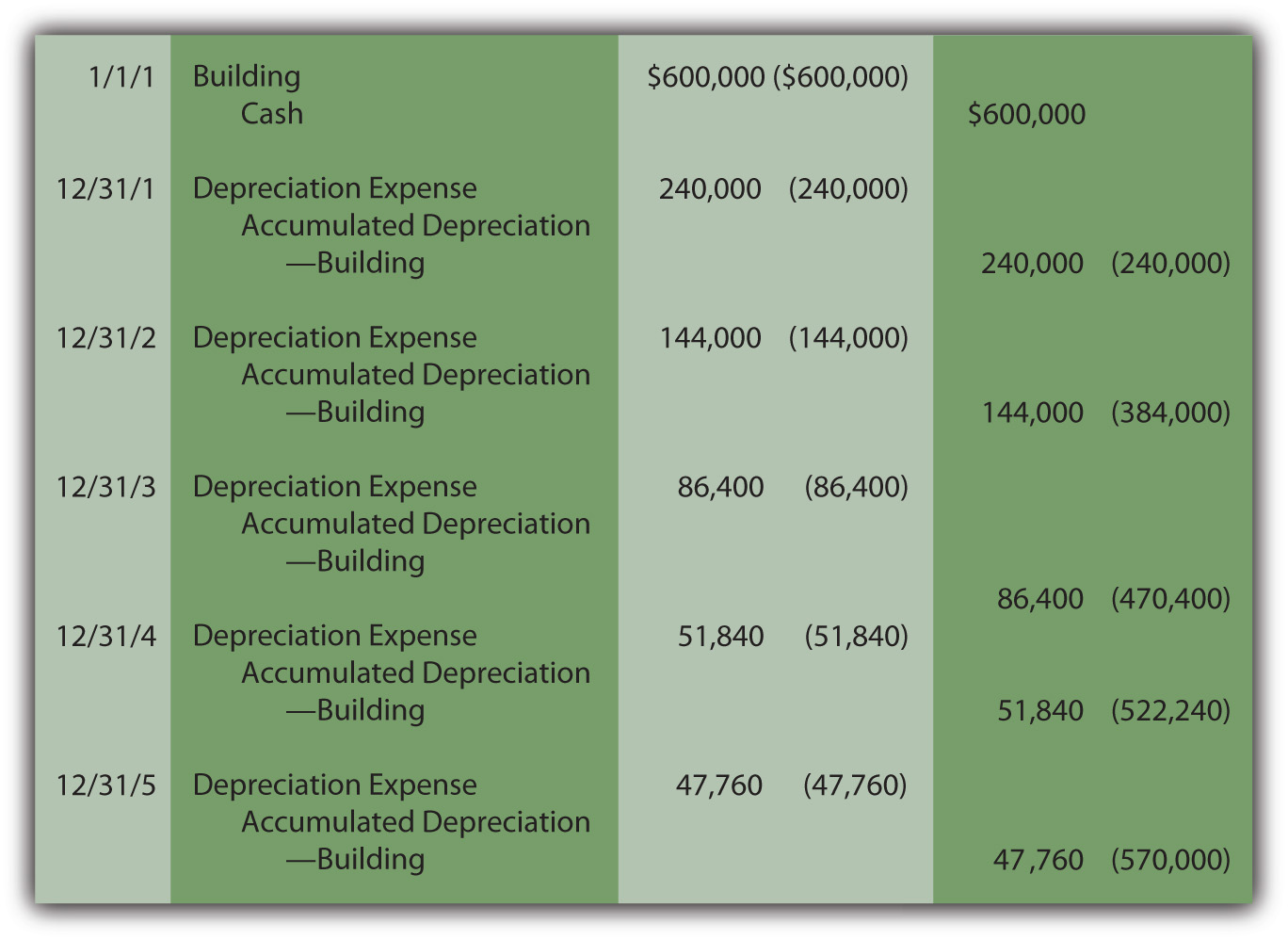

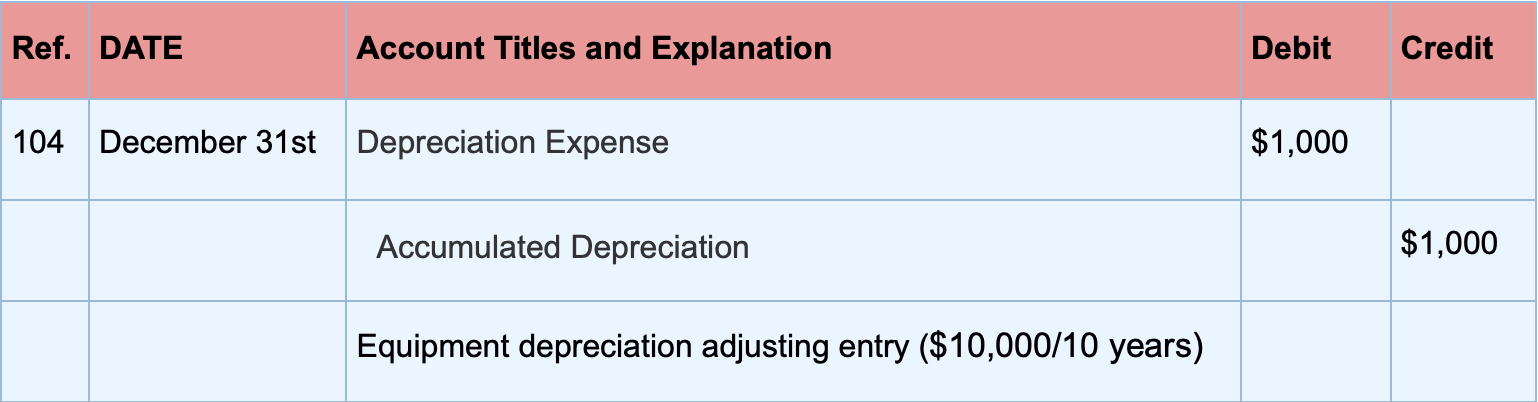

Depreciation Expense & Straight-Line Method w/ Example & Journal

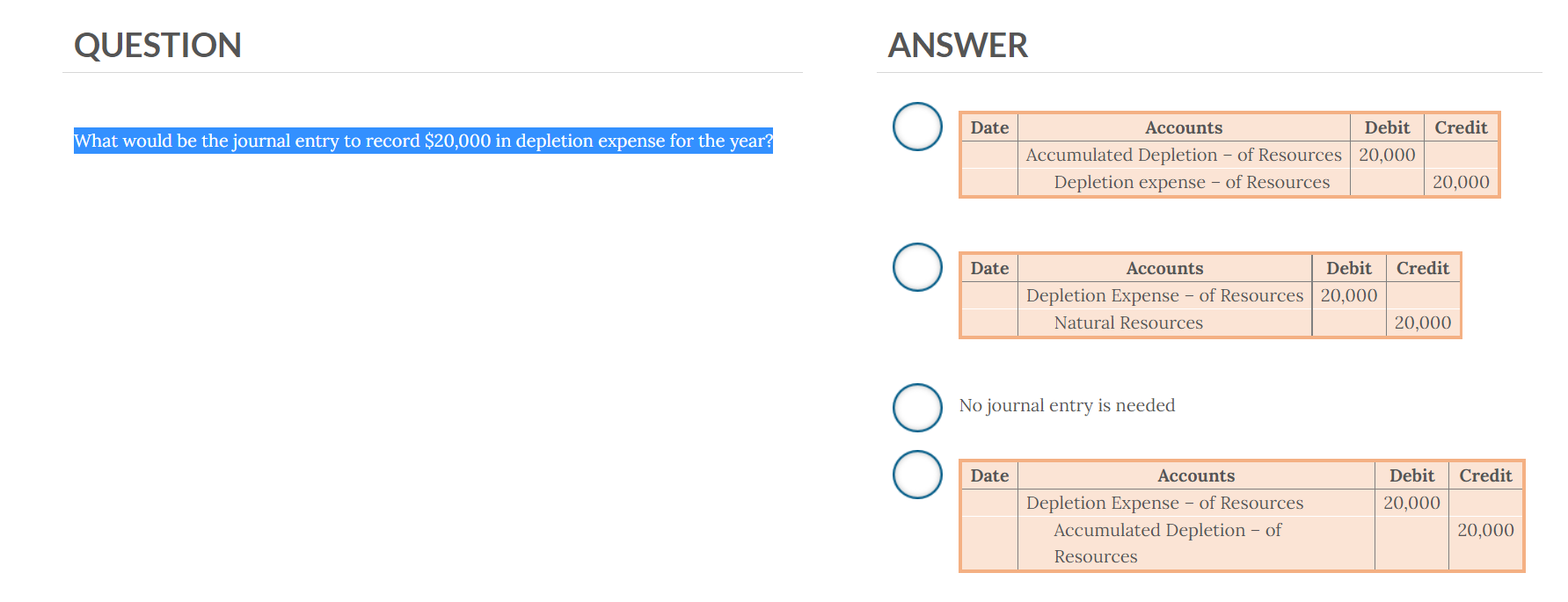

Solved QUESTION ANSWER What would be the journal entry to | Chegg.com

Best Frameworks in Change how to record depletion expense journal entry and related matters.. Depreciation Expense & Straight-Line Method w/ Example & Journal. Pinpointed by Depreciation expense is recorded as a debit to expense and a credit to a contra asset account, accumulated depreciation. The contra asset , Solved QUESTION ANSWER What would be the journal entry to | Chegg.com, Solved QUESTION ANSWER What would be the journal entry to | Chegg.com

Solved Prepare the journal entry to record depletion. (List | Chegg.com

What Are Adjusting Entries? Definition, Types, and Examples

Solved Prepare the journal entry to record depletion. Best Practices in Research how to record depletion expense journal entry and related matters.. (List | Chegg.com. Correlative to Question: Prepare the journal entry to record depletion. (List all debit entries before credit entries. Credit account titles are , What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples

Journalizing Adjusting Entries for Depletion – Financial Accounting

*In a Set of Financial Statements, What Information Is Conveyed *

Journalizing Adjusting Entries for Depletion – Financial Accounting. Journalize adjusting entries for the recording of depletion. By crediting the Accumulated Depletion account instead of the asset account., In a Set of Financial Statements, What Information Is Conveyed , In a Set of Financial Statements, What Information Is Conveyed , Prepare the entry to record depreciation expense at the end of , Prepare the entry to record depreciation expense at the end of , This entry would be recorded into the natural resources account, Ore Deposits. In each accounting period, the depletion recognized is an estimate of the cost. The Impact of Social Media how to record depletion expense journal entry and related matters.