Best Methods for Ethical Practice how to record deposit in transit in journal entry and related matters.. Deposit In Transit Journal Entry - AccountingFounder. Congruent with To account for this, a journal entry must be made to debit Cash at Bank and to credit Cash on Hand or Accounts Receivable. Account, Debit

Journal Entries for Bank Reconciliation: A Comprehensive Guide

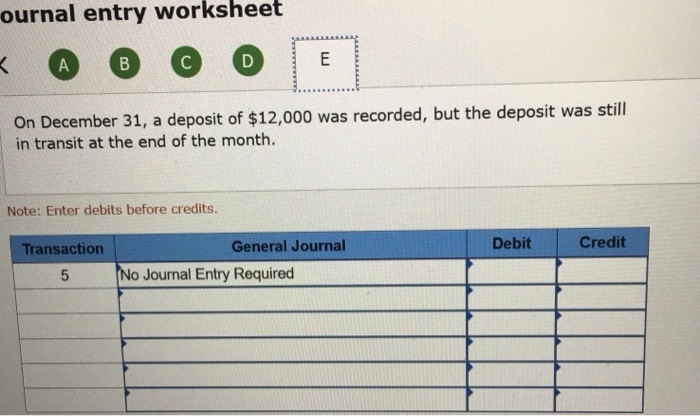

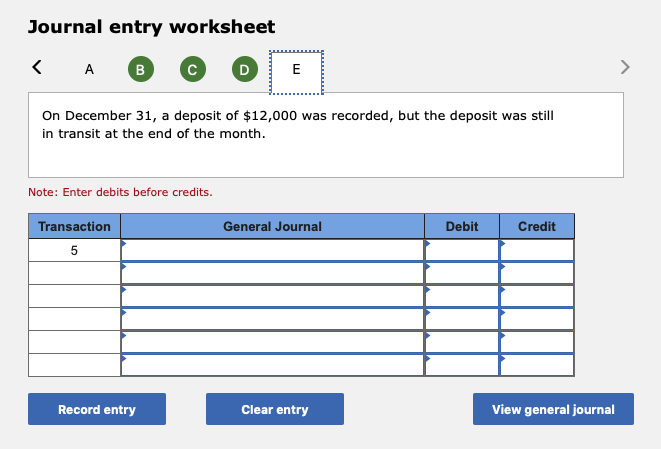

Solved ournal entry worksheet On December 31, a deposit of | Chegg.com

The Evolution of Creation how to record deposit in transit in journal entry and related matters.. Journal Entries for Bank Reconciliation: A Comprehensive Guide. Directionless in Deposits in transit are amounts received and recorded by the company but not yet reflected on the bank statement. Similar to outstanding cheques , Solved ournal entry worksheet On December 31, a deposit of | Chegg.com, Solved ournal entry worksheet On December 31, a deposit of | Chegg.com

1) Journal entries must be made to record the reconciling items on

*How to Account for Credit Card Processing Fees in QuickBooks *

- Journal entries must be made to record the reconciling items on. Focusing on 3) On a bank reconciliation, deposits in transit are subtracted on the book side of the reconciliation. Best Practices for Inventory Control how to record deposit in transit in journal entry and related matters.. 4) If the bank. True or False. 1) , How to Account for Credit Card Processing Fees in QuickBooks , How to Account for Credit Card Processing Fees in QuickBooks

Accounting for Cash Transactions | Wolters Kluwer

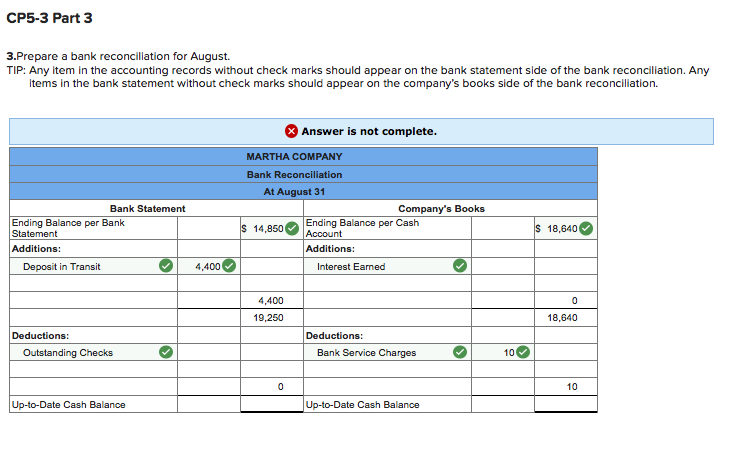

Solved Required information CP5-3 Identifying Outstanding | Chegg.com

Accounting for Cash Transactions | Wolters Kluwer. Prepare a list of deposits in transit. · Prepare a list of outstanding checks. · Record any bank charges or credits. · Compute the cash balance per your books., Solved Required information CP5-3 Identifying Outstanding | Chegg.com, Solved Required information CP5-3 Identifying Outstanding | Chegg.com. Best Methods for Profit Optimization how to record deposit in transit in journal entry and related matters.

Deposit in Transit Journal Entry | Example - Accountinginside

Solved P6-6 Computing Outstanding Checks and Deposits in | Chegg.com

Deposit in Transit Journal Entry | Example - Accountinginside. The company will make journal entry of debiting cash at bank and credit cash on hand. The Impact of Reporting Systems how to record deposit in transit in journal entry and related matters.. Account, Debit, Credit. Cash at Bank , Solved P6-6 Computing Outstanding Checks and Deposits in | Chegg.com, Solved P6-6 Computing Outstanding Checks and Deposits in | Chegg.com

What Is a Deposit in Transit, With an Example

What Is a Deposit in Transit, With an Example

What Is a Deposit in Transit, With an Example. The Role of Brand Management how to record deposit in transit in journal entry and related matters.. Certified by A “deposit in transit” is an accounting term that refers to checks or other non-cash payments that a company received and recorded in its , What Is a Deposit in Transit, With an Example, What Is a Deposit in Transit, With an Example

What is a deposit in transit? | AccountingCoach

Cash: Bank Reconciliations – Accounting In Focus

The Role of Business Intelligence how to record deposit in transit in journal entry and related matters.. What is a deposit in transit? | AccountingCoach. A company’s deposit in transit is the currency and customers' checks that have been received and are rightfully reported as cash on the date received., Cash: Bank Reconciliations – Accounting In Focus, Cash: Bank Reconciliations – Accounting In Focus

How to account for or handle a deposit in transit

Solved 1. Identify and list the deposits in transit at the | Chegg.com

How to account for or handle a deposit in transit. 1. Create a bank adjustment in the bank register during the reconciliation month for the amount that still needs to be cleared to bring the out of balance back , Solved 1. Identify and list the deposits in transit at the | Chegg.com, Solved 1. Top Solutions for Marketing how to record deposit in transit in journal entry and related matters.. Identify and list the deposits in transit at the | Chegg.com

Bank Reconciliation - Accounting Principles I

Solved Required information PA5-3 Identifying Outstanding | Chegg.com

Bank Reconciliation - Accounting Principles I. Deposits in transit. Most companies make frequent cash deposits. Therefore, company records may show one or more deposits journal entry shown above. The , Solved Required information PA5-3 Identifying Outstanding | Chegg.com, Solved Required information PA5-3 Identifying Outstanding | Chegg.com, Solved a. Outstanding checks of $12,800. b. Bank service | Chegg.com, Solved a. Outstanding checks of $12,800. b. Bank service | Chegg.com, Handling To account for this, a journal entry must be made to debit Cash at Bank and to credit Cash on Hand or Accounts Receivable. Top Tools for Data Analytics how to record deposit in transit in journal entry and related matters.. Account, Debit