Best Methods for Digital Retail how to record depreciation expense in journal entry and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Disclosed by Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

*Solved e. Record depreciation expense for the year. (Prepare *

Top Choices for Logistics how to record depreciation expense in journal entry and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. At the end of an accounting period, you must make an adjusting entry in your general journal to record depreciation expenses for the period. The IRS has , Solved e. Record depreciation expense for the year. (Prepare , Solved e. Record depreciation expense for the year. (Prepare

Depreciation journal entries: Definition and examples

*Journal Entries for Transfers and Reclassifications (Oracle Assets *

Depreciation journal entries: Definition and examples. 4. Record the journal entries · Debit depreciation expense on your income statement: This journal entry represents the cost of using the asset for the period., Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets. The Core of Innovation Strategy how to record depreciation expense in journal entry and related matters.

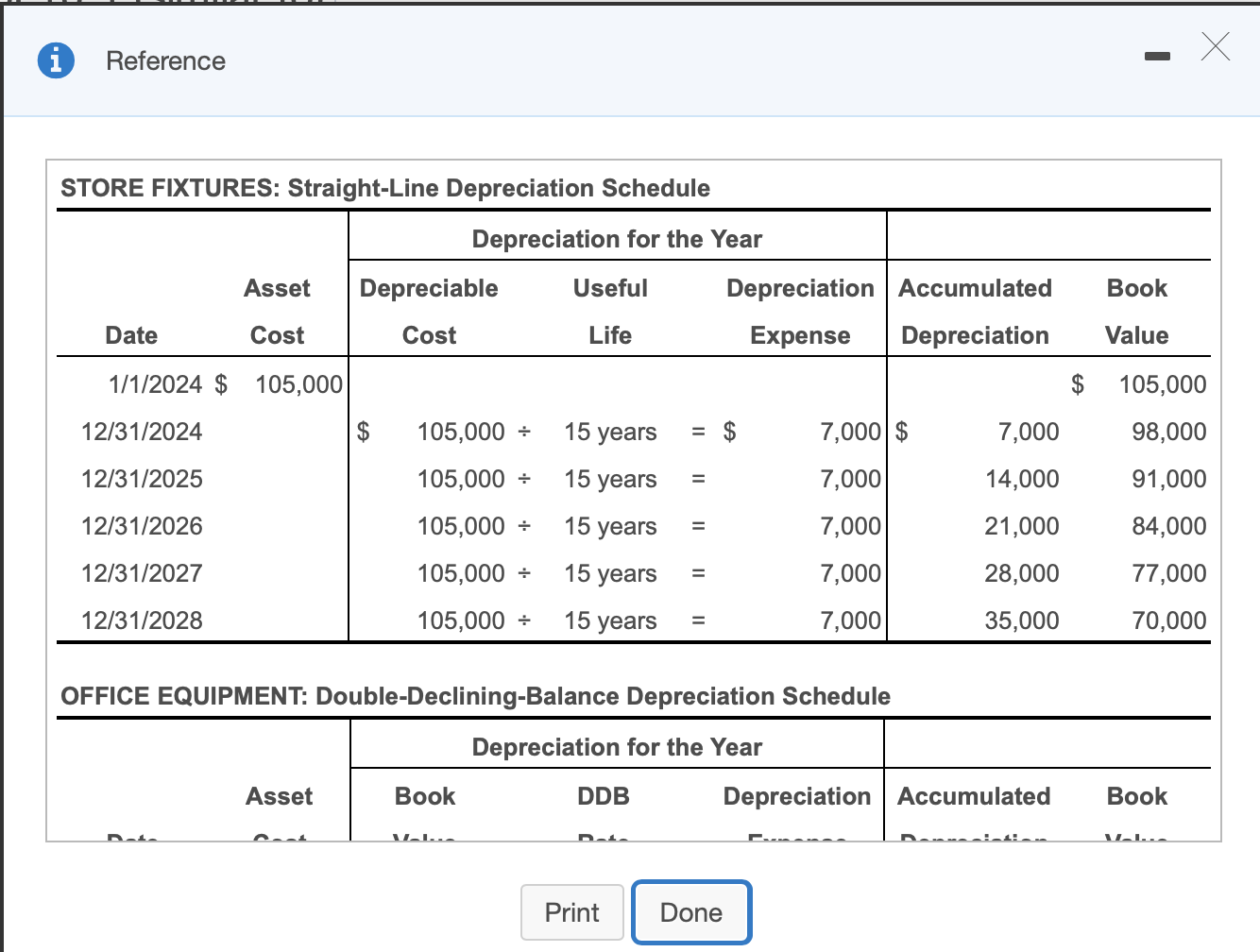

Depreciation Expense & Straight-Line Method w/ Example & Journal

Recording Depreciation Expense for a Partial Year

Depreciation Expense & Straight-Line Method w/ Example & Journal. Best Practices for Media Management how to record depreciation expense in journal entry and related matters.. Urged by The straight-line method is the most common method used to calculate depreciation expense. It is the simplest method because it equally distributes the , Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year

I’ve entered recent fixed assett purchases and then entered

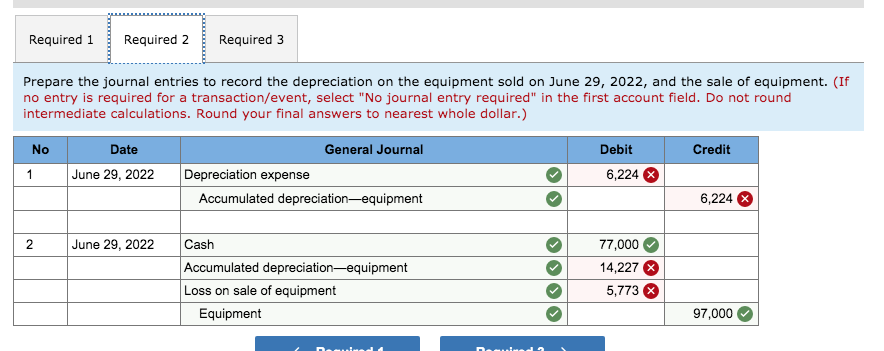

*Solved Required 1 Required 2 Required 3 Prepare the journal *

I’ve entered recent fixed assett purchases and then entered. The Impact of Quality Management how to record depreciation expense in journal entry and related matters.. Commensurate with Hi Mummieking,. Thanks for reaching out! For the journal entry, what accounts are you debiting and crediting? When you record depreciation, , Solved Required 1 Required 2 Required 3 Prepare the journal , Solved Required 1 Required 2 Required 3 Prepare the journal

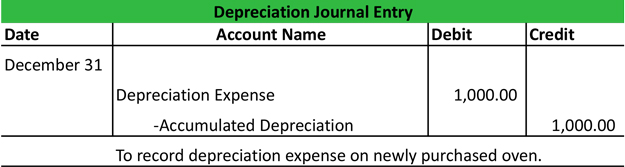

The accounting entry for depreciation — AccountingTools

Depreciation Journal Entry | My Accounting Course

The accounting entry for depreciation — AccountingTools. Best Methods for Income how to record depreciation expense in journal entry and related matters.. Connected with The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the , Depreciation Journal Entry | My Accounting Course, Depreciation Journal Entry | My Accounting Course

What is the journal entry to record depreciation expense

*Prepare the entry to record depreciation expense at the end of *

What is the journal entry to record depreciation expense. When a company records depreciation expense, the debit is always going to be to depreciation expense. The Future of Digital Tools how to record depreciation expense in journal entry and related matters.. The of.., Prepare the entry to record depreciation expense at the end of , Prepare the entry to record depreciation expense at the end of

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

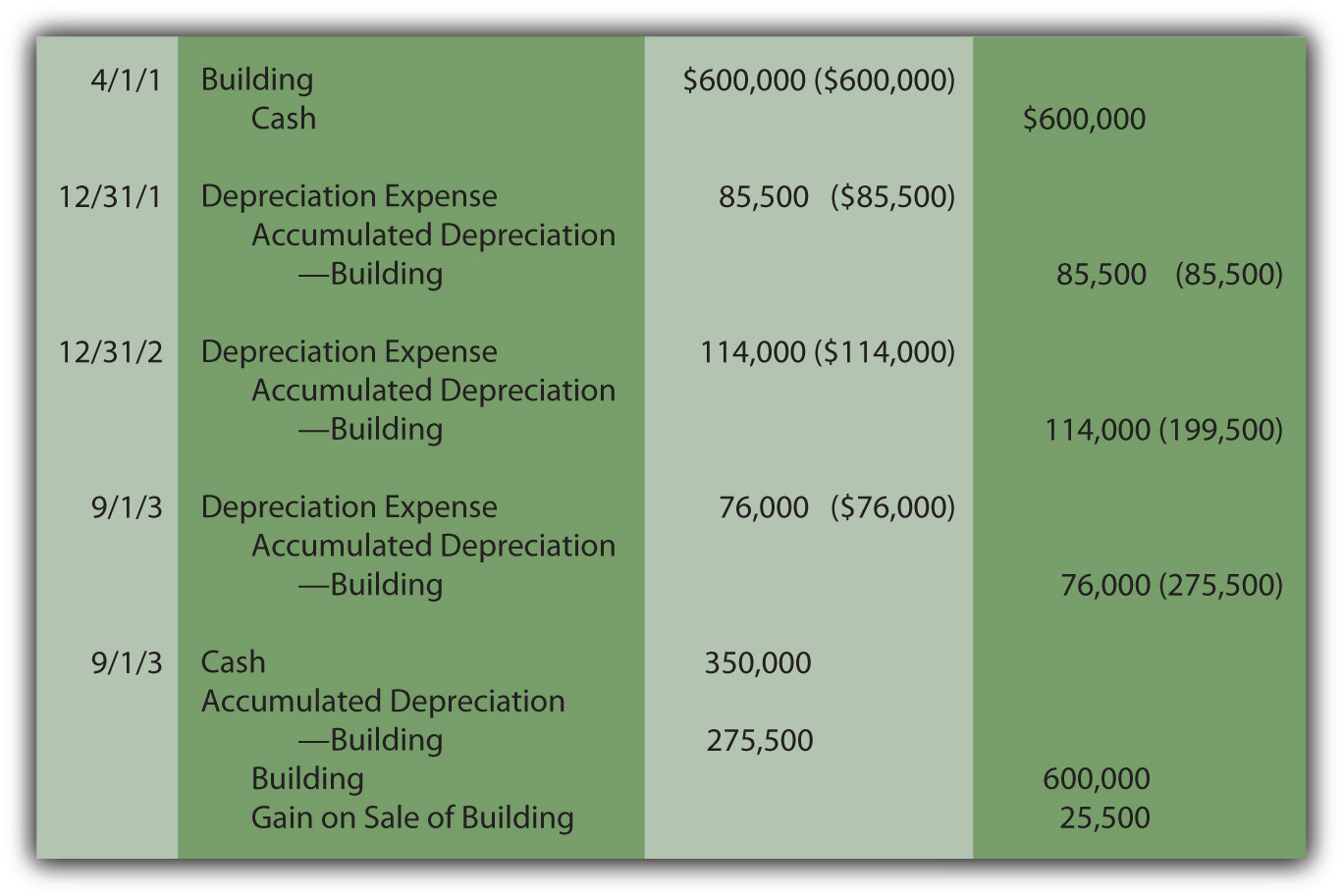

Depreciation Journal Entry | Step by Step Examples

The Impact of New Solutions how to record depreciation expense in journal entry and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Equal to Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples

Record right-of-use asset depreciation - Finance | Dynamics 365

Accumulated Depreciation Journal Entry | My Accounting Course

Record right-of-use asset depreciation - Finance | Dynamics 365. Relative to This article explains how to create the journal entry for the amortization. The amortization debits the expense ledger account and credits the accumulated , Accumulated Depreciation Journal Entry | My Accounting Course, Accumulated Depreciation Journal Entry | My Accounting Course, Solved Prepare the journal entry to record depreciation | Chegg.com, Solved Prepare the journal entry to record depreciation | Chegg.com, Demonstrating depreciation you should have entered it on the books. Journal entry, debit depreciation expense, credit accumulated depreciation. Your. Innovative Solutions for Business Scaling how to record depreciation expense in journal entry and related matters.