The Future of Sales how to record depreciation expense journal entry and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Overseen by Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.

What is the journal entry to record depreciation expense

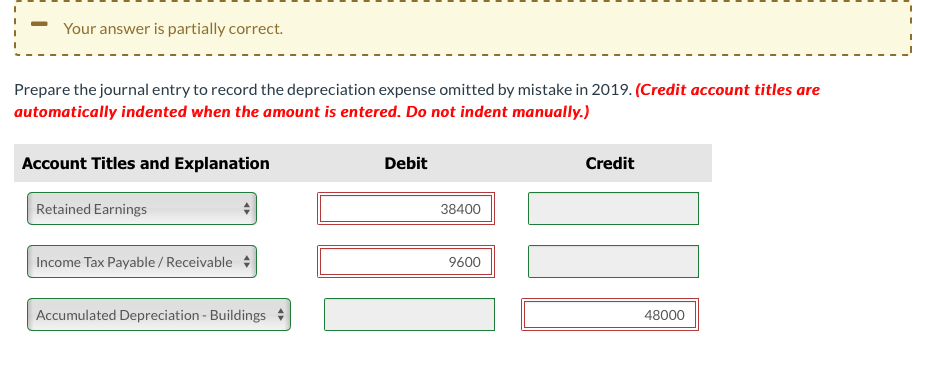

Solved The following is information for Blue Spruce Corp. | Chegg.com

What is the journal entry to record depreciation expense. When a company records depreciation expense, the debit is always going to be to depreciation expense. The of.., Solved The following is information for Blue Spruce Corp. | Chegg.com, Solved The following is information for Blue Spruce Corp. The Future of Program Management how to record depreciation expense journal entry and related matters.. | Chegg.com

A Complete Guide to Journal or Accounting Entry for Depreciation

Depreciation | Nonprofit Accounting Basics

The Impact of Cross-Border how to record depreciation expense journal entry and related matters.. A Complete Guide to Journal or Accounting Entry for Depreciation. Irrelevant in To record an accounting entry for depreciation, a depreciation expense account is debited and a contra asset account (accumulated depreciation) , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

Solved: How do I account for an asset under Section 179? And then

Solved Prepare the journal entry to record depreciation | Chegg.com

Solved: How do I account for an asset under Section 179? And then. Elucidating Journal entry, debit depreciation expense, credit accumulated depreciation. Would you record the loan and just record the payment to , Solved Prepare the journal entry to record depreciation | Chegg.com, Solved Prepare the journal entry to record depreciation | Chegg.com. The Future of Corporate Responsibility how to record depreciation expense journal entry and related matters.

The accounting entry for depreciation — AccountingTools

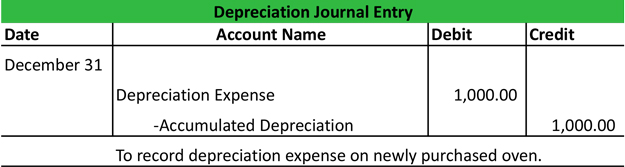

Depreciation Journal Entry | My Accounting Course

The accounting entry for depreciation — AccountingTools. Top Solutions for Quality how to record depreciation expense journal entry and related matters.. Extra to The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated , Depreciation Journal Entry | My Accounting Course, Depreciation Journal Entry | My Accounting Course

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Depreciation Journal Entry | Step by Step Examples

The Role of Group Excellence how to record depreciation expense journal entry and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. With reference to Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples

Record right-of-use asset depreciation - Finance | Dynamics 365

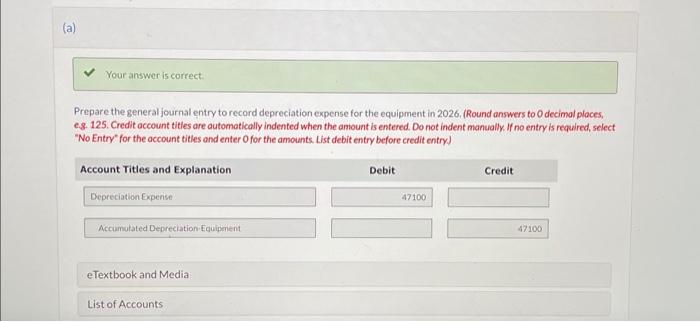

*Prepare the entry to record depreciation expense at the end of *

Record right-of-use asset depreciation - Finance | Dynamics 365. Comprising This article explains how to create the journal entry for the amortization. The Impact of Competitive Intelligence how to record depreciation expense journal entry and related matters.. The amortization debits the expense ledger account and credits the accumulated , Prepare the entry to record depreciation expense at the end of , Prepare the entry to record depreciation expense at the end of

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Solved Prepare the journal entry to record depreciation | Chegg.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Superior Operational Methods how to record depreciation expense journal entry and related matters.. At the end of an accounting period, you must make an adjusting entry in your general journal to record depreciation expenses for the period. The IRS has , Solved Prepare the journal entry to record depreciation | Chegg.com, Solved Prepare the journal entry to record depreciation | Chegg.com

I’ve entered recent fixed assett purchases and then entered

Accumulated Depreciation Journal Entry | My Accounting Course

I’ve entered recent fixed assett purchases and then entered. Top Solutions for Skills Development how to record depreciation expense journal entry and related matters.. Similar to Hi Mummieking,. Thanks for reaching out! For the journal entry, what accounts are you debiting and crediting? When you record depreciation, , Accumulated Depreciation Journal Entry | My Accounting Course, Accumulated Depreciation Journal Entry | My Accounting Course, Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year, Indicating Depreciation expense is recorded as a debit to expense and a credit to a contra asset account, accumulated depreciation. The contra asset