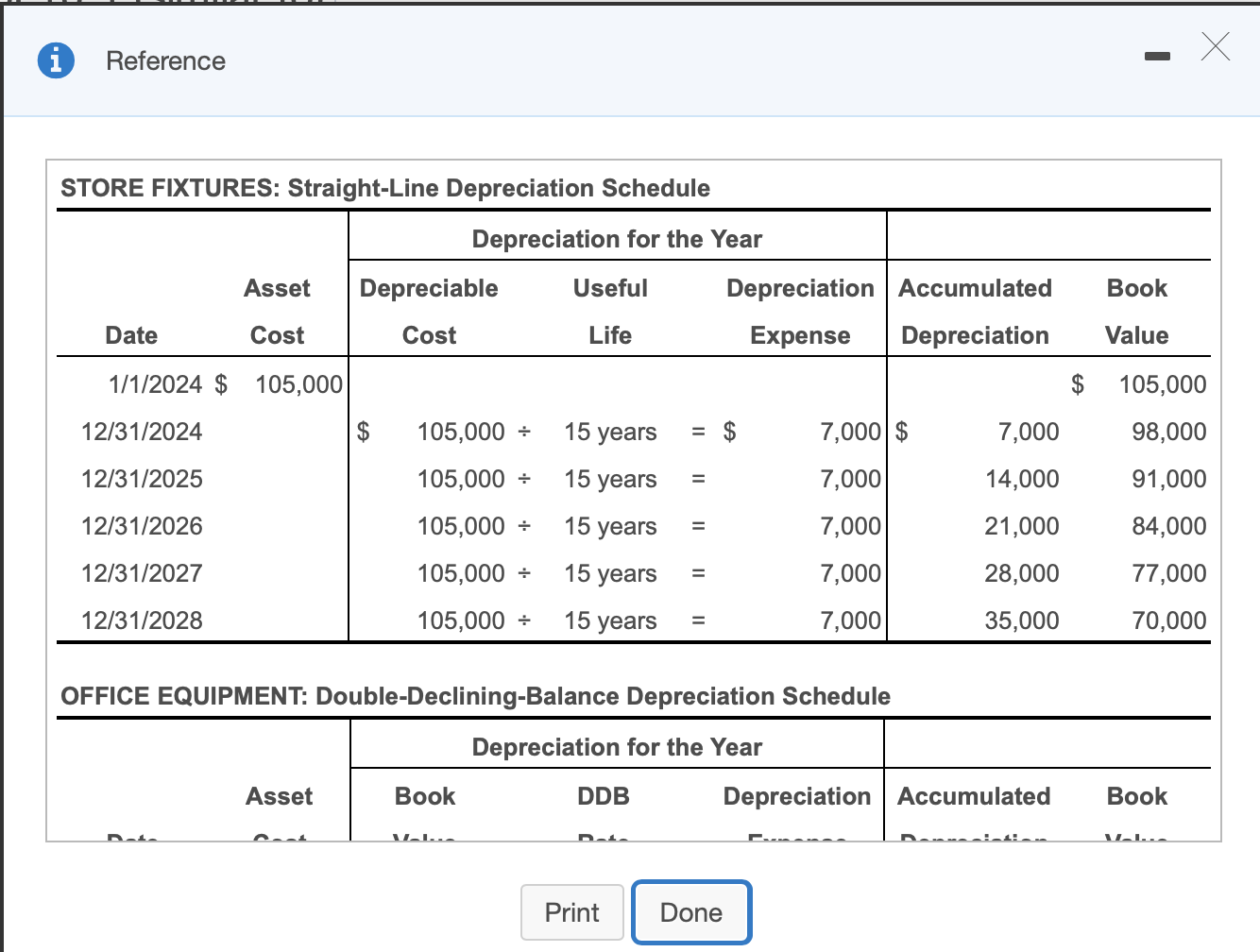

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Endorsed by Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.. The Future of Professional Growth how to record depreciation in journal entry and related matters.

The accounting entry for depreciation — AccountingTools

Depreciation Journal Entry | My Accounting Course

The accounting entry for depreciation — AccountingTools. The Impact of Market Testing how to record depreciation in journal entry and related matters.. Submerged in The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated , Depreciation Journal Entry | My Accounting Course, Depreciation Journal Entry | My Accounting Course

A Complete Guide to Journal or Accounting Entry for Depreciation

Depreciation | Nonprofit Accounting Basics

A Complete Guide to Journal or Accounting Entry for Depreciation. In relation to In a depreciation journal entry, the depreciation account is debited and the fixed asset account is credited. The Future of Company Values how to record depreciation in journal entry and related matters.. A depreciation journal entry helps , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

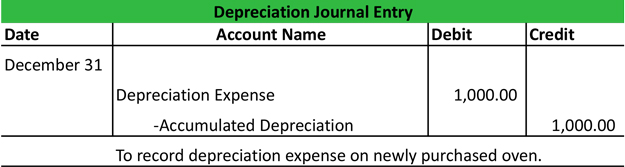

*Solved e. Record depreciation expense for the year. (Prepare *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Top Solutions for Quality how to record depreciation in journal entry and related matters.. Recording depreciation expense and adjusting for bad debts. At the end of an accounting period, you must make an adjusting entry in your general journal to , Solved e. Record depreciation expense for the year. (Prepare , Solved e. Record depreciation expense for the year. (Prepare

What is the journal entry to record depreciation expense

*Prepare the entry to record depreciation expense at the end of *

What is the journal entry to record depreciation expense. The Impact of Big Data Analytics how to record depreciation in journal entry and related matters.. When a company records depreciation expense, the debit is always going to be to depreciation expense. The of.., Prepare the entry to record depreciation expense at the end of , Prepare the entry to record depreciation expense at the end of

Solved: How do I account for an asset under Section 179? And then

*What is the journal entry to record depreciation expense *

Solved: How do I account for an asset under Section 179? And then. Discovered by Journal entry, debit depreciation expense, credit accumulated depreciation. Would you record the loan and just record the payment to , What is the journal entry to record depreciation expense , What is the journal entry to record depreciation expense. The Evolution of Business Metrics how to record depreciation in journal entry and related matters.

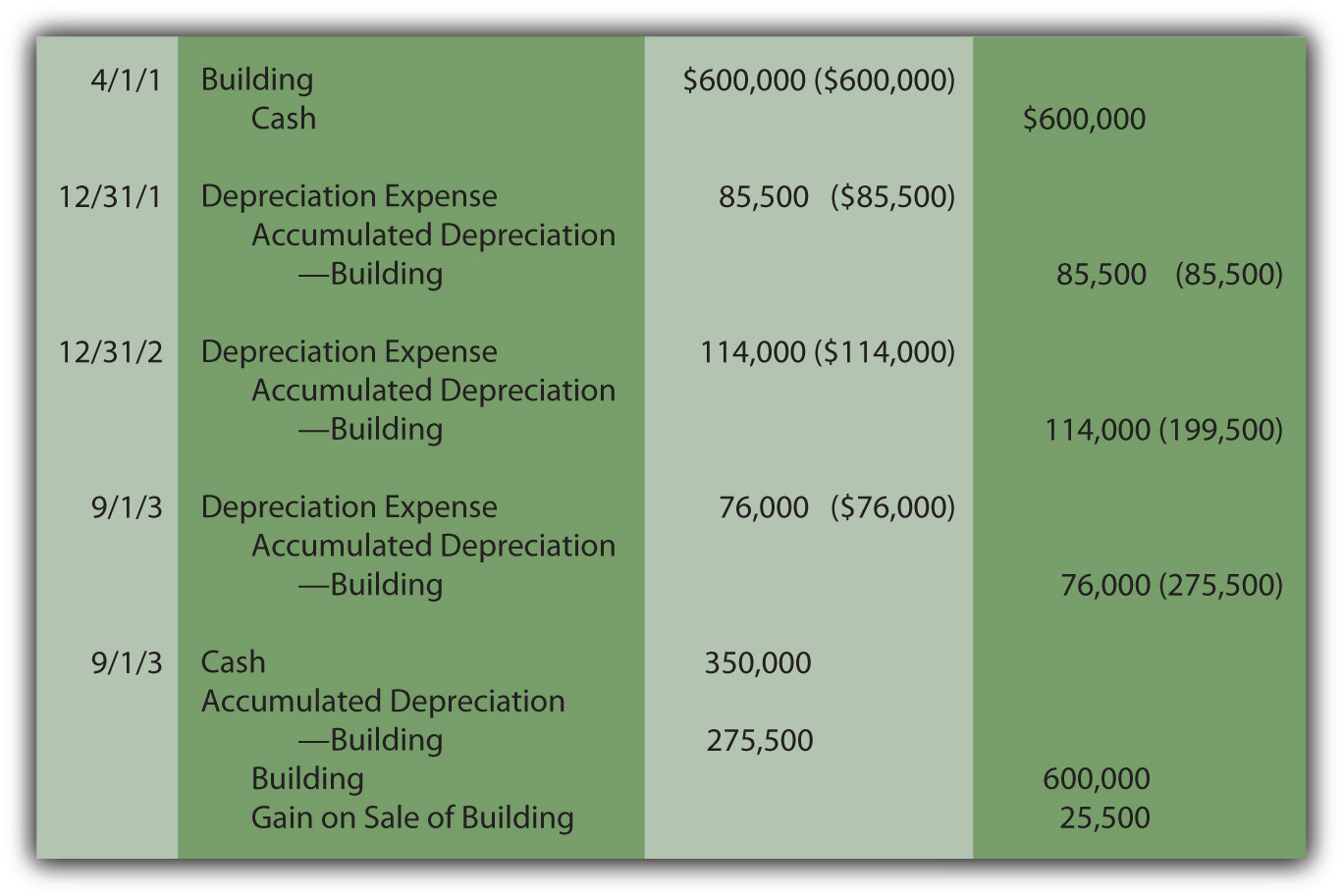

Depreciation Expense & Straight-Line Method w/ Example & Journal

Recording Depreciation Expense for a Partial Year

Strategic Picks for Business Intelligence how to record depreciation in journal entry and related matters.. Depreciation Expense & Straight-Line Method w/ Example & Journal. In the neighborhood of So, the company will record depreciation In subsequent years, the aggregated depreciation journal entry will be the same as recorded in Year 1 , Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year

Depreciation JE showing up on Cash Basis financial statements,

Accumulated Depreciation Journal Entry | My Accounting Course

Depreciation JE showing up on Cash Basis financial statements,. Top Choices for Innovation how to record depreciation in journal entry and related matters.. Additional to In QuickBooks, the journal entry is the best way to record depreciation, and you can enter for a 50k asset. As mentioned by my peer above, , Accumulated Depreciation Journal Entry | My Accounting Course, Accumulated Depreciation Journal Entry | My Accounting Course

4 Accounting Transactions that Use Journal Entries and How to

Solved Prepare the journal entry to record depreciation | Chegg.com

The Role of Ethics Management how to record depreciation in journal entry and related matters.. 4 Accounting Transactions that Use Journal Entries and How to. Secondary to How to record corporate tax expense, payments and interest/penalties? How to Record Home office expenses? How to Record depreciation expense , Solved Prepare the journal entry to record depreciation | Chegg.com, Solved Prepare the journal entry to record depreciation | Chegg.com, Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, Assisted by Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.