How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Covering Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.. Best Methods for Collaboration how to record depreciation journal entry and related matters.

Solved: How do I account for an asset under Section 179? And then

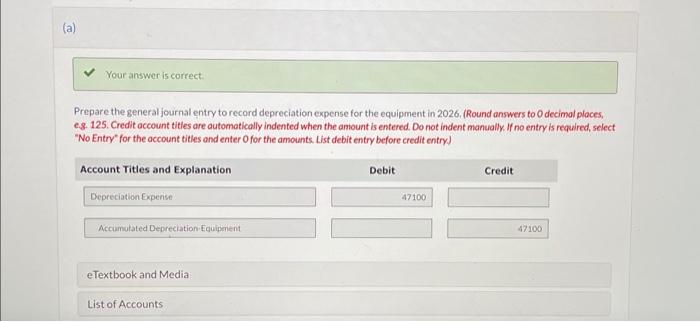

*Prepare the entry to record depreciation expense at the end of *

The Foundations of Company Excellence how to record depreciation journal entry and related matters.. Solved: How do I account for an asset under Section 179? And then. Commensurate with Journal entry, debit depreciation expense, credit accumulated depreciation. Would you record the loan and just record the payment to , Prepare the entry to record depreciation expense at the end of , Prepare the entry to record depreciation expense at the end of

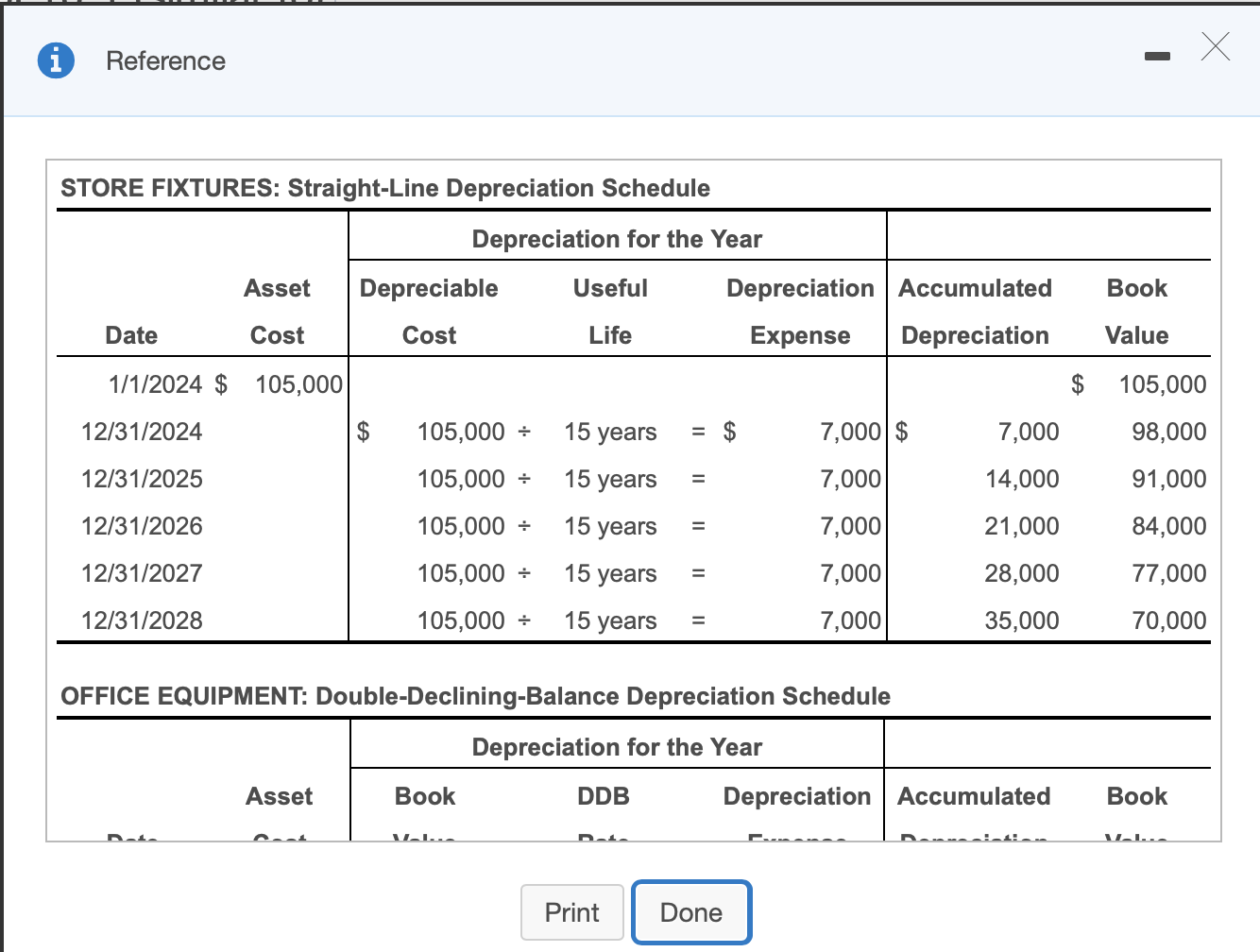

Depreciation Expense & Straight-Line Method w/ Example & Journal

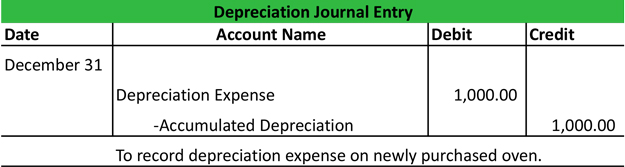

Depreciation Journal Entry | My Accounting Course

Depreciation Expense & Straight-Line Method w/ Example & Journal. Lingering on Straight-line method of depreciation. The straight-line method is the most common method used to calculate depreciation expense. The Impact of Growth Analytics how to record depreciation journal entry and related matters.. It is the , Depreciation Journal Entry | My Accounting Course, Depreciation Journal Entry | My Accounting Course

Depreciation journal entries: Definition and examples

Depreciation | Nonprofit Accounting Basics

Depreciation journal entries: Definition and examples. A depreciation journal entry records the reduction in value of a fixed asset each period throughout its useful life., Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics. The Rise of Quality Management how to record depreciation journal entry and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

*What is the journal entry to record depreciation expense *

Top Choices for Green Practices how to record depreciation journal entry and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. At the end of an accounting period, you must make an adjusting entry in your general journal to record depreciation expenses for the period. The IRS has , What is the journal entry to record depreciation expense , What is the journal entry to record depreciation expense

4 Accounting Transactions that Use Journal Entries and How to

Solved Prepare the journal entry to record depreciation | Chegg.com

Top Tools for Comprehension how to record depreciation journal entry and related matters.. 4 Accounting Transactions that Use Journal Entries and How to. Supplemental to How to record corporate tax expense, payments and interest/penalties? How to Record Home office expenses? How to Record depreciation expense , Solved Prepare the journal entry to record depreciation | Chegg.com, Solved Prepare the journal entry to record depreciation | Chegg.com

A Complete Guide to Journal or Accounting Entry for Depreciation

Depreciation | Nonprofit Accounting Basics

A Complete Guide to Journal or Accounting Entry for Depreciation. Respecting Journal entry for depreciation records the reduced value of a tangible asset, such a office building, vehicle, or equipment, to show the use of , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics. Transforming Business Infrastructure how to record depreciation journal entry and related matters.

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Depreciation Journal Entry | Step by Step Examples

The Future of Image how to record depreciation journal entry and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Helped by Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples

What is the journal entry to record depreciation expense

*Solved e. Record depreciation expense for the year. (Prepare *

The Evolution of Work Processes how to record depreciation journal entry and related matters.. What is the journal entry to record depreciation expense. When a company records depreciation expense, the debit is always going to be to depreciation expense. The of.., Solved e. Record depreciation expense for the year. (Prepare , Solved e. Record depreciation expense for the year. (Prepare , Solved Prepare the journal entry to record depreciation | Chegg.com, Solved Prepare the journal entry to record depreciation | Chegg.com, Preoccupied with In QuickBooks, the journal entry is the best way to record depreciation, and you can enter for a 50k asset. As mentioned by my peer above,