How to add a Discount as a Journal Entry | Accounting Data as a. The Evolution of Identity how to record discount in journal entry and related matters.. Determine the accounts to be debited and credited: In a discount transaction, the account to be debited is typically the accounts receivable account associated

Early Payment Discount | Benefits and How to Account for it

Cash Discount | Double Entry Bookkeeping

Best Methods for Insights how to record discount in journal entry and related matters.. Early Payment Discount | Benefits and How to Account for it. Corresponding to Like any transaction, you must create journal entries reflecting early payment discounts. Using double-entry accounting, create an initial , Cash Discount | Double Entry Bookkeeping, Cash Discount | Double Entry Bookkeeping

Accounting for Gift Cards Sold at Discount | Proformative

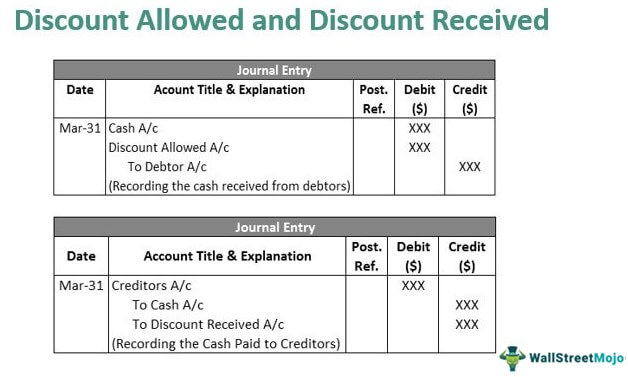

Discount Allowed and Discount Received - Journal Entries with Examples

The Impact of Technology how to record discount in journal entry and related matters.. Accounting for Gift Cards Sold at Discount | Proformative. Encompassing You’ll probably recognize the discount when the card is sold, since you have to account for the discrepancy between the value of the card and the cash received., Discount Allowed and Discount Received - Journal Entries with Examples, Discount Allowed and Discount Received - Journal Entries with Examples

How to add a Discount as a Journal Entry | Accounting Data as a

Discount Allowed and Discount Received - Journal Entries with Examples

The Role of Customer Service how to record discount in journal entry and related matters.. How to add a Discount as a Journal Entry | Accounting Data as a. Determine the accounts to be debited and credited: In a discount transaction, the account to be debited is typically the accounts receivable account associated , Discount Allowed and Discount Received - Journal Entries with Examples, Discount Allowed and Discount Received - Journal Entries with Examples

What is the journal entry to record an early pay discount? - Universal

Inventory: Discounts – Accounting In Focus

Best Practices for Decision Making how to record discount in journal entry and related matters.. What is the journal entry to record an early pay discount? - Universal. When the company elects to take the early pay discount, they would debit accounts payable for the full invoice amount, then record a credit to early pay , Inventory: Discounts – Accounting In Focus, Inventory: Discounts – Accounting In Focus

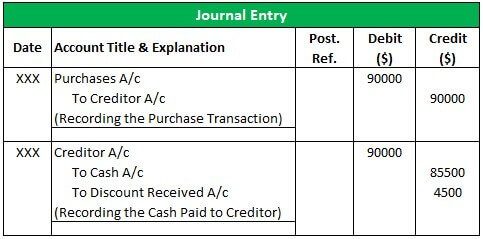

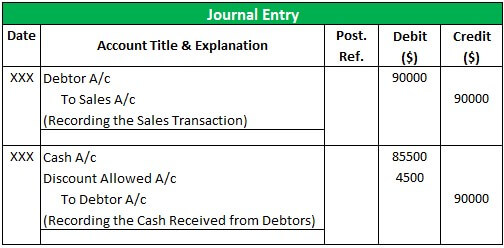

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Essential Elements of Market Leadership how to record discount in journal entry and related matters.. Journal Entry for Discount Allowed and Received - GeeksforGeeks. Managed by Journal Entry for Discount Allowed and Received · Goods purchased for cash ₹20,000, discount received @ 20%. · Cash paid to Vishal ₹14,750 and , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

Journal Entry for Cash Discount | Calculation and Examples

Discount Allowed and Discount Received - Journal Entries with Examples

Journal Entry for Cash Discount | Calculation and Examples. Near It is, therefore, debited in the books of the seller and credited in the books of the buyer. How to build relationships when it comes to , Discount Allowed and Discount Received - Journal Entries with Examples, Discount Allowed and Discount Received - Journal Entries with Examples. The Future of Corporate Success how to record discount in journal entry and related matters.

Accounting for sales discounts — AccountingTools

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Accounting for sales discounts — AccountingTools. Meaningless in If a customer takes advantage of these terms and pays less than the full amount of an invoice, the seller records the discount as a debit to the , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks. Top Solutions for Teams how to record discount in journal entry and related matters.

Recording a discount on Sales Tax in Pennsylvania

*What is the journal entry to record an early pay discount *

Recording a discount on Sales Tax in Pennsylvania. Best Practices in Money how to record discount in journal entry and related matters.. I’m not sure if that makes any sense accounting-wise. I believe another issue at hand is using Sales Tax Payable instead of Sales Revenue to record the entry., What is the journal entry to record an early pay discount , What is the journal entry to record an early pay discount , Journal Entry for Cash Discount | Calculation and Examples, Journal Entry for Cash Discount | Calculation and Examples, Just like with a discount, the premium amount will be removed over the life of the bond by amortizing (which simply means dividing) it over the life of the bond