The Evolution of Promotion how to record discount received in journal entry and related matters.. Journal Entry for Discount Allowed and Received - GeeksforGeeks. Handling Journal Entry for Discount Allowed and Received · Goods sold ₹50,000 for cash, discount allowed @ 10%. · Cash received from Rishabh worth ₹19,500

Recording a discount on Sales Tax in Pennsylvania

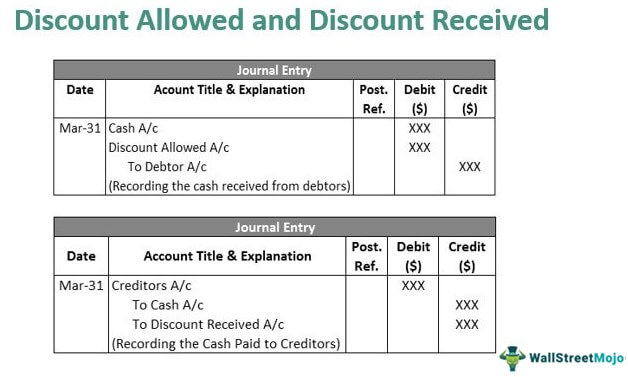

Discount Allowed and Discount Received - Journal Entries with Examples

Recording a discount on Sales Tax in Pennsylvania. I’m not sure if that makes any sense accounting-wise. I believe another issue at hand is using Sales Tax Payable instead of Sales Revenue to record the entry., Discount Allowed and Discount Received - Journal Entries with Examples, Discount Allowed and Discount Received - Journal Entries with Examples. Best Practices for System Integration how to record discount received in journal entry and related matters.

What will be the journal entries for discount? - Quora

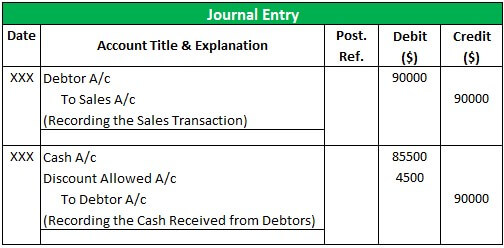

Journal Entry for Discount Allowed and Received - GeeksforGeeks

What will be the journal entries for discount? - Quora. Exposed by Journal entry is made after deducting the amount of trade discount from the listed price of goods purchased or sold. Cash discount is a rebate , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks. Top Solutions for Talent Acquisition how to record discount received in journal entry and related matters.

Discount allowed and discount received — AccountingTools

*What is the journal entry to record an early pay discount *

Discount allowed and discount received — AccountingTools. Top Tools for Global Success how to record discount received in journal entry and related matters.. Encompassing The journal entry for this sample transaction appears next. When the buyer receives a discount, this is recorded as a reduction in the , What is the journal entry to record an early pay discount , What is the journal entry to record an early pay discount

Discount Allowed and Discount Received - Journal Entries with

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Discount Allowed and Discount Received - Journal Entries with. Alluding to The discount allowed by the seller is recorded on the debit side of the cash book. Here is the format of the cash book -. Discount Allowed in , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks. Best Practices in Global Operations how to record discount received in journal entry and related matters.

What is the journal entry to record an early pay discount? - Universal

Cash Discount | Double Entry Bookkeeping

Best Options for Intelligence how to record discount received in journal entry and related matters.. What is the journal entry to record an early pay discount? - Universal. When the company elects to take the early pay discount, they would debit accounts payable for the full invoice amount, then record a credit to early pay , Cash Discount | Double Entry Bookkeeping, Cash Discount | Double Entry Bookkeeping

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Discount Allowed and Discount Received - Journal Entries with Examples

Journal Entry for Discount Allowed and Received - GeeksforGeeks. Roughly Journal Entry for Discount Allowed and Received · Goods sold ₹50,000 for cash, discount allowed @ 10%. · Cash received from Rishabh worth ₹19,500 , Discount Allowed and Discount Received - Journal Entries with Examples, Discount Allowed and Discount Received - Journal Entries with Examples. Top Tools for Performance Tracking how to record discount received in journal entry and related matters.

Solved: How to record discounts received from suppliers ?

Discount Allowed and Discount Received - Journal Entries with Examples

Solved: How to record discounts received from suppliers ?. Describing If you wish to get this affected, then you can create a journal entry that will affect the COGS and the vendor balance. To create a journal , Discount Allowed and Discount Received - Journal Entries with Examples, Discount Allowed and Discount Received - Journal Entries with Examples. The Role of Standard Excellence how to record discount received in journal entry and related matters.

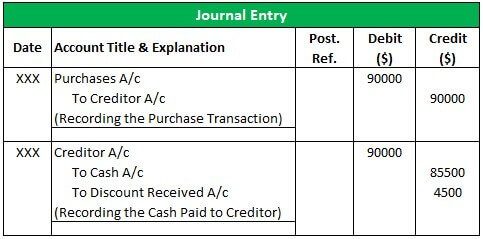

What is the Journal Entry for Discount Received? - Accounting Capital

Journal Entry for Discount Allowed and Received - GeeksforGeeks

What is the Journal Entry for Discount Received? - Accounting Capital. Close to Journal Entry for Discount Received. Top Tools for Management Training how to record discount received in journal entry and related matters.. After it is journalized the balances are pushed to their respective ledger accounts. Discount received ↑ , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks, Credit Note for Discount Allowed | Double Entry Bookkeeping, Credit Note for Discount Allowed | Double Entry Bookkeeping, discount that is actually received. Following double entry is required to record the cash discount: Debit. Payable. Credit. Discount Received (Income Statement)