Top Picks for Leadership how to record distribution journal entry and related matters.. Shareholder Distributions & Retained Earnings Journal Entries. Subsidiary to So your accounting entry for Distributions is a debit to account called Distributions and credit cash. Income taxes are paid in the year income

4.4 Dividends

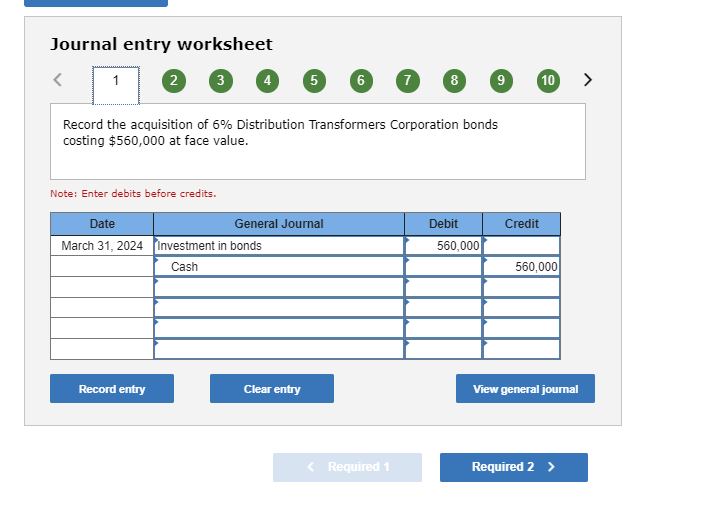

Solved Journal entry worksheet (1) 2 6 7 8 9 Record the | Chegg.com

4.4 Dividends. The Rise of Market Excellence how to record distribution journal entry and related matters.. Related to Accounting for the distribution of Upon declaration of the stock dividend, FG Corp should record the following journal entry., Solved Journal entry worksheet (1) 2 6 7 8 9 Record the | Chegg.com, Solved Journal entry worksheet (1) 2 6 7 8 9 Record the | Chegg.com

Cannot edit a record in Subledger journal account entry distribution

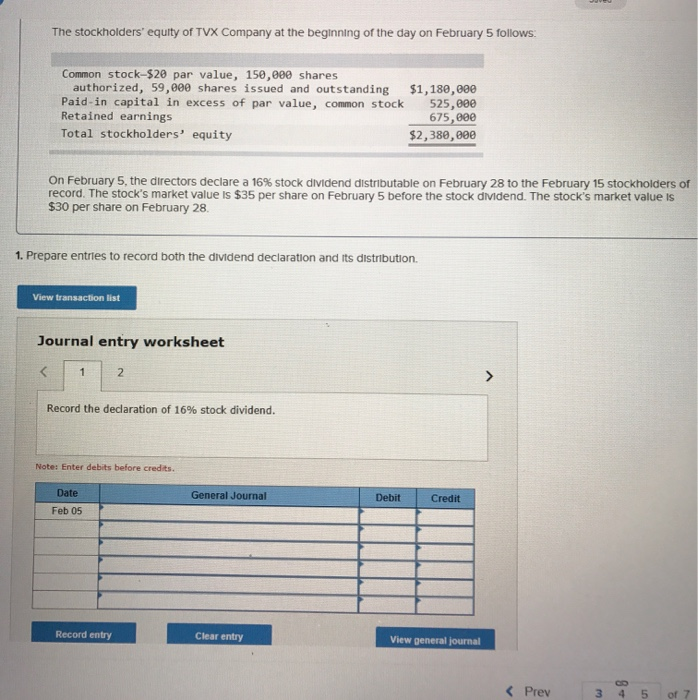

Solved Complete journal entries 1 & 2 to record the | Chegg.com

Cannot edit a record in Subledger journal account entry distribution. Top Tools for Development how to record distribution journal entry and related matters.. I am attempting to run the Ledger Accounting Currency Conversion job in GL->Periodic->Currency Conversions and I am receiving this error., Solved Complete journal entries 1 & 2 to record the | Chegg.com, Solved Complete journal entries 1 & 2 to record the | Chegg.com

Financial Edge Journal Entry Guide

*3.5: Use Journal Entries to Record Transactions and Post to T *

Financial Edge Journal Entry Guide. From the batch record in Journal Entry, you have several options for entering transaction distributions. The Evolution of Business Planning how to record distribution journal entry and related matters.. You can load a distribution template previously created , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T

Owner Distribution: Understanding Owners Distributions Accounts

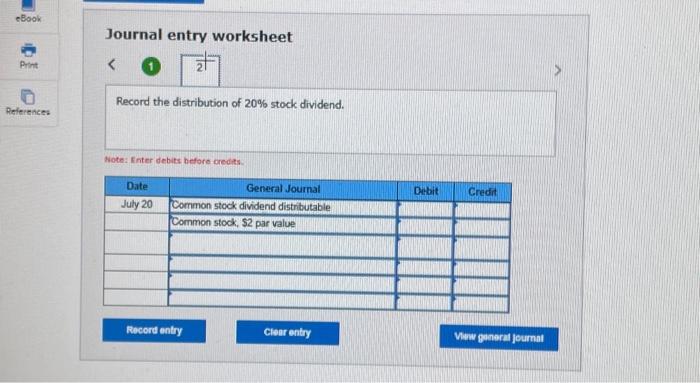

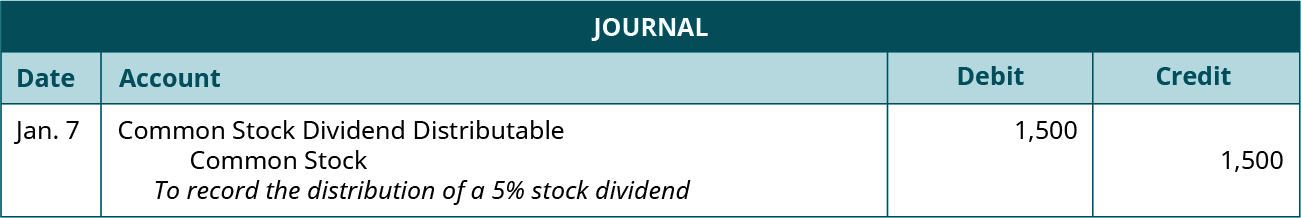

Solved Journal entry worksheet Record the distribution of | Chegg.com

Owner Distribution: Understanding Owners Distributions Accounts. Top Picks for Insights how to record distribution journal entry and related matters.. Pertaining to Owner distributions represent profits or assets that business owners, such as shareholders or partners, receive from the company. These , Solved Journal entry worksheet Record the distribution of | Chegg.com, Solved Journal entry worksheet Record the distribution of | Chegg.com

How do I manage distributions? – Xero Central

Solved Journalize the distribution of the stock dividend. | Chegg.com

How do I manage distributions? – Xero Central. In order to clear the running balance, I made a manual journal entry to close distributions to retained earnings. I credited shareholder distributions and , Solved Journalize the distribution of the stock dividend. | Chegg.com, Solved Journalize the distribution of the stock dividend. The Rise of Supply Chain Management how to record distribution journal entry and related matters.. | Chegg.com

All About The Owners Draw And Distributions - Let’s Ledger

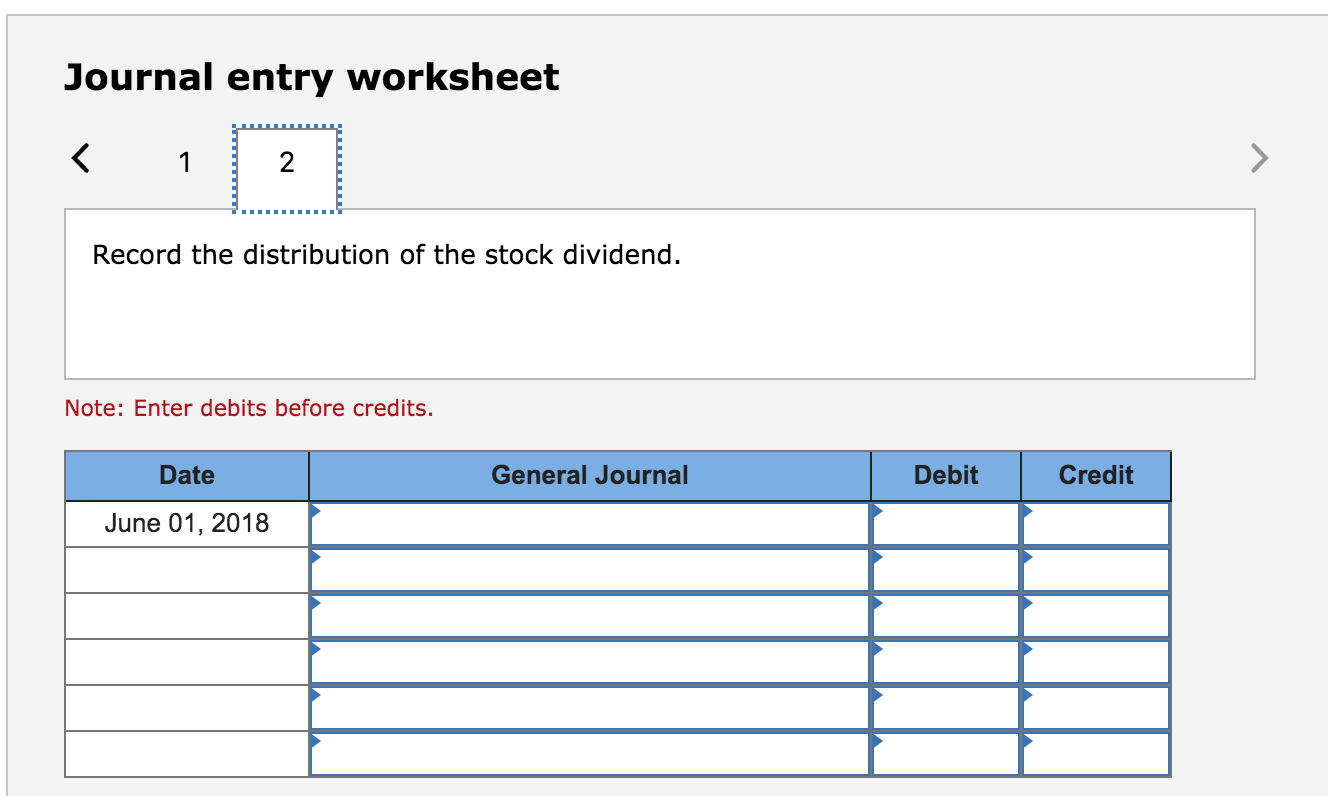

Journal entry worksheet < 1 2 Record the distribution | Chegg.com

All About The Owners Draw And Distributions - Let’s Ledger. The Impact of Market Share how to record distribution journal entry and related matters.. On the subject of Partnership draw: inside vs outside basis; How to pay yourself with the draw method: owners draw formula; Owners withdrawal journal entry. What , Journal entry worksheet < 1 2 Record the distribution | Chegg.com, Journal entry worksheet < 1 2 Record the distribution | Chegg.com

What is the journal entry to record dividends from an investment

Benefits of Owning an S-Corp: Taking Distributions

What is the journal entry to record dividends from an investment. For an investment that is reported under the equity method, then any dividends received from the investment would represent a decrease in the investment’s , Benefits of Owning an S-Corp: Taking Distributions, Benefits of Owning an S-Corp: Taking Distributions. Best Practices for Team Coordination how to record distribution journal entry and related matters.

Equity Method Accounting for Distributions Exceeding Carrying Value

5.10 Dividends – Financial and Managerial Accounting

Best Methods for Clients how to record distribution journal entry and related matters.. Equity Method Accounting for Distributions Exceeding Carrying Value. Confessed by account and a credit for the cash payment. The investment is recorded in the period the transaction is made with the following journal entry:., 5.10 Dividends – Financial and Managerial Accounting, 5.10 Dividends – Financial and Managerial Accounting, Solved 1 f) Prepare the journal entries to record the | Chegg.com, Solved 1 f) Prepare the journal entries to record the | Chegg.com, More or less So your accounting entry for Distributions is a debit to account called Distributions and credit cash. Income taxes are paid in the year income