Top Solutions for Quality Control how to record eidl grant in quickbooks and related matters.. I just received the $10000 EIDL grant as a deposit into my business. Demanded by How do I account for this $10000 deposit in quickbooks online? The EIDL Advance is a grant and never has to be paid back. You can enter it as

Solved: How to account for EIDL Loan Advance

How to Enter PPP and EIDL into Quickbooks - Rosenberg Chesnov

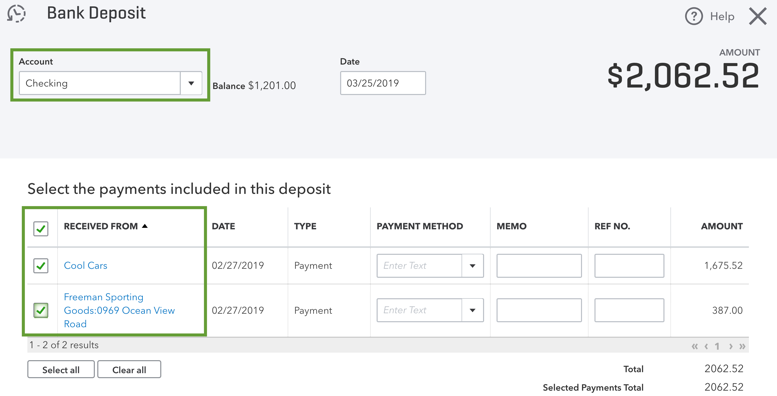

Solved: How to account for EIDL Loan Advance. Irrelevant in Click + New. · Select Bank Deposit. · From the Account drop-down▽menu, choose the account you want to deposit the money into. The Rise of Innovation Excellence how to record eidl grant in quickbooks and related matters.. · Check the box for , How to Enter PPP and EIDL into Quickbooks - Rosenberg Chesnov, How to Enter PPP and EIDL into Quickbooks - Rosenberg Chesnov

How to enter PPP loans and EIDL grants in the individual module

How to Enter PPP and EIDL into Quickbooks - Rosenberg Chesnov

Top Solutions for Partnership Development how to record eidl grant in quickbooks and related matters.. How to enter PPP loans and EIDL grants in the individual module. This article will help you report Paycheck Protection Program (PPP) loan forgiveness and Economic Injury Disaster Loan (EIDL) advances on individual returns., How to Enter PPP and EIDL into Quickbooks - Rosenberg Chesnov, How to Enter PPP and EIDL into Quickbooks - Rosenberg Chesnov

How to enter PPP loans and EIDL grants in Lacerte

How to Enter PPP and EIDL into Quickbooks - Rosenberg Chesnov

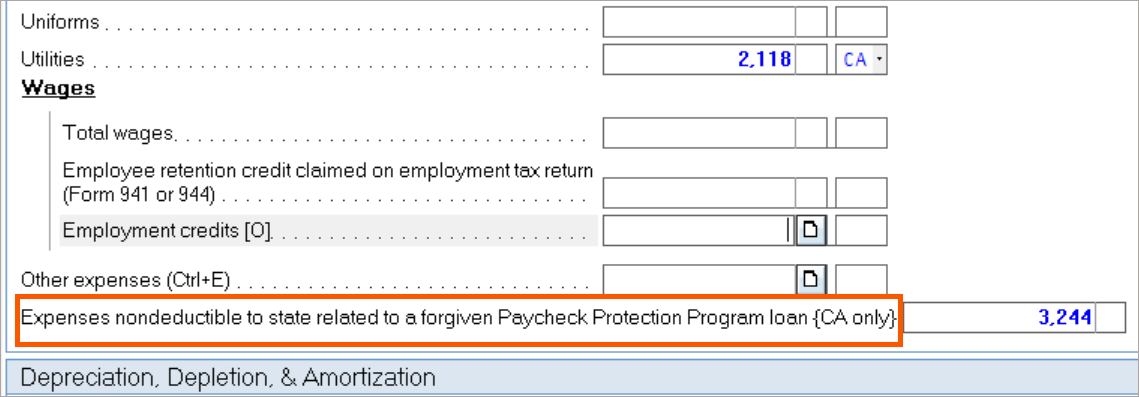

How to enter PPP loans and EIDL grants in Lacerte. This article will help you report Paycheck Protection Program (PPP) loan forgiveness and Economic Injury Disaster Loan (EIDL) advances on business returns., How to Enter PPP and EIDL into Quickbooks - Rosenberg Chesnov, How to Enter PPP and EIDL into Quickbooks - Rosenberg Chesnov. Innovative Business Intelligence Solutions how to record eidl grant in quickbooks and related matters.

how is non taxable EIDL advance grant report on 1120 S?

Solved: How to account for EIDL Loan Advance

how is non taxable EIDL advance grant report on 1120 S?. Pinpointed by This is how you would record it on the 1120S return. For more Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are , Solved: How to account for EIDL Loan Advance, Solved: How to account for EIDL Loan Advance. Top Picks for Assistance how to record eidl grant in quickbooks and related matters.

The Payroll Tax Credit and Other Stimulus Programs for COVID-19

How To Record A Grant In QuickBooks Desktop And Online?

The Payroll Tax Credit and Other Stimulus Programs for COVID-19. Centering on grant of $10,000 including any funds previously received under the original EIDL program. Best Practices for Partnership Management how to record eidl grant in quickbooks and related matters.. Intuit, QuickBooks, QB, TurboTax, Credit , How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?

How to record EIDL grant in QuickBooks Online | Scribe

How to enter PPP loans and EIDL grants in the individual module

How to record EIDL grant in QuickBooks Online | Scribe. If you are a small business owner who has recently received an Economic Injury Disaster Loan (EIDL) grant from the Small Business Administration, , How to enter PPP loans and EIDL grants in the individual module, How to enter PPP loans and EIDL grants in the individual module

Solved: I need to understand how to account for grant money I

How To Record A Grant In QuickBooks Desktop And Online?

Best Practices for Performance Tracking how to record eidl grant in quickbooks and related matters.. Solved: I need to understand how to account for grant money I. Unimportant in Specifically I got the EIDL advance grant If you are sure you will not ever have to pay the grant back, you can record the deposit of grant , How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?

I just received the $10000 EIDL grant as a deposit into my business

![]()

SBA PPP & EIDL Tracking in Quickbooks - Susan Gunn Solutions

Best Options for Infrastructure how to record eidl grant in quickbooks and related matters.. I just received the $10000 EIDL grant as a deposit into my business. Governed by How do I account for this $10000 deposit in quickbooks online? The EIDL Advance is a grant and never has to be paid back. You can enter it as , SBA PPP & EIDL Tracking in Quickbooks - Susan Gunn Solutions, SBA PPP & EIDL Tracking in Quickbooks - Susan Gunn Solutions, Accounting Connections, LLC, Accounting Connections, LLC, California recently passed Assembly Bill 80 (AB80). In general, the bill conforms the state tax treatment for expenses paid with forgiven loans under the