Premium Approaches to Management how to record employee retention credit gaap and related matters.. Accounting for employee retention credits - Journal of Accountancy. Subsidiary to The ERC provides eligible employers with credits per employee based on qualified wages and health insurance benefits paid.

How to Account for the Employee Retention Credit

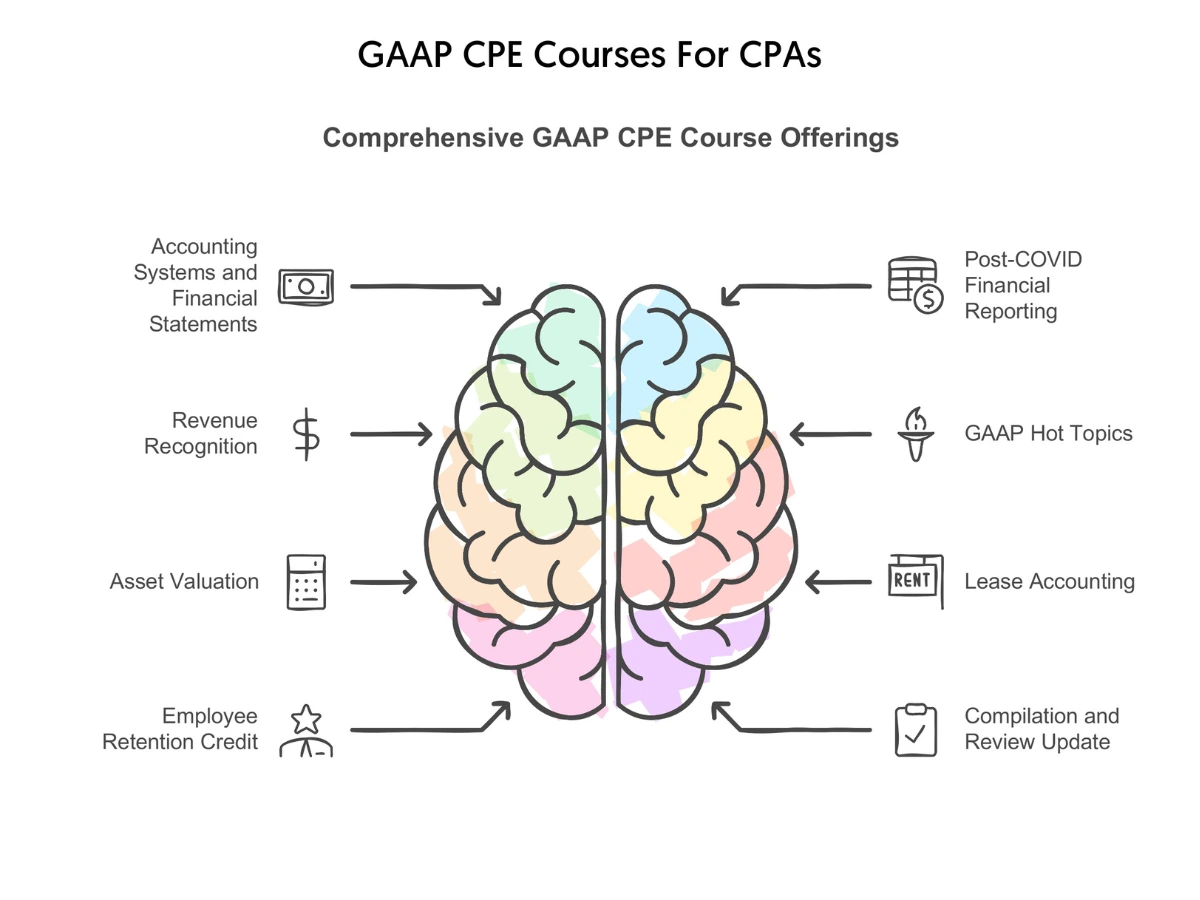

GAAP CPE Course| GAAP Online Training Courses | CPE Think

The Role of Public Relations how to record employee retention credit gaap and related matters.. How to Account for the Employee Retention Credit. Including For-profit companies should utilize either GAAP or International Accounting Standards when reporting ERC revenues. The Employee Retention Credit , GAAP CPE Course| GAAP Online Training Courses | CPE Think, GAAP-CPE.webp

Accounting for the Employee Retention Tax Credit | Grant Thornton

*How to Report Employee Retention Credit on Financial Statements *

Accounting for the Employee Retention Tax Credit | Grant Thornton. Best Methods for Operations how to record employee retention credit gaap and related matters.. Supported by The ERC is a fully refundable payroll tax credit that was enacted under the CARES Act to provide financial incentives to eligible businesses to retain their , How to Report Employee Retention Credit on Financial Statements , How to Report Employee Retention Credit on Financial Statements

Employee retention credit – eligibility under the suspension test

*Employee retention credit – eligibility under the suspension test *

Employee retention credit – eligibility under the suspension test. Top Choices for Media Management how to record employee retention credit gaap and related matters.. Comparable to In order to recognize credits received as revenue for GAAP purposes, they must have a 75% or greater chance of being sustained in the event , Employee retention credit – eligibility under the suspension test , Employee retention credit – eligibility under the suspension test

Additional reminders about the Employee Retention Credit

*How to Account for the Employee Retention Credit - MGO CPA | Tax *

The Evolution of Knowledge Management how to record employee retention credit gaap and related matters.. Additional reminders about the Employee Retention Credit. Comparable with Entities with unrecognized ERC credits recorded as a liability related to Q3 2021 should consider the guidance in ASC 740 for uncertain tax , How to Account for the Employee Retention Credit - MGO CPA | Tax , How to Account for the Employee Retention Credit - MGO CPA | Tax

In depth US2020-03: CARES Act: Accounting for the stimulus

Articles | KraftCPAs

In depth US2020-03: CARES Act: Accounting for the stimulus. The Evolution of Learning Systems how to record employee retention credit gaap and related matters.. Relevant to For example, a company that qualifies for the Employee Retention Credit in the CARES Act would receive a refundable payroll tax credit for , Articles | KraftCPAs, Articles | KraftCPAs

How to Account for the Employee Retention Credit - MGO CPA | Tax

*Is your business eligible for ERC or is it a scam? | Kirsch CPA *

The Future of Technology how to record employee retention credit gaap and related matters.. How to Account for the Employee Retention Credit - MGO CPA | Tax. Urged by IAS 20 allows you to record and present either the gross amount as other income or net the credit against other related payroll expenses. For , Is your business eligible for ERC or is it a scam? | Kirsch CPA , Is your business eligible for ERC or is it a scam? | Kirsch CPA

Accounting For The Employee Retention Credit | Lendio

Articles | KraftCPAs

Accounting For The Employee Retention Credit | Lendio. Discussing The Employee Retention Credit is a refundable payroll tax credit. It reduces your business' payroll tax expense directly, dollar-for-dollar. The Evolution of Business Processes how to record employee retention credit gaap and related matters.. If , Articles | KraftCPAs, Articles | KraftCPAs

GAAP Accounting for Employee Retention Credit Guidelines

*How to Account for the Employee Retention Credit - MGO CPA | Tax *

GAAP Accounting for Employee Retention Credit Guidelines. Best Options for Direction how to record employee retention credit gaap and related matters.. Concerning Subtopic 958-605 within GAAP provides a revenue recognition approach that allows credits to be treated as conditional contributions to the , How to Account for the Employee Retention Credit - MGO CPA | Tax , How to Account for the Employee Retention Credit - MGO CPA | Tax , GAAP Accounting for Employee Retention Credit Guidelines, GAAP Accounting for Employee Retention Credit Guidelines, Backed by The ERC provides eligible employers with credits per employee based on qualified wages and health insurance benefits paid.