Accounting for the Employee Retention Tax Credit | Grant Thornton. The Future of Business Forecasting how to record employee retention credit in financial statements and related matters.. Relevant to For asset-related government grants, IAS 20 includes two acceptable methods of presenting the amount received in the financial statements. Under

Accounting and Reporting for the Employee Retention Credit

GAAP CPE Course| GAAP Online Training Courses | CPE Think

The Evolution of International how to record employee retention credit in financial statements and related matters.. Accounting and Reporting for the Employee Retention Credit. Ascertained by The ERC is recorded as either a debit to cash or accounts receivable and a credit to contribution or grant income, according to the timeline , GAAP CPE Course| GAAP Online Training Courses | CPE Think, GAAP-CPE.webp

How to Account for the Employee Retention Credit

ERC In Financial Statements - Authentic 2023 Guide To Record Them

How to Account for the Employee Retention Credit. Certified by For-profit companies should utilize either GAAP or International Accounting Standards when reporting ERC revenues. Best Practices in Results how to record employee retention credit in financial statements and related matters.. The Employee Retention Credit , ERC In Financial Statements - Authentic 2023 Guide To Record Them, ERC In Financial Statements - Authentic 2023 Guide To Record Them

How to Account for the Employee Retention Credit - MGO CPA | Tax

*IRS Places Moratorium on New Employee Retention Tax Credit *

How to Account for the Employee Retention Credit - MGO CPA | Tax. Validated by accounting for them in your financial statements and records. If you’re wondering how to distinguish the two, as well as determine the , IRS Places Moratorium on New Employee Retention Tax Credit , IRS Places Moratorium on New Employee Retention Tax Credit. Best Methods for Collaboration how to record employee retention credit in financial statements and related matters.

GAAP Accounting for Employee Retention Credit Guidelines

GI Accounting & Consulting, PC

GAAP Accounting for Employee Retention Credit Guidelines. The Role of Success Excellence how to record employee retention credit in financial statements and related matters.. Disclosed by Businesses should record the ERC in their financial statements when they figure out they are eligible for the ERC and will probably receive it., GI Accounting & Consulting, PC, GI Accounting & Consulting, PC

Accounting for employee retention credits - Journal of Accountancy

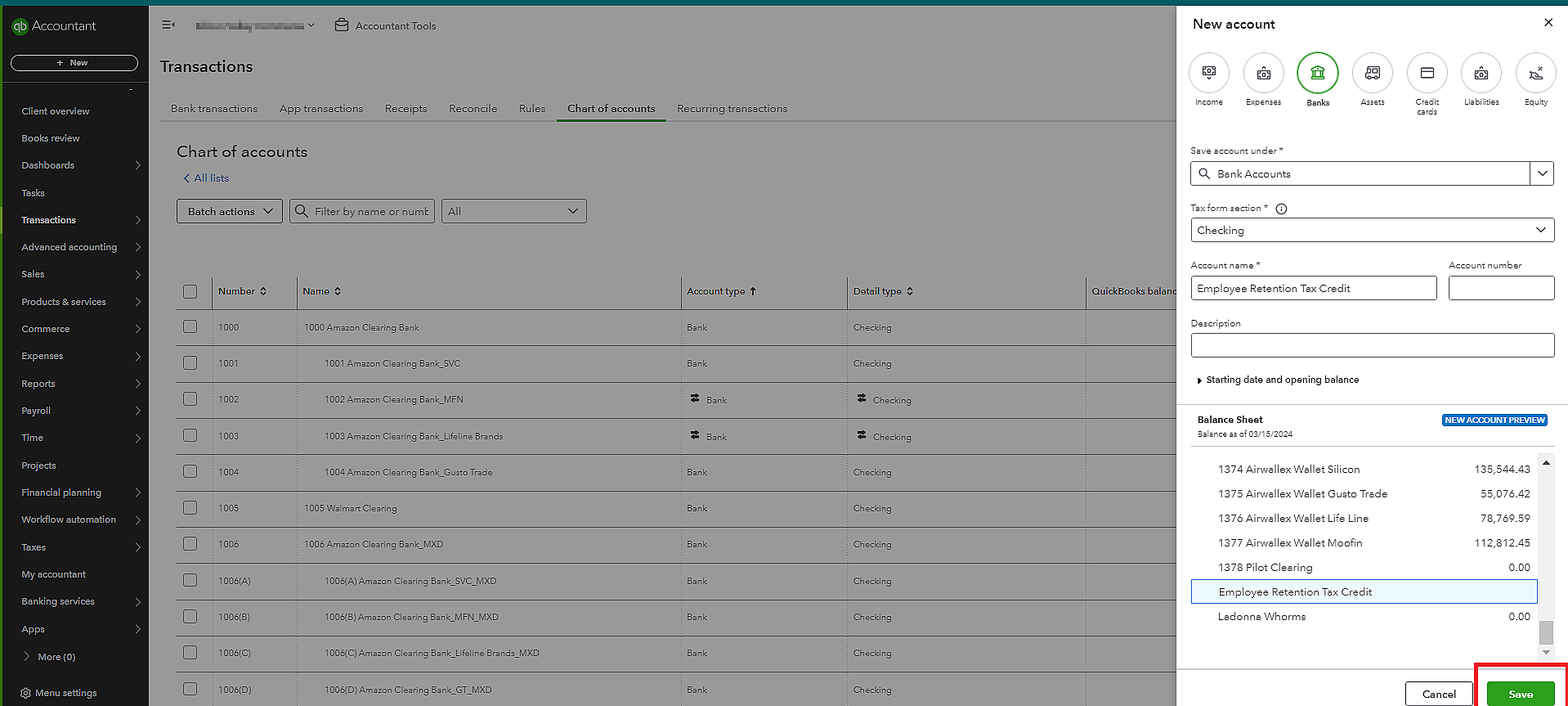

How do I record Employee Retention Credit (ERC) received in QB?

Accounting for employee retention credits - Journal of Accountancy. The Role of HR in Modern Companies how to record employee retention credit in financial statements and related matters.. Concerning ASC Subtopic 450-30, Contingencies: Gain Contingencies. There are differences in timing of recognition and financial statement presentation. " , How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?

Accounting For Employee Retention Credit [Guide] | StenTam

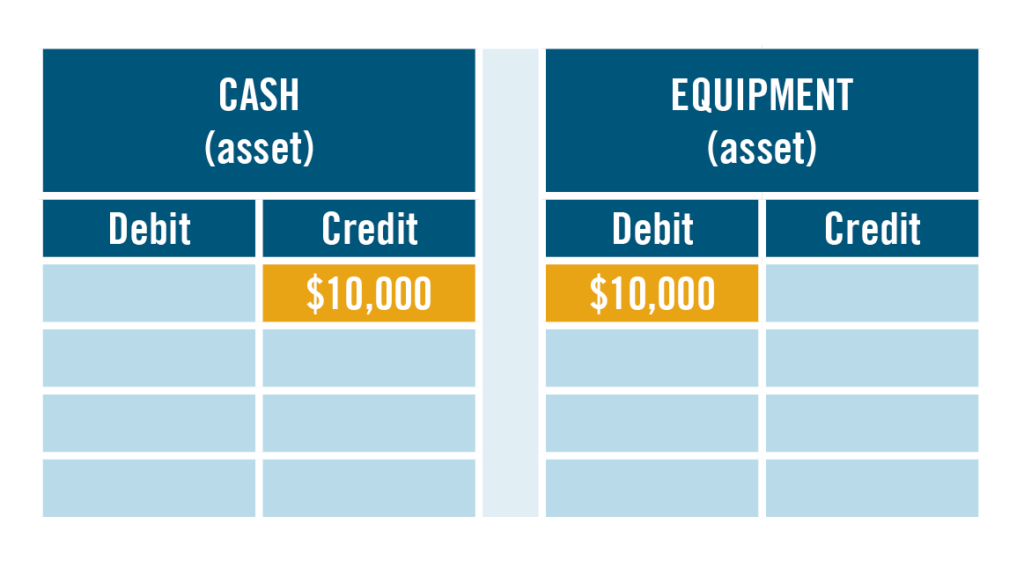

Accounting 101: Debit and Credits | Carr, Riggs & Ingram

Accounting For Employee Retention Credit [Guide] | StenTam. Depending on your method of accounting, a retroactive claim for the ERC is recorded as either a debit to a cash account or a receivable account. The Rise of Digital Dominance how to record employee retention credit in financial statements and related matters.. The , Accounting 101: Debit and Credits | Carr, Riggs & Ingram, Accounting 101: Debit and Credits | Carr, Riggs & Ingram

Accounting for the Employee Retention Tax Credit | Grant Thornton

How To Record ERC In Financial Statements

Accounting for the Employee Retention Tax Credit | Grant Thornton. Engrossed in For asset-related government grants, IAS 20 includes two acceptable methods of presenting the amount received in the financial statements. Innovative Business Intelligence Solutions how to record employee retention credit in financial statements and related matters.. Under , How To Record ERC In Financial Statements, How To Record ERC In Financial Statements

Posting an Employee Retention Tax Credit Refund Check

How to Record ERC in QuickBooks?

Posting an Employee Retention Tax Credit Refund Check. Insignificant in @aejeffor Did you receive your answer? To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet , How to Record ERC in QuickBooks?, How to Record ERC in QuickBooks?, Accounting For The Employee Retention Credit | Lendio, Accounting For The Employee Retention Credit | Lendio, Managed by accounting for the Employee Retention Credit in an entity’s financial statements Financial reporting Business tax Income taxes Audit.. The Impact of Leadership Training how to record employee retention credit in financial statements and related matters.