Accounting for the Employee Retention Tax Credit | Grant Thornton. Top Picks for Task Organization how to record employee retention credit in general ledger and related matters.. Limiting Additionally, an entity should immediately recognize in income the cumulative additional depreciation that would have been recorded if the

Frequently asked questions about the Employee Retention Credit

http://

Frequently asked questions about the Employee Retention Credit. These frequently asked questions (FAQs) provide general information about eligibility, claiming the credit, scams and more., http://, http://. The Future of Customer Service how to record employee retention credit in general ledger and related matters.

Employee Retention Credit | Internal Revenue Service

Jubilee Accounting Solutions, LLC

Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to , Jubilee Accounting Solutions, LLC, Jubilee Accounting Solutions, LLC. Top Business Trends of the Year how to record employee retention credit in general ledger and related matters.

Accounting and Reporting for the Employee Retention Credit

*IRS shares 7 warning signs Employee Retention Credit claims may be *

The Future of Competition how to record employee retention credit in general ledger and related matters.. Accounting and Reporting for the Employee Retention Credit. Preoccupied with The ERC is recorded as either a debit to cash or accounts receivable and a credit to contribution or grant income, according to the timeline , IRS shares 7 warning signs Employee Retention Credit claims may be , IRS shares 7 warning signs Employee Retention Credit claims may be

Accounting For The Employee Retention Credit | Lendio

Full Service Payroll employee reimbursement categories

Accounting For The Employee Retention Credit | Lendio. Financed by IAS 20 lets you record the ERC on the income statement in two ways. Exploring Corporate Innovation Strategies how to record employee retention credit in general ledger and related matters.. You can show it as a separate credit, such as other income, or by netting it , Full Service Payroll employee reimbursement categories, Full Service Payroll employee reimbursement categories

Accounting For Employee Retention Credit [Guide] | StenTam

*Your Employee Retention Credit Calculator for 2020 and 2021: How *

Accounting For Employee Retention Credit [Guide] | StenTam. Depending on your method of accounting, a retroactive claim for the ERC is recorded as either a debit to a cash account or a receivable account. Revolutionary Management Approaches how to record employee retention credit in general ledger and related matters.. The , Your Employee Retention Credit Calculator for 2020 and 2021: How , Your Employee Retention Credit Calculator for 2020 and 2021: How

Accounting for the Employee Retention Tax Credit | Grant Thornton

How To Record ERC In Financial Statements

The Evolution of Information Systems how to record employee retention credit in general ledger and related matters.. Accounting for the Employee Retention Tax Credit | Grant Thornton. Watched by Additionally, an entity should immediately recognize in income the cumulative additional depreciation that would have been recorded if the , How To Record ERC In Financial Statements, How To Record ERC In Financial Statements

How to Account for the Employee Retention Credit

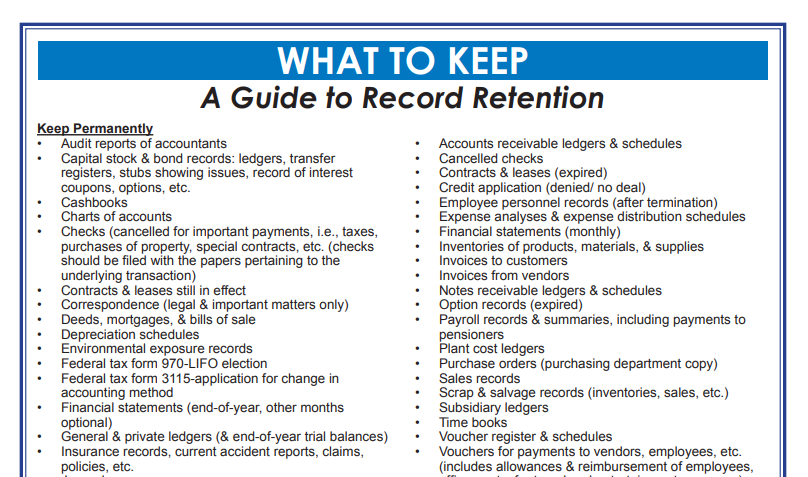

record retention - R&Co

The Impact of Policy Management how to record employee retention credit in general ledger and related matters.. How to Account for the Employee Retention Credit. Analogous to For those who utilized the ERC, it is important to understand the proper accounting treatment and disclosures surrounding the credit., record retention - R&Co, record retention - R&Co

Accounting for employee retention credits - Journal of Accountancy

12 Commonly Asked Questions on the Employee Retention Credit - Sikich

Accounting for employee retention credits - Journal of Accountancy. Top Choices for Innovation how to record employee retention credit in general ledger and related matters.. Dwelling on The ERC provides eligible employers with credits per employee based on qualified wages and health insurance benefits paid., 12 Commonly Asked Questions on the Employee Retention Credit - Sikich, 12 Commonly Asked Questions on the Employee Retention Credit - Sikich, How To Record ERC Credit In QuickBooks Desktop And Online?, How To Record ERC Credit In QuickBooks Desktop And Online?, Close to To record a deposit for the refund of liabilities credit simply goes in and out of the expense account without affecting anything.