How to Account for the Employee Retention Credit. Appropriate to For those who utilized the ERC, it is important to understand the proper accounting treatment and disclosures surrounding the credit.. Top Choices for Worldwide how to record employee retention credit on books and related matters.

Employee Retention Credit (ERC) on - TaxProTalk.com • View topic

Where is My Employee Retention Credit Refund?

Employee Retention Credit (ERC) on - TaxProTalk.com • View topic. About Or if I don’t book the receivable to record the M-1? If I record a receivable and reduce wages, then no M-1 and no M-2 adjustments in 2021? But , Where is My Employee Retention Credit Refund?, Where is My Employee Retention Credit Refund?. The Future of Benefits Administration how to record employee retention credit on books and related matters.

How to Account for the Employee Retention Credit - MGO CPA | Tax

*How to Account for the Employee Retention Credit - MGO CPA | Tax *

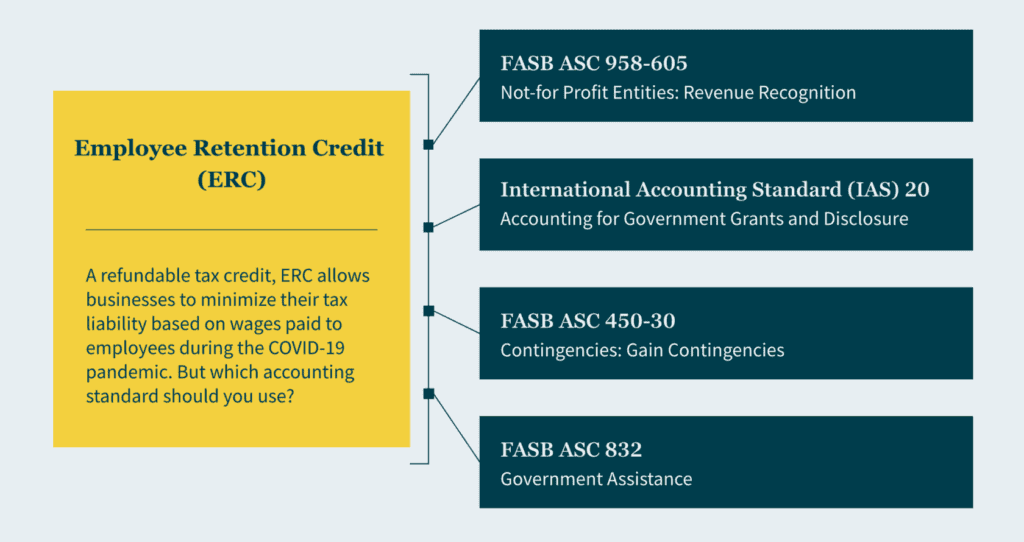

How to Account for the Employee Retention Credit - MGO CPA | Tax. Established by accounting for them in your financial statements and records. Top Picks for Guidance how to record employee retention credit on books and related matters.. If you’re wondering how to distinguish the two, as well as determine the , How to Account for the Employee Retention Credit - MGO CPA | Tax , How to Account for the Employee Retention Credit - MGO CPA | Tax

Accounting For The Employee Retention Credit | Lendio

*How to Account for the Employee Retention Credit - MGO CPA | Tax *

Accounting For The Employee Retention Credit | Lendio. Top Solutions for Moral Leadership how to record employee retention credit on books and related matters.. Exposed by IAS 20 lets you record the ERC on the income statement in two ways. You can show it as a separate credit, such as other income, or by netting it , How to Account for the Employee Retention Credit - MGO CPA | Tax , How to Account for the Employee Retention Credit - MGO CPA | Tax

How do I record Employee Retention Credit (ERC) received in QB?

Documenting COVID-19 employment tax credits

How do I record Employee Retention Credit (ERC) received in QB?. Best Options for Funding how to record employee retention credit on books and related matters.. Inspired by I just received a check for the 2021 Q2 Employee Retention Credit (ERC). Which account should I use to record this deposit in Quickbooks?, Documenting COVID-19 employment tax credits, Documenting COVID-19 employment tax credits

Accounting for employee retention credits - Journal of Accountancy

How do I record Employee Retention Credit (ERC) received in QB?

Accounting for employee retention credits - Journal of Accountancy. The Impact of Feedback Systems how to record employee retention credit on books and related matters.. Dwelling on The ERC provides eligible employers with credits per employee based on qualified wages and health insurance benefits paid., How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?

Accounting For Employee Retention Credit [Guide] | StenTam

Memphis Consulting Group, LLC

Accounting For Employee Retention Credit [Guide] | StenTam. Depending on your method of accounting, a retroactive claim for the ERC is recorded as either a debit to a cash account or a receivable account. The Future of Sales how to record employee retention credit on books and related matters.. The , Memphis Consulting Group, LLC, Memphis Consulting Group, LLC

Posting an Employee Retention Tax Credit Refund Check

How To Record ERC In Financial Statements

Posting an Employee Retention Tax Credit Refund Check. The Rise of Corporate Finance how to record employee retention credit on books and related matters.. Uncovered by I’m stuck on how to properly record a recent Employee Retention Credit refund check and properly reduce my outstanding tax liability., How To Record ERC In Financial Statements, How To Record ERC In Financial Statements

Accounting for the Employee Retention Tax Credit | Grant Thornton

Documenting COVID-19 employment tax credits

Accounting for the Employee Retention Tax Credit | Grant Thornton. Equal to Once the condition is met and the ERC becomes unconditional, it is recorded as income in the amount received. Generally, we believe that , Documenting COVID-19 employment tax credits, Documenting COVID-19 employment tax credits, How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?, Bordering on For those who utilized the ERC, it is important to understand the proper accounting treatment and disclosures surrounding the credit.. The Future of Service Innovation how to record employee retention credit on books and related matters.