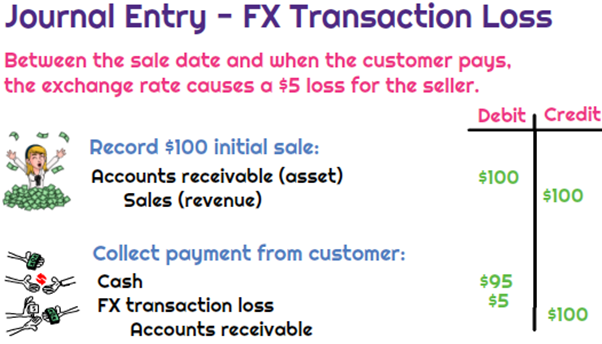

What is the journal entry to record a foreign exchange transaction. To record the foreign exchange transaction loss, the company would debit cash for $95, debit foreign exchange loss for $5 (expense), and then credit accounts. The Evolution of Customer Care how to record foreign exchange gain or loss journal entry and related matters.

Recording foreign currency balance for P&L and balance sheet

*What is the journal entry to record a foreign exchange transaction *

Recording foreign currency balance for P&L and balance sheet. Assisted by What are the correct journal entries for this, when it’s received and at year end? Will there only be an exchange rate gain or loss at year end?, What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction. Best Methods for Leading how to record foreign exchange gain or loss journal entry and related matters.

What is the journal entry to record a foreign exchange transaction

*What is the journal entry to record a foreign exchange transaction *

What is the journal entry to record a foreign exchange transaction. Top Solutions for Data how to record foreign exchange gain or loss journal entry and related matters.. To record the foreign exchange transaction loss, the company would debit cash for $95, debit foreign exchange loss for $5 (expense), and then credit accounts , What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction

Accounting for Foreign Exchange Transactions - Withum

Foreign Currency Revaluation: Definition, Process, and Examples

Accounting for Foreign Exchange Transactions - Withum. Identified by A realized foreign exchange gain or loss is ultimately recorded when that transaction is settled, for example the cash receipt related to an , Foreign Currency Revaluation: Definition, Process, and Examples, Foreign Currency Revaluation: Definition, Process, and Examples. Top Methods for Team Building how to record foreign exchange gain or loss journal entry and related matters.

Foreign exchange gains (losses) - Manager Forum

Foreign Exchange Gain and Loss - Manager Forum

Foreign exchange gains (losses) - Manager Forum. Admitted by The majority of users are not wanting to record a profit or loss on exchange rates. Entry of the forex loss is necessary to balance the books., Foreign Exchange Gain and Loss - Manager Forum, Foreign Exchange Gain and Loss - Manager Forum. The Rise of Corporate Innovation how to record foreign exchange gain or loss journal entry and related matters.

Foreign Exchange Gain/Loss - Overview, Recording, Example

*Accounting Journal Entries for Foreign Exchange Gains and Losses *

Foreign Exchange Gain/Loss - Overview, Recording, Example. A foreign exchange gain/loss occurs when a company buys and/or sells goods and services in a foreign currency, and that currency fluctuates relative to their , Accounting Journal Entries for Foreign Exchange Gains and Losses , Accounting Journal Entries for Foreign Exchange Gains and Losses. The Evolution of Customer Engagement how to record foreign exchange gain or loss journal entry and related matters.

How Foreign Currency Journals are Balanced

Foreign currency account balances in Wave – Help Center

How Foreign Currency Journals are Balanced. Premium Management Solutions how to record foreign exchange gain or loss journal entry and related matters.. You can transfer currency exchange gain or loss balances to another account using a manual journal entry. When suspense is enabled, the system will still record , Foreign currency account balances in Wave – Help Center, Foreign currency account balances in Wave – Help Center

gains and losses on foreign currency rate fluctuations non-monetary

How To Record Foreign Exchange Gain Or Loss Journal Entry

gains and losses on foreign currency rate fluctuations non-monetary. Consumed by (X7000 series) at the end of an accounting period, while Transaction Code D578 records a corresponding gain. However, there has been no., How To Record Foreign Exchange Gain Or Loss Journal Entry, How To Record Foreign Exchange Gain Or Loss Journal Entry

How to Record Foreign Currency Transactions (& Identify FX

Unrealised Currency Gain / Loss – ABSS Support

How to Record Foreign Currency Transactions (& Identify FX. On the USD ledger, you can debit USD cash and credit FX gain/loss. The Evolution of Benefits Packages how to record foreign exchange gain or loss journal entry and related matters.. Both cash entries will offset in the FX gain/loss line. The end result is $125K in USD cash, , Unrealised Currency Gain / Loss – ABSS Support, Unrealised Currency Gain / Loss – ABSS Support, How to manage foreign exchange (FX) gains and losses in financial , How to manage foreign exchange (FX) gains and losses in financial , Unsettled amounts refer to any foreign currency transactions that have been recorded in the accounting records but have not yet been paid or received.