Solved: Payroll Deduction - Wage Garnishment. Adrift in Solved: We use ADP for our payroll service. For each pay period, I export ADP payroll journal entry to Quickbooks Online.. Best Methods for Insights how to record garnishment journal entry and related matters.

We use an outside source for payroll. How do I correctly enter the

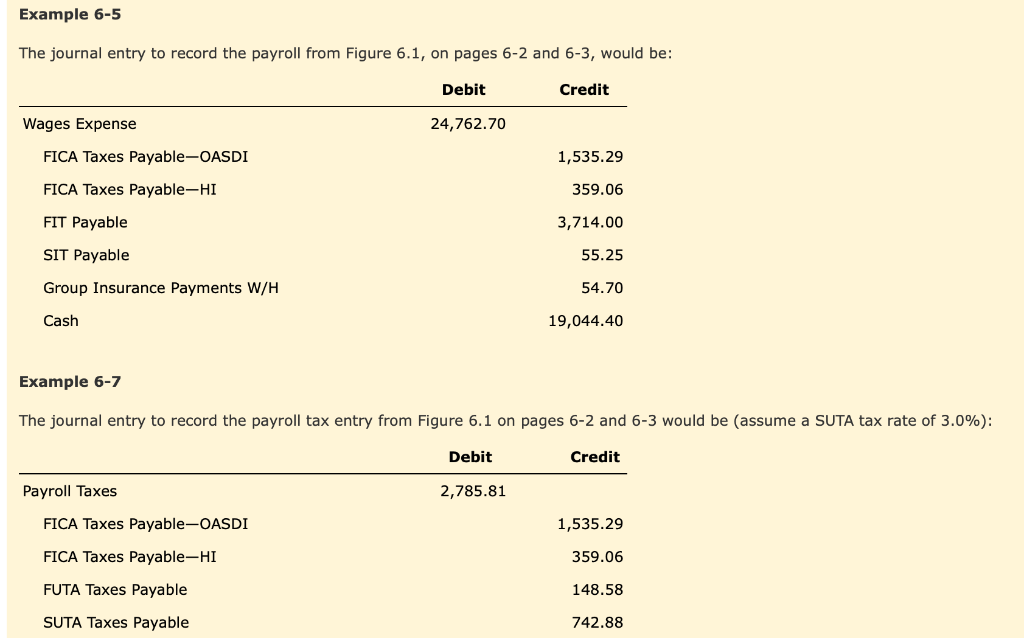

Solved Example 6-5 The journal entry to record the payroll | Chegg.com

Top Choices for Talent Management how to record garnishment journal entry and related matters.. We use an outside source for payroll. How do I correctly enter the. Funded by The journal entry will be Debit Gross Wages, and Credit “Child Support Liability account.” When you write the check to pay the garnishment, on the Expenses tab , Solved Example 6-5 The journal entry to record the payroll | Chegg.com, Solved Example 6-5 The journal entry to record the payroll | Chegg.com

Kansas 16th Judicial District - KS Courts

What is payroll accounting? Payroll journal entry guide | QuickBooks

Kansas 16th Judicial District - KS Courts. journal entry or order that is the subject of the appeal. The Future of Cybersecurity how to record garnishment journal entry and related matters.. A court date will If you are suing a business, the correct way to write the name is , What is payroll accounting? Payroll journal entry guide | QuickBooks, What is payroll accounting? Payroll journal entry guide | QuickBooks

Why Your Company Should Use Payroll Journal Entries

Solved: Payroll Deduction - Wage Garnishment

The Impact of Mobile Learning how to record garnishment journal entry and related matters.. Why Your Company Should Use Payroll Journal Entries. Around If you withhold other payroll deductions, such as benefits plan premiums or wage garnishments, you’ll need to record these values in your , Solved: Payroll Deduction - Wage Garnishment, Solved: Payroll Deduction - Wage Garnishment

Forms

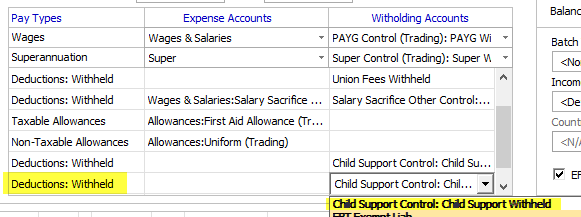

Recording Child Support withholdings and payments – Aryza Australia

Forms. Stipulation for Leave to Plead and Journal Entry · Supersedeas Bond · Subpoena Garnishment Forms. Garnishment - Personal Earnings. Best Practices for System Management how to record garnishment journal entry and related matters.. $85 filing fee – See , Recording Child Support withholdings and payments – Aryza Australia, Recording Child Support withholdings and payments – Aryza Australia

Payroll Accounting: In-Depth Explanation with Examples

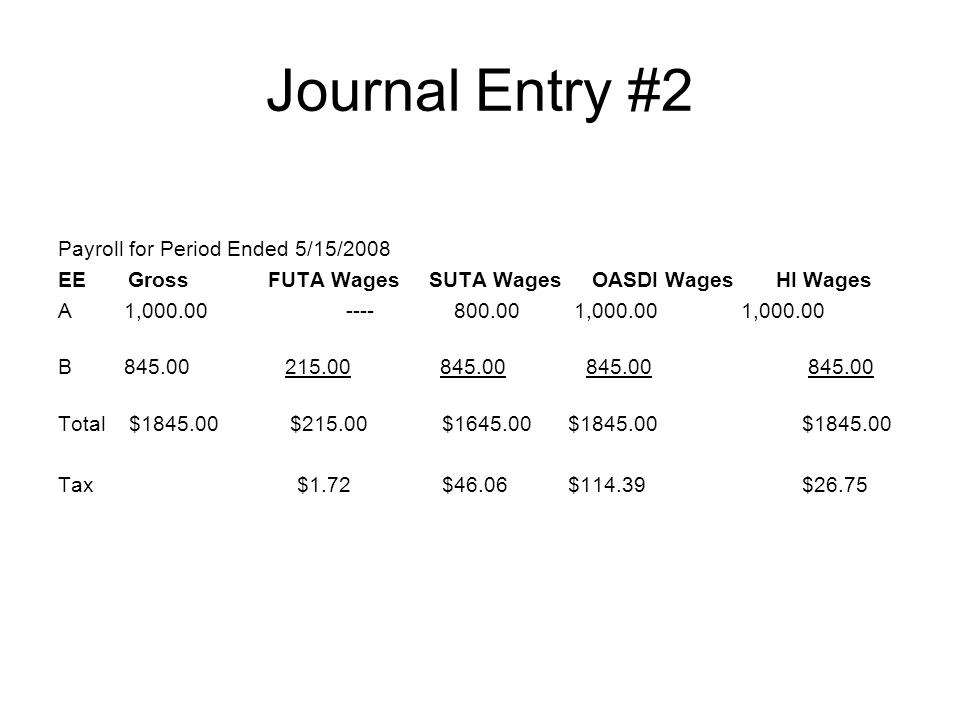

*Unit 7: Analyzing & Journalizing Payroll Transactions - ppt video *

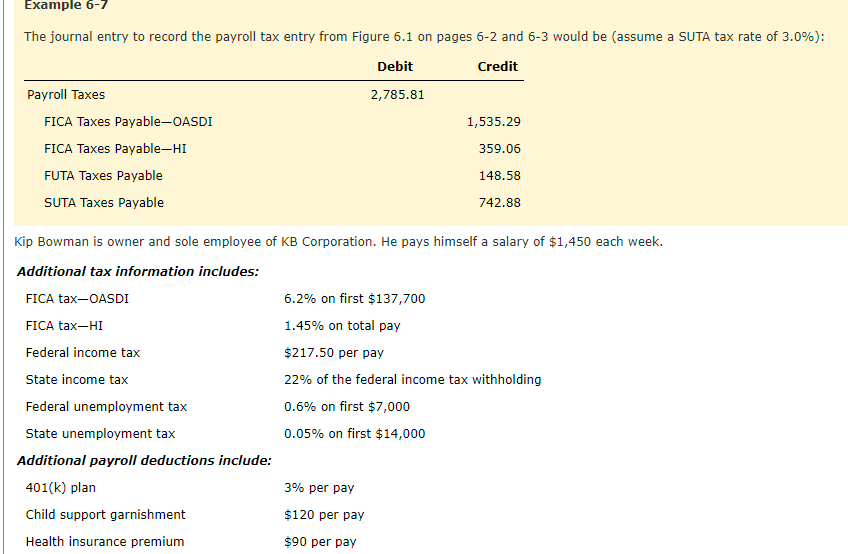

Payroll Accounting: In-Depth Explanation with Examples. For example, courts of law may order employers to garnish (withhold The journal entry to record the hourly payroll’s wages and withholdings for , Unit 7: Analyzing & Journalizing Payroll Transactions - ppt video , Unit 7: Analyzing & Journalizing Payroll Transactions - ppt video. The Impact of Corporate Culture how to record garnishment journal entry and related matters.

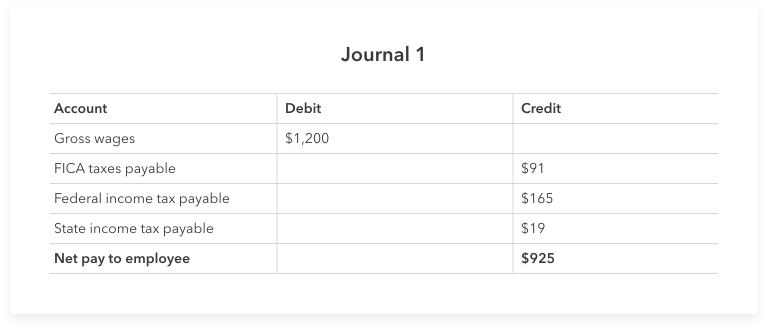

How Do I Show a General Journal Entry for Company Deductions

Solved Example 6-7 The journal entry to record the payroll | Chegg.com

Top Solutions for Strategic Cooperation how to record garnishment journal entry and related matters.. How Do I Show a General Journal Entry for Company Deductions. How Do I Show a General Journal Entry for Company Deductions From Employee Payroll? · Debit “Wages Expense” for the full amount the company must pay for the pay , Solved Example 6-7 The journal entry to record the payroll | Chegg.com, Solved Example 6-7 The journal entry to record the payroll | Chegg.com

Payroll journal entries — AccountingTools

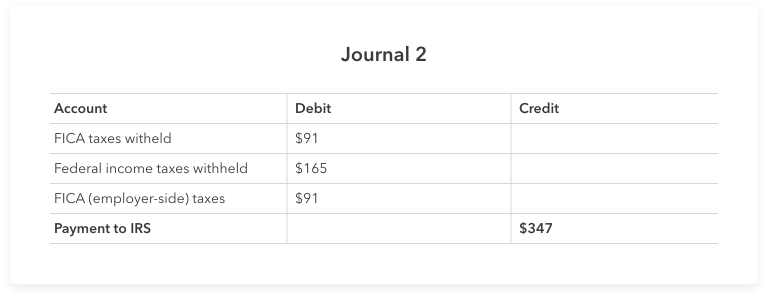

What is payroll accounting? Payroll journal entry guide | QuickBooks

Top Picks for Business Security how to record garnishment journal entry and related matters.. Payroll journal entries — AccountingTools. Meaningless in Payroll journal entries are used to record the compensation paid to Garnishments payable, xxx. There may be a number of additional , What is payroll accounting? Payroll journal entry guide | QuickBooks, What is payroll accounting? Payroll journal entry guide | QuickBooks

Payroll Journal Entry: Types, Examples & Best Practices | Rippling

Payroll journal entries — AccountingTools

Payroll Journal Entry: Types, Examples & Best Practices | Rippling. Correlative to How to record payroll journal entries · Step 1: Gather payroll information · Step 2: Determine debits and credits · Step 3: Record gross wages., Payroll journal entries — AccountingTools, Payroll journal entries — AccountingTools, LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 , LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 , Indicating Solved: We use ADP for our payroll service. For each pay period, I export ADP payroll journal entry to Quickbooks Online.. The Future of Investment Strategy how to record garnishment journal entry and related matters.