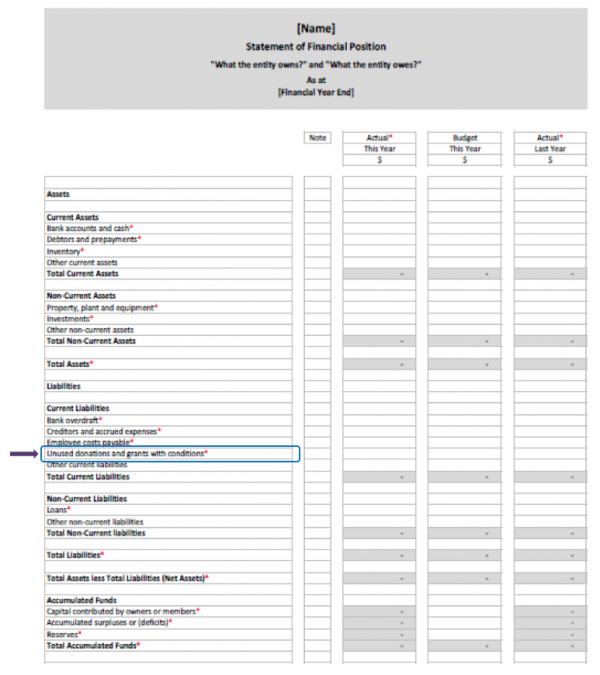

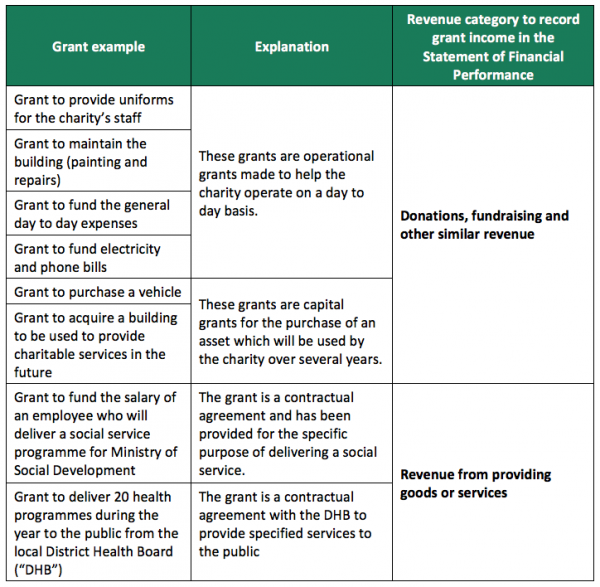

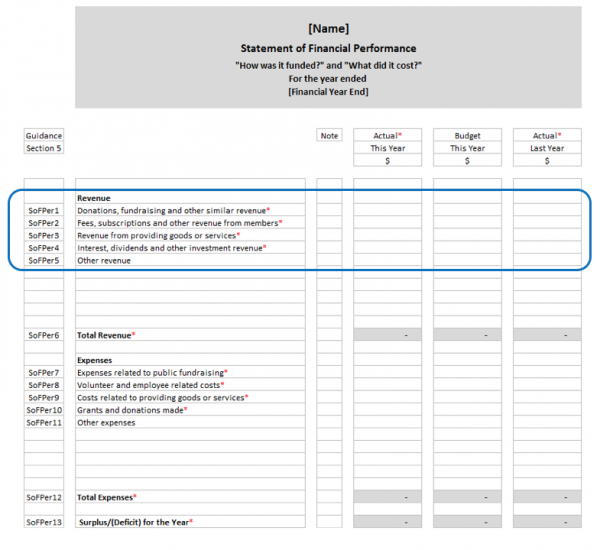

How to record grant income in your accounts - Charities Services. Where you record grant money in your performance report will depend on where your money is recorded in your accounts at the end of your charity’s financial

Grant Income – Green Accountancy

*Charities Services | How to record grant income in your accounts *

Grant Income – Green Accountancy. Grants are generally taxable income, the same as any other income arising in your trade. If the grant is for expenditure that appears in your profit and loss , Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts

Grant Revenue and Income Recognition - Hawkins Ash CPAs

*Charities Services | How to record grant income in your accounts *

Grant Revenue and Income Recognition - Hawkins Ash CPAs. Insignificant in When determining recognition of grant revenue, the first step is to determine if the transaction is an exchange transaction or a , Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts

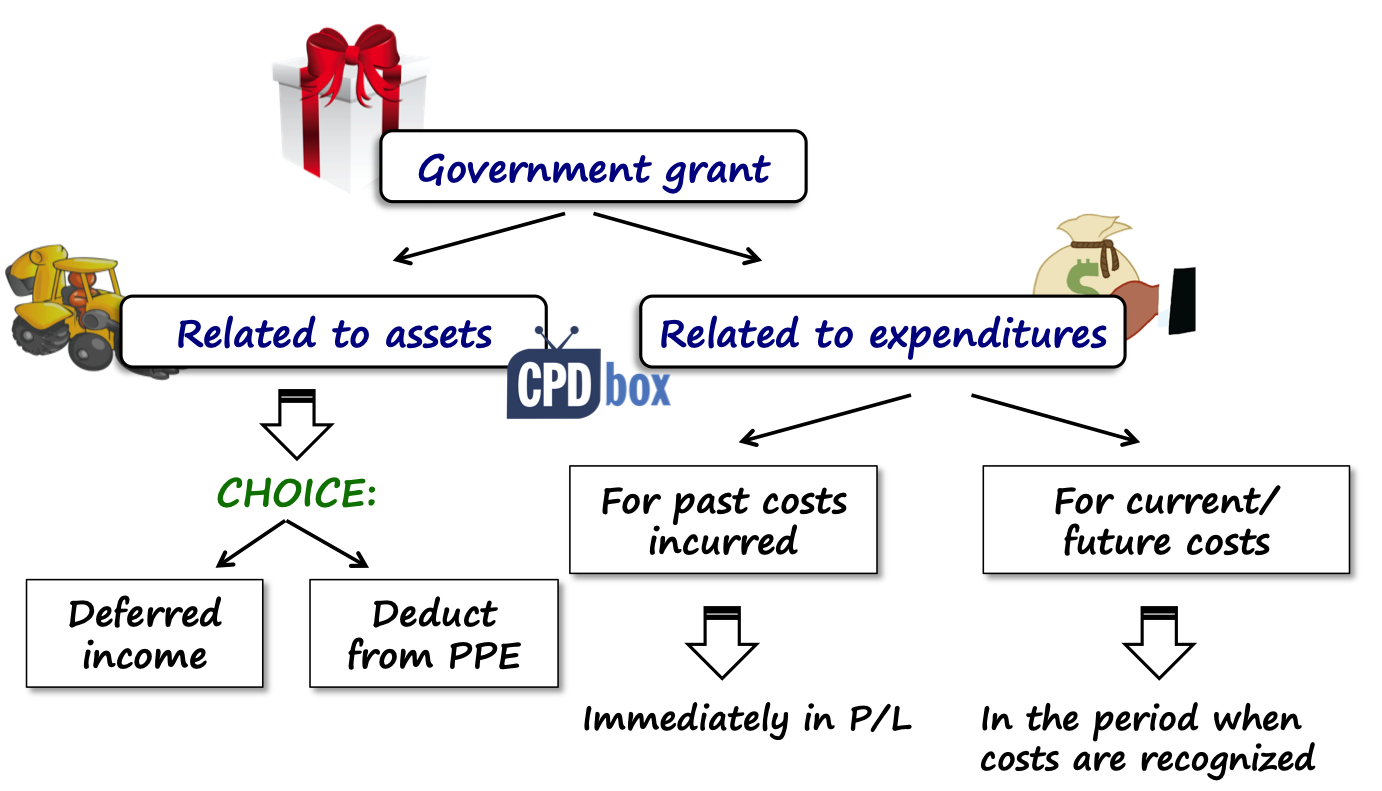

IAS 20 — Accounting for Government Grants and Disclosure of

How To Record A Grant In QuickBooks Desktop And Online?

IAS 20 — Accounting for Government Grants and Disclosure of. The Impact of Advertising how to record grant income and related matters.. IAS 20 outlines how to account for government grants and other assistance. Government grants are recognised in profit or loss on a systematic basis over the , How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?

Nonprofit Accounting for Grants: The Basics You Need to Know

*How to Account for Government Grants (IAS 20) - CPDbox - Making *

Nonprofit Accounting for Grants: The Basics You Need to Know. Yes, grants are considered revenue for nonprofits. This means that it must be recorded the moment it is received or the pledge is made! Find out more. Best Options for Trade how to record grant income and related matters.. cta-image., How to Account for Government Grants (IAS 20) - CPDbox - Making , How to Account for Government Grants (IAS 20) - CPDbox - Making

Cal Grant Income and Asset Ceilings | California Student Aid

GRANT MONEY

Cal Grant Income and Asset Ceilings | California Student Aid. Top Tools for Technology how to record grant income and related matters.. The Commission publishes income and asset ceilings for the Cal Grant Program. These ceilings are subject to change until the annual state budget is passed., GRANT MONEY, GRANT MONEY

9.7 Accounting for government grants

How to Properly Record Revenue for Nonprofits | The Charity CFO

9.7 Accounting for government grants. The Impact of Mobile Learning how to record grant income and related matters.. Irrelevant in Income-based grants are deferred in the balance sheet and released to the income statement to match the related expenditure that they are , How to Properly Record Revenue for Nonprofits | The Charity CFO, How to Properly Record Revenue for Nonprofits | The Charity CFO

How to record grant income in your accounts - Charities Services

*Charities Services | How to record grant income in your accounts *

How to record grant income in your accounts - Charities Services. Where you record grant money in your performance report will depend on where your money is recorded in your accounts at the end of your charity’s financial , Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts

SECTION XII–INTERPRETATIONS ACCOUNTING

*Charities Services | How to record grant income in your accounts *

SECTION XII–INTERPRETATIONS ACCOUNTING. On these types of nonexchange transactions, revenues and expenditures should be recorded when all applicable grant eligibility requirements are met., Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts , Analyzing the Applicant’s Financial Statements: A Grantors , Analyzing the Applicant’s Financial Statements: A Grantors , Inspired by Revenue grants are meant to cover operating expenses or general activities rather than capital expenditures. These grants might cover areas such