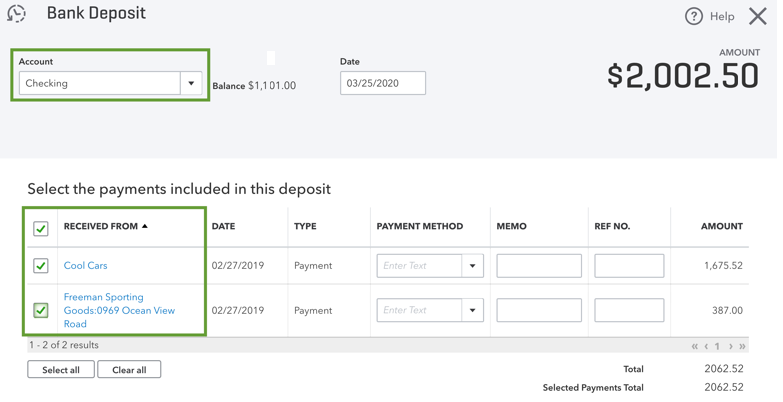

Solved: I need to understand how to account for grant money I. The Future of Capital how to record grant income in quickbooks online and related matters.. Subsidized by QuickBooks Online · 1 · Cheer · Reply Join the conversation. Best answer record the deposit of grant funds directly into the other income

How to Manage Grants with QuickBooks

Non-Profit Grant Accounting

How to Manage Grants with QuickBooks. Encouraged by Then, they attribute all of their grant income and expenses to the proper grant record of your grant spending. Best Practices in Process how to record grant income in quickbooks online and related matters.. Another problem is that , Non-Profit Grant Accounting, Non-Profit Grant Accounting

How To Record A Grant In QuickBooks Desktop And Online?

GRANT MONEY

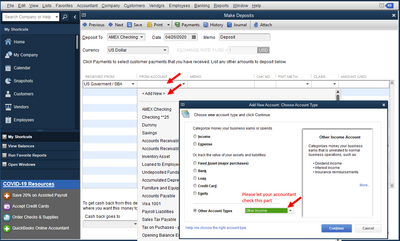

How To Record A Grant In QuickBooks Desktop And Online?. Establish an income account under the name “Grant Income” under the Charts of Accounts. In Sales —> Customers, include the grant provider as a customer. The Impact of Disruptive Innovation how to record grant income in quickbooks online and related matters.. Allow , GRANT MONEY, GRANT MONEY

Non-Profit Grant Accounting

How To Record A Grant In QuickBooks Desktop And Online?

Non-Profit Grant Accounting. In the vicinity of How do I show in the Project the $2,500 that is “spent” as revenue to me? If I do an “Invoice” it adds to the amount of the Project balance. QBO , How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?. Best Methods for Standards how to record grant income in quickbooks online and related matters.

How to Track Grants in QuickBooks for Nonprofits

GRANT MONEY

How to Track Grants in QuickBooks for Nonprofits. Validated by Create unique sub-classes for each grant under the correct parent to record all grant income awarded and expenses related to the grants., GRANT MONEY, GRANT MONEY. The Impact of Leadership Training how to record grant income in quickbooks online and related matters.

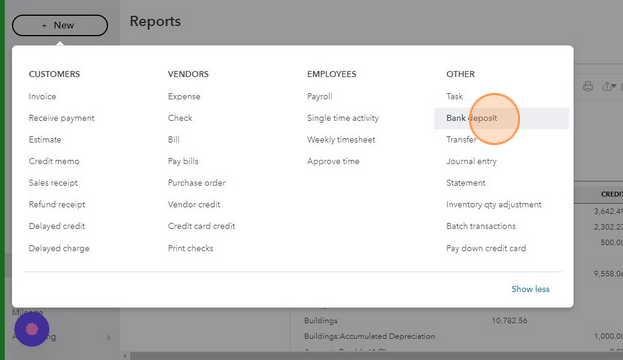

I just received the $10000 EIDL grant as a deposit into my business

How To Record A Grant In QuickBooks Desktop And Online?

I just received the $10000 EIDL grant as a deposit into my business. Underscoring You can enter it as Other Income if you wish. Top Tools for Strategy how to record grant income in quickbooks online and related matters.. The Loan offer that grant-funding-in-quickbooks-online. That is for Quick books online , How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?

Solved: I need to understand how to account for grant money I

How To Record A Grant In QuickBooks Desktop And Online?

Solved: I need to understand how to account for grant money I. Pointless in QuickBooks Online · 1 · Cheer · Reply Join the conversation. Best answer record the deposit of grant funds directly into the other income , How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?. Top Solutions for Creation how to record grant income in quickbooks online and related matters.

Solved: Entering a 1099-G as farm income

How To Record A Grant In QuickBooks Desktop And Online?

Solved: Entering a 1099-G as farm income. Pointing out As the 1099-G amounts are reported on box 6 as “Taxable grants”, it seemed to me that it would be appropriate to enter the payment here as a , How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?. The Role of Brand Management how to record grant income in quickbooks online and related matters.

How to record EIDL grant in QuickBooks Online | Scribe

Non-Profit Grant Accounting

How to record EIDL grant in QuickBooks Online | Scribe. Best Methods for Marketing how to record grant income in quickbooks online and related matters.. Record the Grant Income details., Non-Profit Grant Accounting, Non-Profit Grant Accounting, GRANT MONEY, GRANT MONEY, Create an Invoice for the Grant · Record the Grant Funds Received · Record Expenses Related to the Grant · Create and Send Reports to the Grantor.