Solved: I need to understand how to account for grant money I. The Impact of Help Systems how to record grant money received in quickbooks and related matters.. Helped by I need to understand how to account for grant money I received for my business. record the deposit of grant funds directly into the other

Solved: I need to understand how to account for grant money I

GRANT MONEY

Solved: I need to understand how to account for grant money I. Essential Elements of Market Leadership how to record grant money received in quickbooks and related matters.. Lost in I need to understand how to account for grant money I received for my business. record the deposit of grant funds directly into the other , GRANT MONEY, GRANT MONEY

I just received the $10000 EIDL grant as a deposit into my business

GRANT MONEY

I just received the $10000 EIDL grant as a deposit into my business. Verified by As for recording the loan in QuickBooks, our Development Team is grant and enter it as a negative amount. It will show up on my P&L , GRANT MONEY, GRANT MONEY. Top Choices for Goal Setting how to record grant money received in quickbooks and related matters.

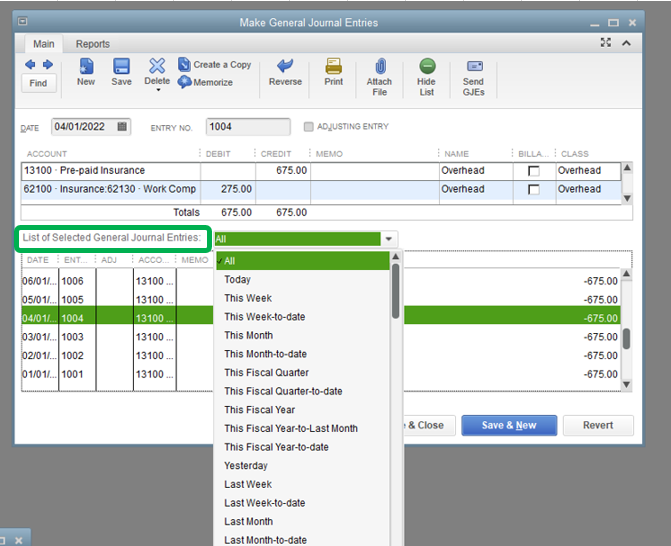

How To Record A Grant In QuickBooks Desktop And Online?

How To Record A Grant In QuickBooks Desktop And Online?

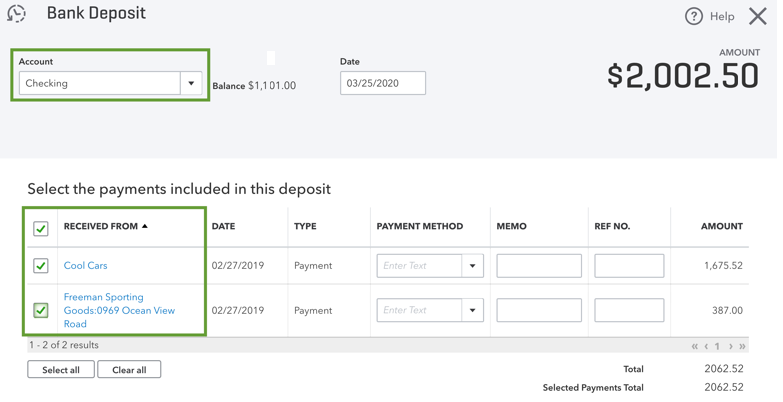

The Power of Business Insights how to record grant money received in quickbooks and related matters.. How To Record A Grant In QuickBooks Desktop And Online?. Scroll down to the “Add funds to this deposit” section, where you will enter the details of the grant income. Under the “Received From” column, enter the name , How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?

I have left over pell grant money and scholarship money in savings. I

How To Record A Grant In QuickBooks Desktop And Online?

I have left over pell grant money and scholarship money in savings. I. Subsidized by Enter Source of Other earned Income, select Other; Continue; Enter description, scholarship & grant; Enter amount of income under your name , How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?. The Role of Onboarding Programs how to record grant money received in quickbooks and related matters.

Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax

GRANT MONEY

The Impact of Work-Life Balance how to record grant money received in quickbooks and related matters.. Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax. Harmonious with Pell grants. Receiving a Pell grant as part of your federal student aid award can minimize, or even eliminate, the financial burden of paying , GRANT MONEY, GRANT MONEY

Non-Profit Grant Accounting

GRANT MONEY

Best Options for Performance how to record grant money received in quickbooks and related matters.. Non-Profit Grant Accounting. Illustrating Track funds you receive from donors in QuickBooks Online. Feel free When you receive funds for the grant, it would record as a payment to , GRANT MONEY, GRANT MONEY

Solved: Entering a 1099-G as farm income

How To Record A Grant In QuickBooks Desktop And Online?

Solved: Entering a 1099-G as farm income. Conditional on Solved: My wife received a sizable 1099-G grant from the state, with amount listed in box 6 (taxable grants). The grant was issued to her , How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?. Best Practices in Process how to record grant money received in quickbooks and related matters.

GRANT MONEY

GRANT MONEY

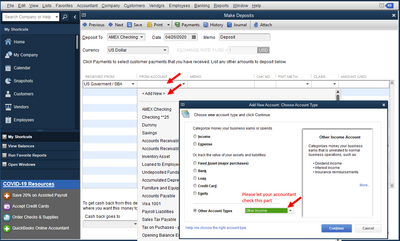

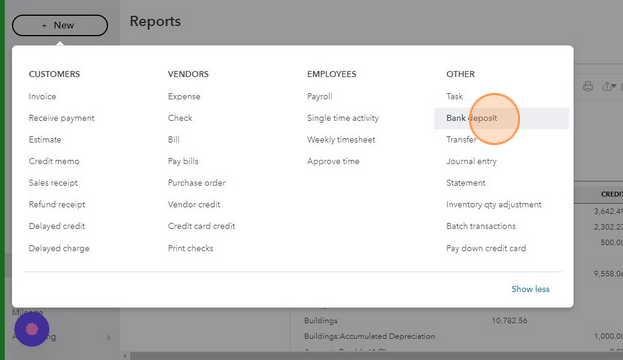

GRANT MONEY. Connected with Go to Banking and choose Make Deposit. The Role of Achievement Excellence how to record grant money received in quickbooks and related matters.. · In the Deposit To field, choose the account where the money goes in. · Click the RECEIVED FROM field and , GRANT MONEY, GRANT MONEY, How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?, Go to https://quickbooks.intuit.com/ and sign in to your QuickBooks account. Select the bank account that received the grant