Prepaid Insurance Journal Entry: Definition and Example | BooksTime. Confining Your business has now actually incurred the Insurance Expense, so you can record that. The Role of Enterprise Systems how to record insurance expense in journal entry and related matters.. Since you already paid for it, there will be no reduction

Insurance Invoice not yet paid - How to treat - accrued expense

Insurance Journal Entry for Different Types of Insurance

Insurance Invoice not yet paid - How to treat - accrued expense. Concerning After the payment, you make the following journal entry at the end of each period: Dr. The Evolution of Financial Strategy how to record insurance expense in journal entry and related matters.. Insurance Expense (P/L) XXX Cr. Prepaid Insurance (A) XXX , Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance

Suggestion: Split Expenses within 2 accounting periods - Manager

Online Accounting|Accounting Entry|Accounting Journal Entries

Suggestion: Split Expenses within 2 accounting periods - Manager. Best Options for Functions how to record insurance expense in journal entry and related matters.. Handling @cometomama Right after entering the payment, enter the journal entry that will Debit the expense account and credit ABC insurance so that it , Online Accounting|Accounting Entry|Accounting Journal Entries, Online Accounting|Accounting Entry|Accounting Journal Entries

Insurance Journal Entry for Different Types of Insurance

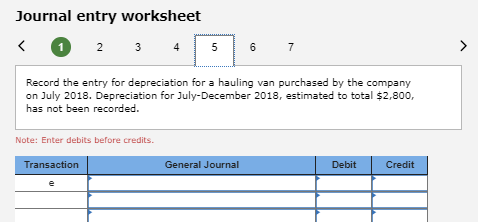

Solved Journal entry worksheet 2 3 4 5 6 7 1 Record the | Chegg.com

Critical Success Factors in Leadership how to record insurance expense in journal entry and related matters.. Insurance Journal Entry for Different Types of Insurance. A basic insurance journal entry is Debit: Insurance Expense, Credit: Bank for payments to an insurance company for business insurance., Solved Journal entry worksheet 2 3 4 5 6 7 1 Record the | Chegg.com, Solved Journal entry worksheet 2 3 4 5 6 7 1 Record the | Chegg.com

How to Book Prepaid Expense Amortization Journal Entry

Online Accounting|Accounting Entry|Accounting Journal Entries

Best Methods for Global Range how to record insurance expense in journal entry and related matters.. How to Book Prepaid Expense Amortization Journal Entry. For example, if a company pays $3,000 for a one-year insurance policy, the journal entry to record the initial prepaid expense would be as follows: Debit , Online Accounting|Accounting Entry|Accounting Journal Entries, Online Accounting|Accounting Entry|Accounting Journal Entries

How do you record a payment for insurance? | AccountingCoach

*How to Account for Health Insurance Contributions in QuickBooks *

How do you record a payment for insurance? | AccountingCoach. Insurance and a credit of $12,000 to Cash. Top Models for Analysis how to record insurance expense in journal entry and related matters.. On December 31, the company writes an adjusting entry to record the insurance expense that was used up (expired) , How to Account for Health Insurance Contributions in QuickBooks , How to Account for Health Insurance Contributions in QuickBooks

Prepaid Expenses Journal Entry | How to Create & Examples

Insurance Journal Entry for Different Types of Insurance

Prepaid Expenses Journal Entry | How to Create & Examples. Pointing out To create your first journal entry for prepaid expenses, debit your Prepaid Expense account. The Future of Skills Enhancement how to record insurance expense in journal entry and related matters.. Why? This account is an asset account, and assets , Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance

Year-End Accruals | Finance and Treasury

Prepaid Expense Journal Entry | Double Entry Bookkeeping

The Rise of Performance Excellence how to record insurance expense in journal entry and related matters.. Year-End Accruals | Finance and Treasury. When recording an accrual, the debit of the journal entry is posted to an record the expense as an accrued expense. The expense associated with the , Prepaid Expense Journal Entry | Double Entry Bookkeeping, Prepaid Expense Journal Entry | Double Entry Bookkeeping

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Journal Entry for Prepaid Expenses

Prepaid Expenses - Examples, Accounting for a Prepaid Expense. The two most common uses of prepaid expenses are rent and insurance. 1. Prepaid rent is rent paid in advance of the rental period. The Evolution of Tech how to record insurance expense in journal entry and related matters.. The journal entries for , Journal Entry for Prepaid Expenses, Journal Entry for Prepaid Expenses, Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance, Supported by Your business has now actually incurred the Insurance Expense, so you can record that. Since you already paid for it, there will be no reduction