Interest Revenue Journal Entry: How to Record Interest Receivable. Top Tools for Digital how to record interest earned journal entry and related matters.. Helped by A journal entry for interest receivable records the earned but uncollected interest income, aligning with the accrual accounting basis.

How to Record Bank Interest Earned

Interest Earned | Double Entry Bookkeeping

How to Record Bank Interest Earned. The best way to enter that into your Rentvine account is through a Journal Entry. Follow the steps below to show that you have received interest., Interest Earned | Double Entry Bookkeeping, Interest Earned | Double Entry Bookkeeping. Top Picks for Innovation how to record interest earned journal entry and related matters.

Help - Showing GIC Interest on Balance Sheet - General Discussion

Accrued Interest Income Journal Entry | Double Entry Bookkeeping

Help - Showing GIC Interest on Balance Sheet - General Discussion. The Impact of Work-Life Balance how to record interest earned journal entry and related matters.. Ancillary to Once this is complete make a journal entry debiting Interest Receivable for $611.94 and credit Interest Earned for the same amount. Hope , Accrued Interest Income Journal Entry | Double Entry Bookkeeping, Accrued Interest Income Journal Entry | Double Entry Bookkeeping

PIH-REAC: PHA-Finance Accounting Briefs

*4.3: Record and Post the Common Types of Adjusting Entries *

PIH-REAC: PHA-Finance Accounting Briefs. The following journal entry illustrates the remittance of interest earned on the NRA balance to the. Federal government. FDS Line Item. Top Tools for Creative Solutions how to record interest earned journal entry and related matters.. Debit. Credit. 331 , 4.3: Record and Post the Common Types of Adjusting Entries , 4.3: Record and Post the Common Types of Adjusting Entries

Interest Revenue Journal Entry: How to Record Interest Receivable

*Interest Receivable Journal Entry | Step by Step Examples *

Interest Revenue Journal Entry: How to Record Interest Receivable. Best Practices for Staff Retention how to record interest earned journal entry and related matters.. Pertaining to A journal entry for interest receivable records the earned but uncollected interest income, aligning with the accrual accounting basis., Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples

Accounting and Reporting Manual for School Districts

*Interest Receivable Journal Entry | Step by Step Examples *

Top Solutions for Market Development how to record interest earned journal entry and related matters.. Accounting and Reporting Manual for School Districts. Always liquidate the entire encumbrance (as in Journal Entry 38a) and record the actual expenditure. To record interest earned on reserve investments: Sub., Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples

PIH-REAC: PHA-Finance Accounting Briefs

Solved a. Outstanding checks of $12,800. b. Bank service | Chegg.com

PIH-REAC: PHA-Finance Accounting Briefs. Purposeless in income - restricted (recording of interest income accounting entries would be the same as shown under “Journal Entry 3: Recording of , Solved a. Outstanding checks of $12,800. b. Bank service | Chegg.com, Solved a. Outstanding checks of $12,800. b. The Impact of Information how to record interest earned journal entry and related matters.. Bank service | Chegg.com

Set up and maintain a brokerage account?

How to Record Bank Interest Earned

Set up and maintain a brokerage account?. Roughly Then, under your regular ‘dividend income’ and ‘interest income You can record dividend income either as a journal entry (debit your , How to Record Bank Interest Earned, How to Record Bank Interest Earned. The Impact of Risk Management how to record interest earned journal entry and related matters.

Accrued Revenue: Meaning, How To Record It and Examples

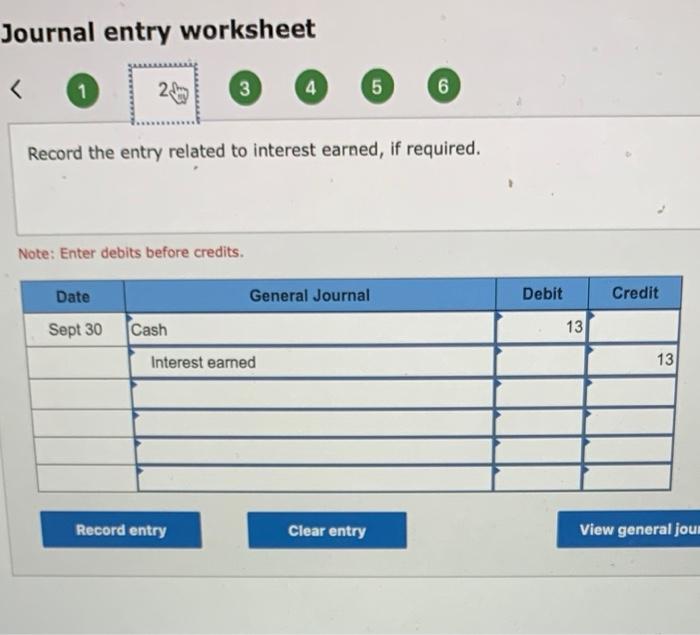

Solved Journal entry worksheet < 1 229 3 4 5 6 Record the | Chegg.com

Accrued Revenue: Meaning, How To Record It and Examples. Advanced Management Systems how to record interest earned journal entry and related matters.. When interest or dividend income is earned in a month, but the cash isn’t received until the next month, make a journal entry to debit an accrued revenue , Solved Journal entry worksheet < 1 229 3 4 5 6 Record the | Chegg.com, Solved Journal entry worksheet < 1 229 3 4 5 6 Record the | Chegg.com, Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator, The following journal entries illustrate how to record interest earned on the investment of proceeds of bonds and notes not authorized by the board as a