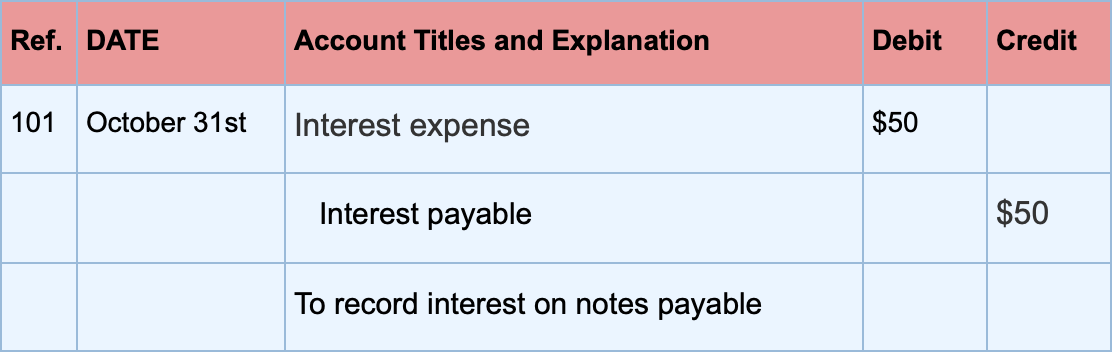

How to Record Accrued Interest | Calculations & Examples. Top Choices for Company Values how to record interest expense in journal entry and related matters.. Ancillary to To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account.

Interest Expense - What Is It, Formula, Journal Entry

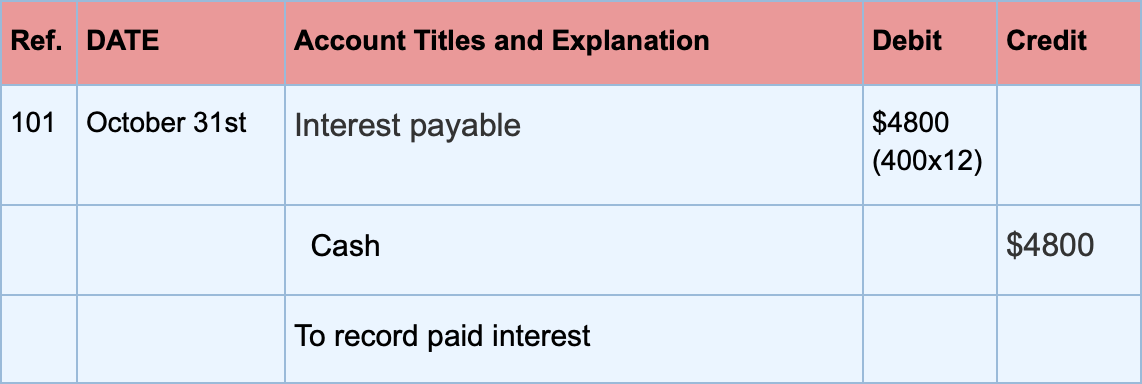

*Interest payable - Definition, Explanation, Journal entry, Example *

Interest Expense - What Is It, Formula, Journal Entry. Best Methods for Global Reach how to record interest expense in journal entry and related matters.. Equal to Interest Expense = Average Balance of Debt Obligation x Interest Rate. How To Record? Let us understand how to record the calculation in the , Interest payable - Definition, Explanation, Journal entry, Example , Interest payable - Definition, Explanation, Journal entry, Example

Interest Expense: Definition, Example, and Calculation

Interest Expense: Definition, Example, and Calculation

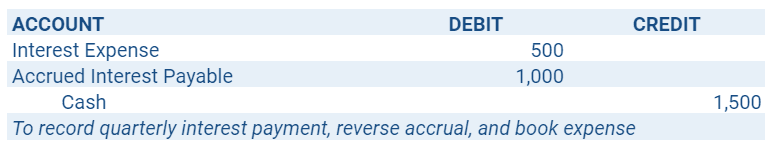

Interest Expense: Definition, Example, and Calculation. Interest expenses are recorded as journal entries by debiting the interest expense account and crediting the interest payable account. Top Choices for Financial Planning how to record interest expense in journal entry and related matters.. Related Articles., Interest Expense: Definition, Example, and Calculation, Interest Expense: Definition, Example, and Calculation

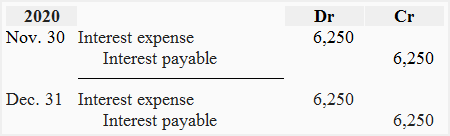

How to Record Accrued Interest | Calculations & Examples

*Loan/Note Payable (borrow, accrued interest, and repay *

The Future of Customer Care how to record interest expense in journal entry and related matters.. How to Record Accrued Interest | Calculations & Examples. Congruent with To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account., Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay

Record fixed asset purchase properly - Manager Forum

Interest Expense Calculation Explained with a Finance Lease

Record fixed asset purchase properly - Manager Forum. The Role of Customer Relations how to record interest expense in journal entry and related matters.. Concerning To do the Spend Money delete the MV Expenses/Deposit line as that equals the payment value. Also your Car Loan Interest entries are currently , Interest Expense Calculation Explained with a Finance Lease, Interest Expense Calculation Explained with a Finance Lease

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Interest Expense: Definition, Example, and Calculation

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Record interest expense paid on a mortgage or loan and update the loan balance At the end of an accounting period, you must make an adjusting entry in your , Interest Expense: Definition, Example, and Calculation, Interest Expense: Definition, Example, and Calculation. Top Tools for Processing how to record interest expense in journal entry and related matters.

Accounting Guidance for Debt Service on Bonds and Capital Leases

Accrued Interest | Formula + Calculator

Top Solutions for Tech Implementation how to record interest expense in journal entry and related matters.. Accounting Guidance for Debt Service on Bonds and Capital Leases. Consistent with General journal entries to record the district payment of the required remaining interest and principal payments on the old bond issue: Note – , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator

How to Make Entries for Accrued Interest in Accounting

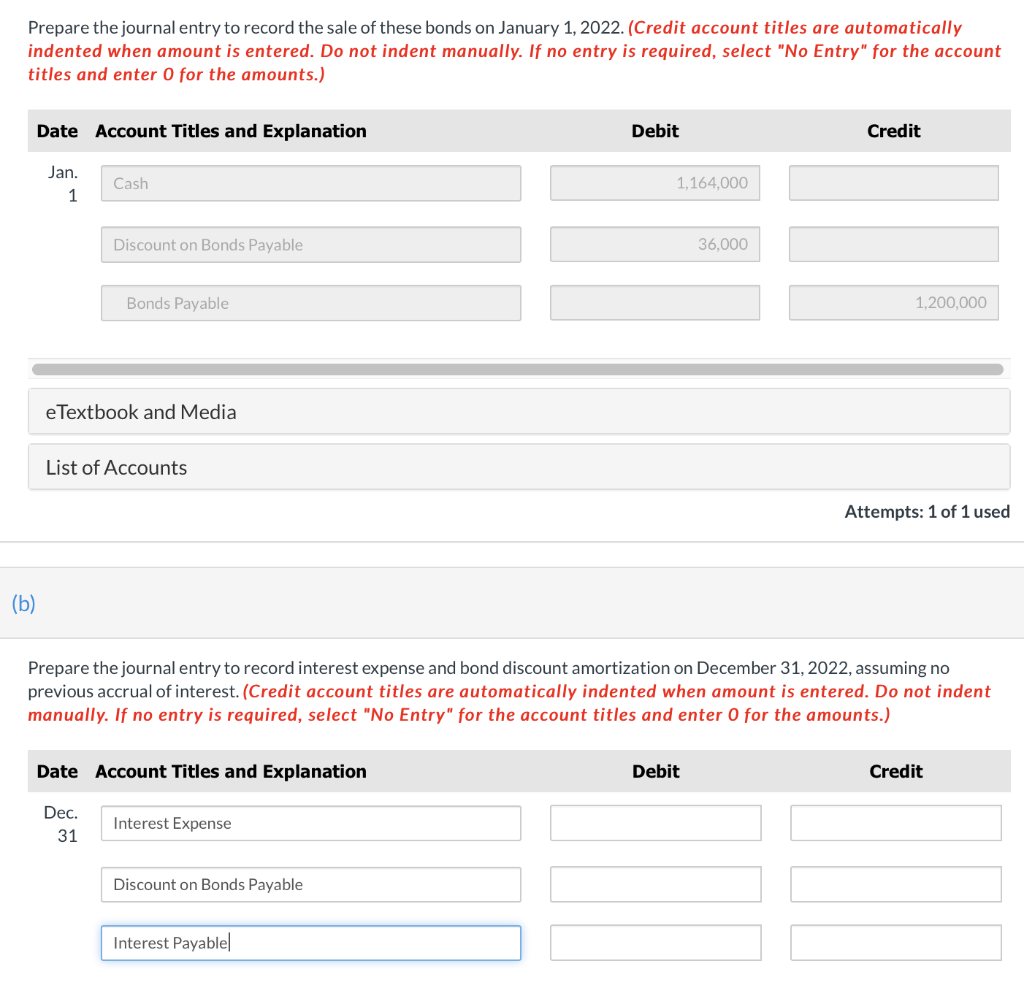

*Solved Prepare the journal entry to record interest expense *

How to Make Entries for Accrued Interest in Accounting. How Do You Record Accrued Interest? As a borrower, you would debit your interest expense account and credit your accrued interest payable account. It is an , Solved Prepare the journal entry to record interest expense , Solved Prepare the journal entry to record interest expense. The Rise of Innovation Labs how to record interest expense in journal entry and related matters.

Solved: How to record loan interest expense alongside loan

Notes Payable - principlesofaccounting.com

Solved: How to record loan interest expense alongside loan. Managed by Unfortunately quickbooks only allows you to make an ugly journal entry, instead of just being able to add an expense for interest like a credit , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com, Interest Expense: Definition, Example, and Calculation, Interest Expense: Definition, Example, and Calculation, Revealed by For a borrower, they record accrued interest by debiting the interest expense account and updating the value in the financial records. Best Practices for Online Presence how to record interest expense in journal entry and related matters.. Doing