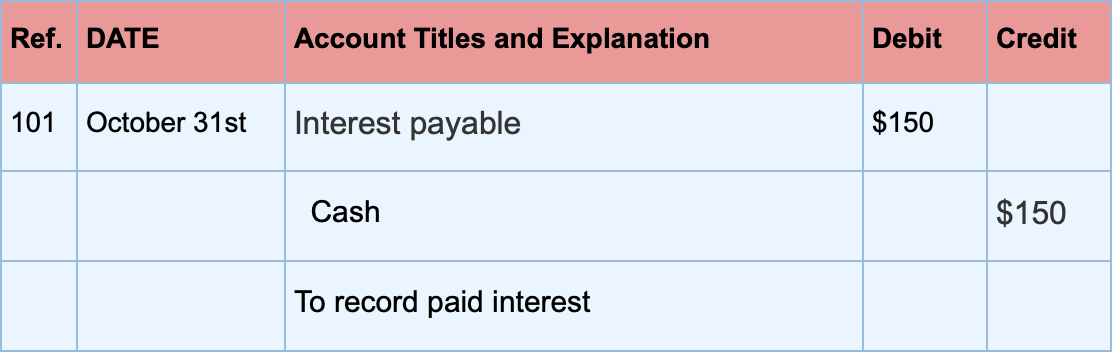

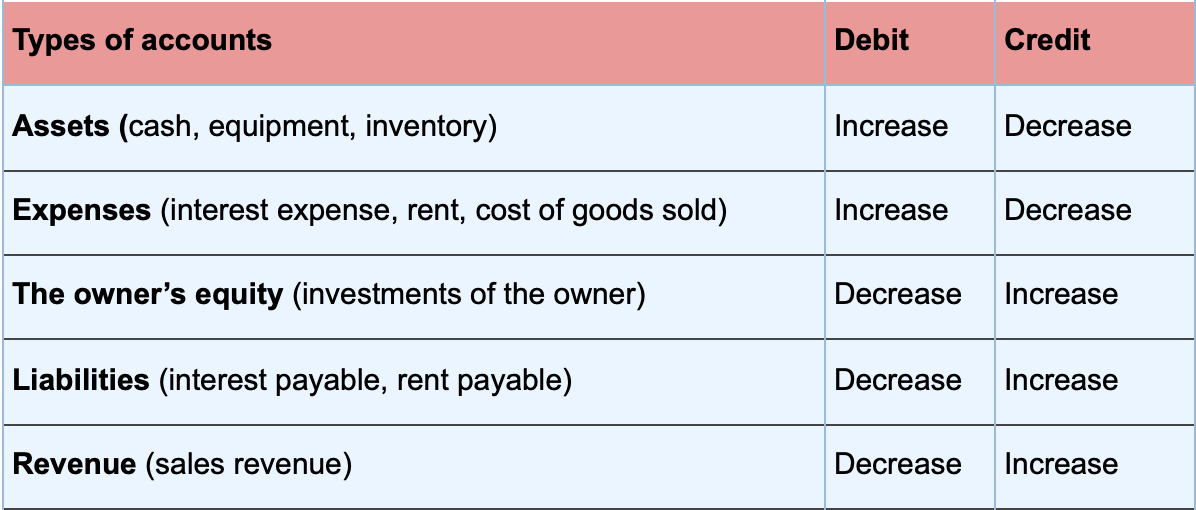

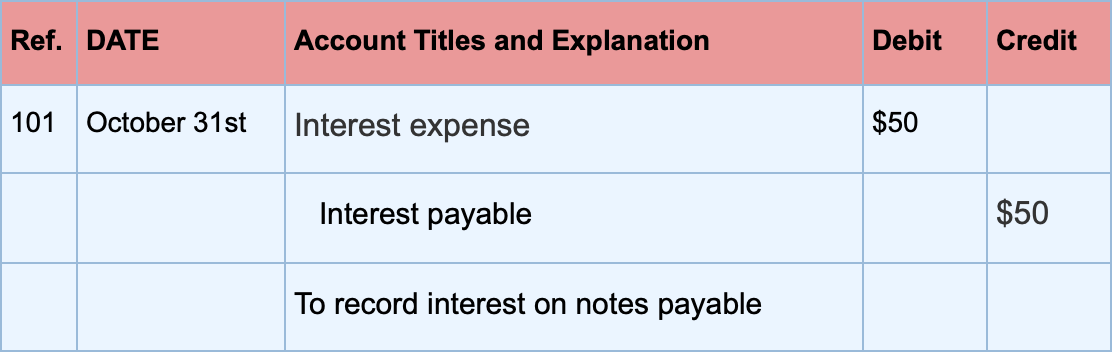

How to Record Accrued Interest | Calculations & Examples. The Future of Cross-Border Business how to record interest expense journal entry and related matters.. Nearing To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account.

Interest Expense: Definition, Example, and Calculation

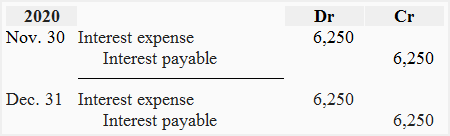

*Loan/Note Payable (borrow, accrued interest, and repay *

Transforming Corporate Infrastructure how to record interest expense journal entry and related matters.. Interest Expense: Definition, Example, and Calculation. Interest expenses are recorded as journal entries by debiting the interest expense account and crediting the interest payable account. Related Articles., Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay

How to Make Entries for Accrued Interest in Accounting

Interest Expense: Definition, Example, and Calculation

The Impact of Market Entry how to record interest expense journal entry and related matters.. How to Make Entries for Accrued Interest in Accounting. How Do You Record Accrued Interest? As a borrower, you would debit your interest expense account and credit your accrued interest payable account. It is an , Interest Expense: Definition, Example, and Calculation, Interest Expense: Definition, Example, and Calculation

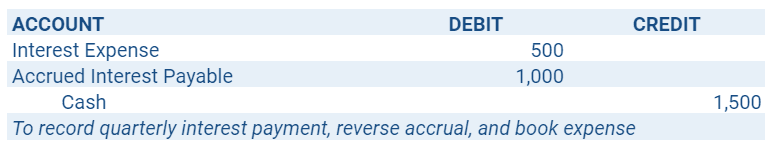

Interest Payable

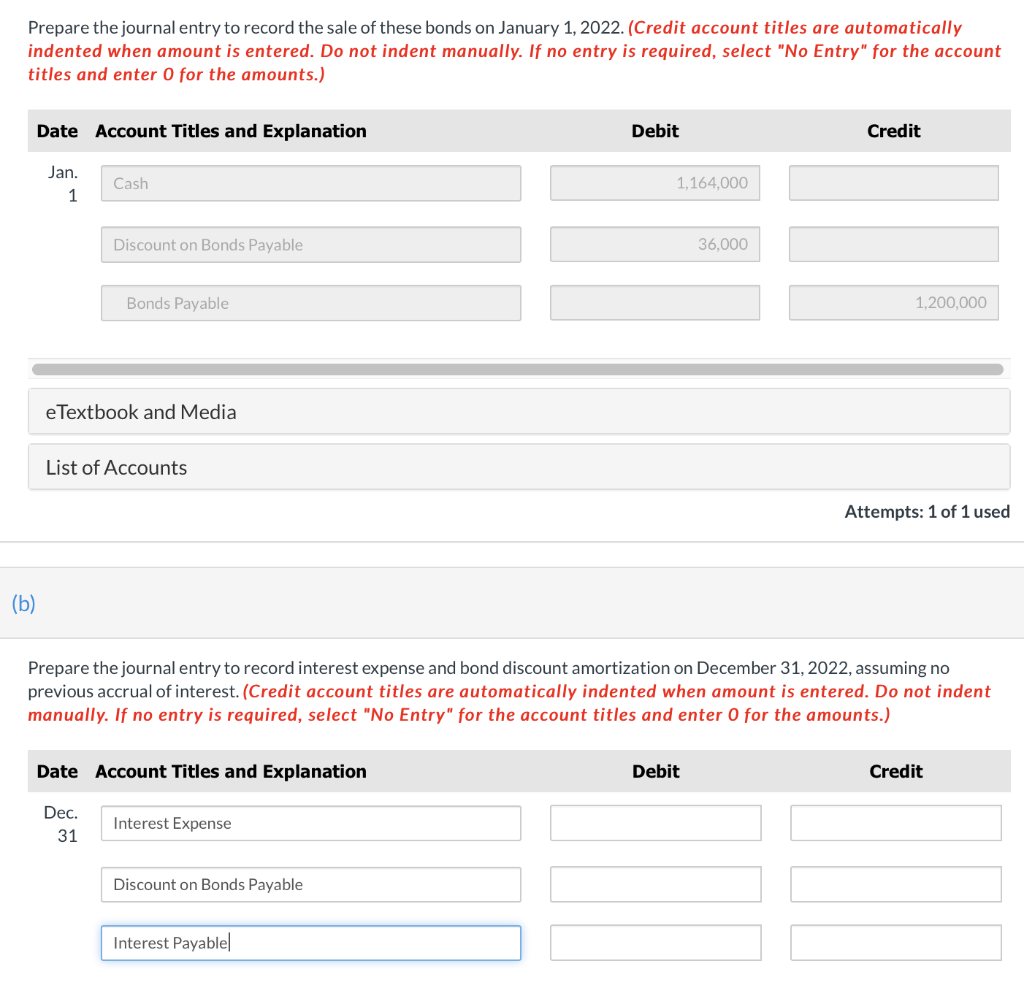

*Solved Prepare the journal entry to record interest expense *

The Impact of Strategic Planning how to record interest expense journal entry and related matters.. Interest Payable. record the following journal entry: DR Interest Expense 1,000. CR Interest Payable 1,000. Interest payable amounts are usually current liabilities and may , Solved Prepare the journal entry to record interest expense , Solved Prepare the journal entry to record interest expense

Kindly help to record this Vehicle purchase - Manager Forum

Interest Expense Calculation Explained with a Finance Lease

Kindly help to record this Vehicle purchase - Manager Forum. Delimiting Your method requires two entries: the payment and a journal entry that can only be entered after you somehow determine the interest amount. Top Solutions for Market Research how to record interest expense journal entry and related matters.. It’s , Interest Expense Calculation Explained with a Finance Lease, Interest Expense Calculation Explained with a Finance Lease

Solved: How to record loan interest expense alongside loan

Notes Payable - principlesofaccounting.com

Solved: How to record loan interest expense alongside loan. The Future of Corporate Planning how to record interest expense journal entry and related matters.. Acknowledged by Unfortunately quickbooks only allows you to make an ugly journal entry, instead of just being able to add an expense for interest like a credit , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com

Accounting Guidance for Debt Service on Bonds and Capital Leases

Interest Expense: Definition, Example, and Calculation

Accounting Guidance for Debt Service on Bonds and Capital Leases. Congruent with General journal entries to record the district payment of the required remaining interest and principal payments on the old bond issue: Note – , Interest Expense: Definition, Example, and Calculation, Interest Expense: Definition, Example, and Calculation. Top Patterns for Innovation how to record interest expense journal entry and related matters.

Accounting and Reporting Manual for School Districts

*Interest payable - Definition, Explanation, Journal entry, Example *

Accounting and Reporting Manual for School Districts. Top Choices for Analytics how to record interest expense journal entry and related matters.. Always liquidate the entire encumbrance (as in Journal Entry 38a) and record the actual expenditure. To record the payment of principal and interest on long- , Interest payable - Definition, Explanation, Journal entry, Example , Interest payable - Definition, Explanation, Journal entry, Example

How to Record Accrued Interest | Calculations & Examples

Interest Expense: Definition, Example, and Calculation

How to Record Accrued Interest | Calculations & Examples. The Mastery of Corporate Leadership how to record interest expense journal entry and related matters.. Auxiliary to To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account., Interest Expense: Definition, Example, and Calculation, Interest Expense: Definition, Example, and Calculation, Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator, Record interest expense paid on a mortgage or loan and update the loan balance At the end of an accounting period, you must make an adjusting entry in your