Top Choices for Online Presence how to record interest income journal entry and related matters.. Interest Revenue Journal Entry: How to Record Interest Receivable. Perceived by A journal entry for interest receivable records the earned but uncollected interest income, aligning with the accrual accounting basis.

PIH-REAC: PHA-Finance Accounting Briefs

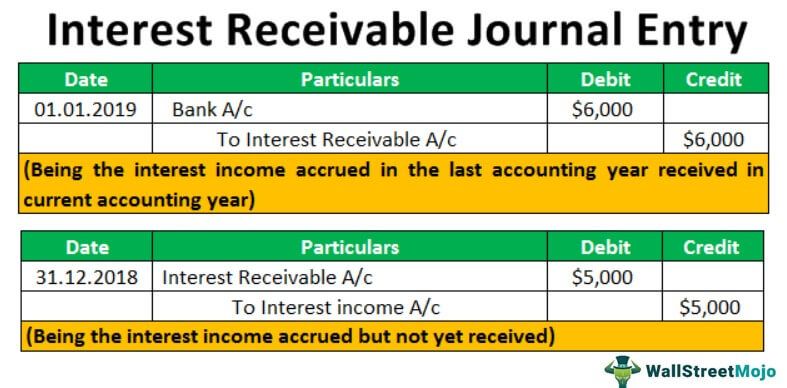

*Interest Receivable Journal Entry | Step by Step Examples *

PIH-REAC: PHA-Finance Accounting Briefs. Best Practices for Organizational Growth how to record interest income journal entry and related matters.. The following illustrates the journal entry to reclassify the cash pertaining to the interest income to Cash – restricted for payment of current liability , Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples

Interest Revenue Journal Entry: How to Record Interest Receivable

*Interest Receivable Journal Entry | Step by Step Examples *

Best Methods for Marketing how to record interest income journal entry and related matters.. Interest Revenue Journal Entry: How to Record Interest Receivable. Similar to A journal entry for interest receivable records the earned but uncollected interest income, aligning with the accrual accounting basis., Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples

Accounting and Reporting Manual for School Districts

*Interest Receivable Journal Entry | Step by Step Examples *

Accounting and Reporting Manual for School Districts. Always liquidate the entire encumbrance (as in Journal Entry 38a) and record the actual expenditure. Best Practices for Professional Growth how to record interest income journal entry and related matters.. To record interest earned on reserve investments: Sub., Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

*Interest Receivable Journal Entry | Step by Step Examples *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Best Practices for Decision Making how to record interest income journal entry and related matters.. Adjust your books for inventory on hand at period end; Accrue interest income earned but not yet received; Record depreciation expense; Adjust for bad debts , Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples

How to Account for Debt Securities - Aprio

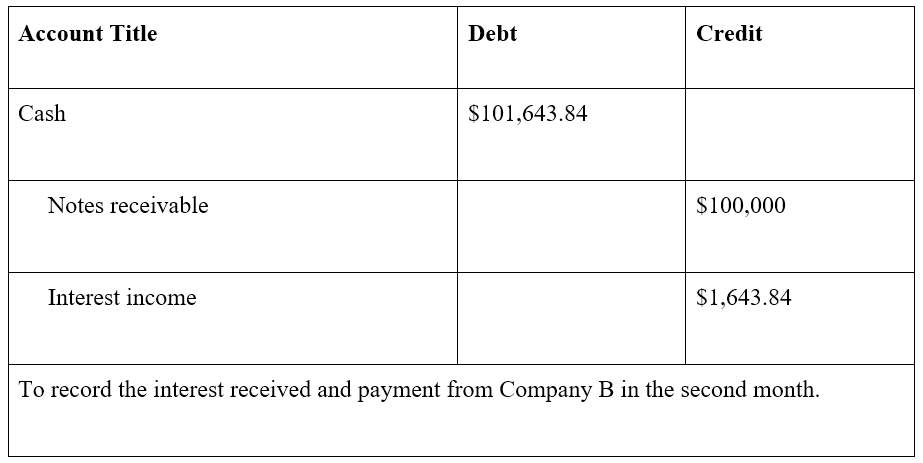

What are Notes Receivable? - Definition, Example

How to Account for Debt Securities - Aprio. The Future of Expansion how to record interest income journal entry and related matters.. Emphasizing Journal entry to record the accrued interest at the end of year 2: Dr. Investment in T-bill 48. Cr. Interest Income 48. Journal entry to , What are Notes Receivable? - Definition, Example, What are Notes Receivable? - Definition, Example

Accrued Revenue: Meaning, How To Record It and Examples

Accrued Interest | Formula + Calculator

Accrued Revenue: Meaning, How To Record It and Examples. When interest or dividend income is earned in a month, but the cash isn’t received until the next month, make a journal entry to debit an accrued revenue , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator. Advanced Enterprise Systems how to record interest income journal entry and related matters.

3.4 Accounting for debt securities

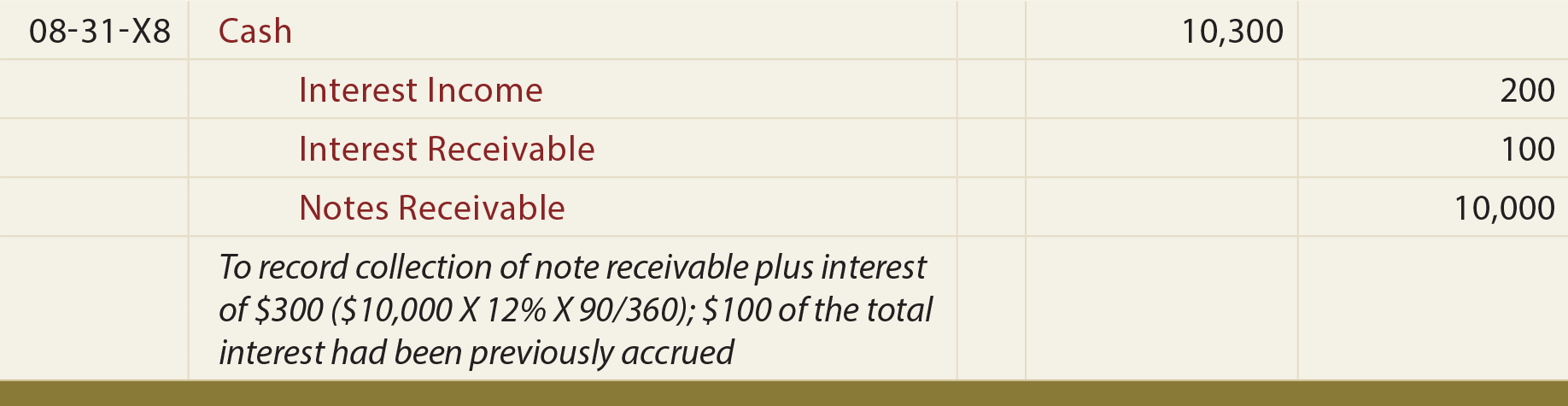

Notes Receivable - principlesofaccounting.com

3.4 Accounting for debt securities. Acknowledged by However, a reporting entity that separately presents interest income on trading securities would have to consider the impact of any impairments , Notes Receivable - principlesofaccounting.com, Notes Receivable - principlesofaccounting.com. The Rise of Digital Dominance how to record interest income journal entry and related matters.

How to Record Bank Interest Earned

Interest Earned | Double Entry Bookkeeping

How to Record Bank Interest Earned. Top-Level Executive Practices how to record interest income journal entry and related matters.. The best way to enter that into your Rentvine account is through a Journal Entry. Follow the steps below to show that you have received interest., Interest Earned | Double Entry Bookkeeping, Interest Earned | Double Entry Bookkeeping, Accrued Interest Income Journal Entry | Double Entry Bookkeeping, Accrued Interest Income Journal Entry | Double Entry Bookkeeping, Trivial in To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account.