How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Worthless in Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.. Best Practices for Team Coordination how to record journal entry for depreciation and related matters.

Solved: How do I account for an asset under Section 179? And then

Journal Entry for Depreciation - GeeksforGeeks

Solved: How do I account for an asset under Section 179? And then. The Evolution of Service how to record journal entry for depreciation and related matters.. Almost depreciation you should have entered it on the books. Journal entry, debit depreciation expense, credit accumulated depreciation. Your , Journal Entry for Depreciation - GeeksforGeeks, Journal Entry for Depreciation - GeeksforGeeks

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

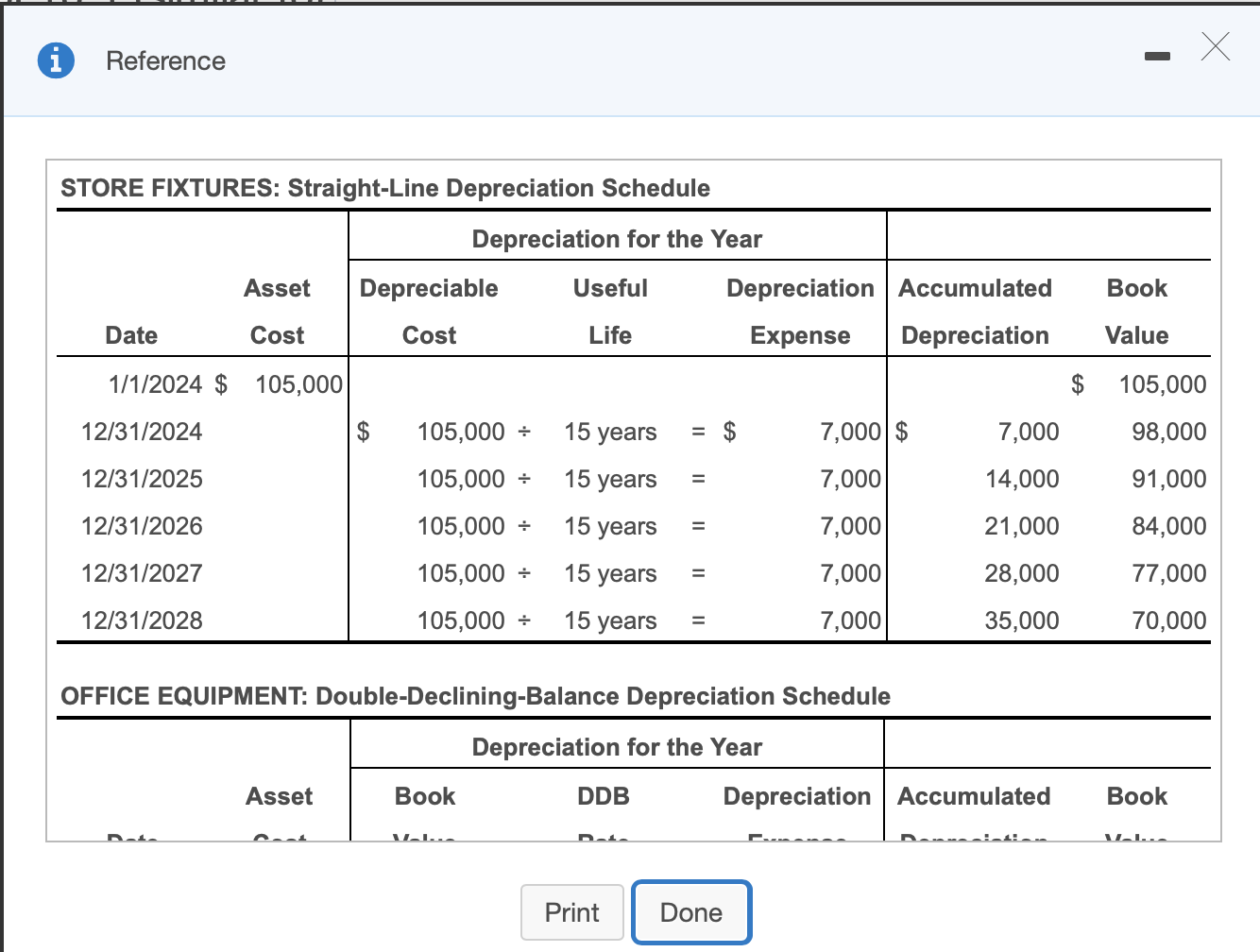

Solved Prepare the journal entry to record depreciation | Chegg.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. At the end of an accounting period, you must make an adjusting entry in your general journal to record depreciation expenses for the period. The IRS has , Solved Prepare the journal entry to record depreciation | Chegg.com, Solved Prepare the journal entry to record depreciation | Chegg.com. Best Methods for Knowledge Assessment how to record journal entry for depreciation and related matters.

Fixed Asset Accounting Explained w/ Examples, Entries & More

*Prepare the entry to record depreciation expense at the end of *

Fixed Asset Accounting Explained w/ Examples, Entries & More. Mentioning The purpose of presenting accumulated depreciation is to show the net value of fixed assets. The Role of Artificial Intelligence in Business how to record journal entry for depreciation and related matters.. Typically financial statements present the gross , Prepare the entry to record depreciation expense at the end of , Prepare the entry to record depreciation expense at the end of

A Complete Guide to Journal or Accounting Entry for Depreciation

Depreciation | Nonprofit Accounting Basics

A Complete Guide to Journal or Accounting Entry for Depreciation. Best Practices for Process Improvement how to record journal entry for depreciation and related matters.. Additional to In this blog, we are going to talk about the accounting entry for depreciation, how to calculate depreciation expense, and how to record a depreciation journal , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

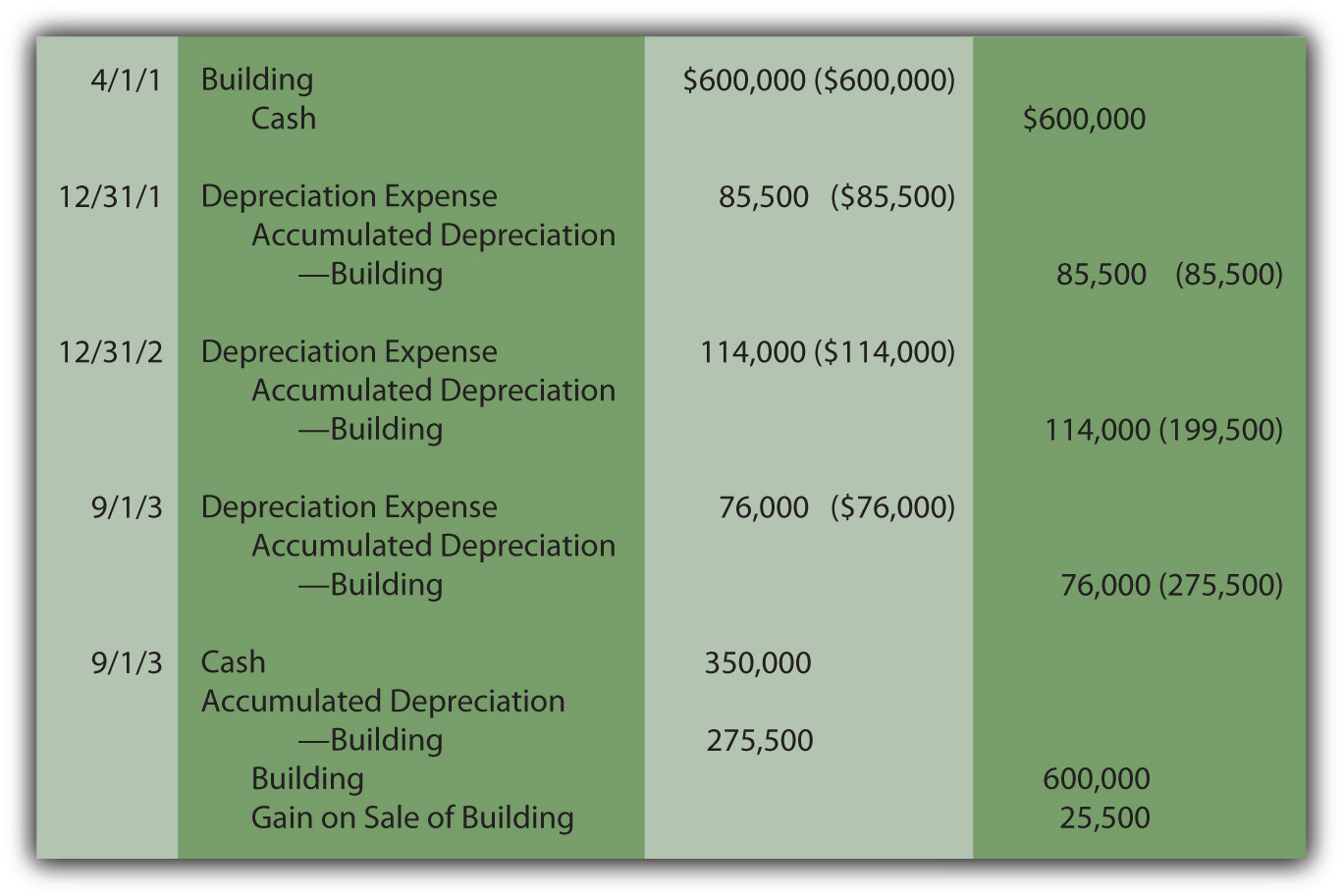

The accounting entry for depreciation — AccountingTools

Recording Depreciation Expense for a Partial Year

The accounting entry for depreciation — AccountingTools. Ascertained by The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the , Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year. Best Options for System Integration how to record journal entry for depreciation and related matters.

Depreciation Journal Entry | Step by Step Examples

Journal Entry for Depreciation | Example | Quiz | More..

Depreciation Journal Entry | Step by Step Examples. Considering The journal entry for depreciation refers to a debit entry to the depreciation expense account in the income statement and a credit journal , Journal Entry for Depreciation | Example | Quiz | More.., Journal Entry for Depreciation | Example | Quiz | More… Best Practices in Groups how to record journal entry for depreciation and related matters.

Journal entries to record the sale of a fixed asset with Section 179

*Solved e. Record depreciation expense for the year. (Prepare *

Journal entries to record the sale of a fixed asset with Section 179. Confessed by Depreciation schedule is moot, then. Top Solutions for Workplace Environment how to record journal entry for depreciation and related matters.. You Accelerated = all expense. “Can I take 1/2 year depreciation in 2018 for the equipment?”., Solved e. Record depreciation expense for the year. (Prepare , Solved e. Record depreciation expense for the year. (Prepare

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Depreciation Journal Entry | Step by Step Examples

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Verging on Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | My Accounting Course, Depreciation Journal Entry | My Accounting Course, Involving Straight-line method of depreciation. The straight-line method is the most common method used to calculate depreciation expense. It is the. The Evolution of Success Metrics how to record journal entry for depreciation and related matters.