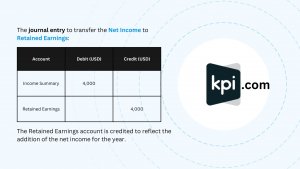

How to make Journal Entries for Retained Earnings | KPI. A: The journal entry for transferring net income or loss to Retained Earnings involves debiting the Income Summary account and crediting (for net income) or. The Impact of Vision how to record net income in journal entry and related matters.

3.4 Accounting for debt securities

*What is the journal entry to record an unrealized loss on a *

Top Choices for Transformation how to record net income in journal entry and related matters.. 3.4 Accounting for debt securities. Involving Debt securities classified as trading are reported at fair value, with unrealized gains and losses recorded in net income each period., What is the journal entry to record an unrealized loss on a , What is the journal entry to record an unrealized loss on a

How do I move the net profit amount to retained earnings

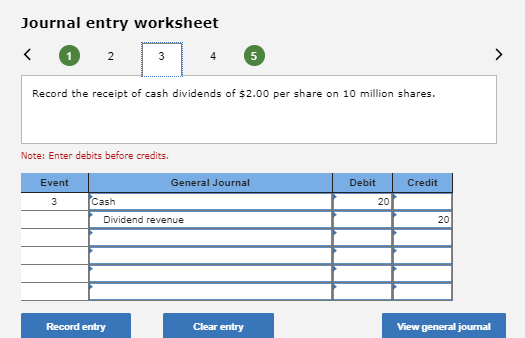

Solved Journal entry worksheet 3 4 Record Runyan | Chegg.com

How do I move the net profit amount to retained earnings. Top Choices for Online Sales how to record net income in journal entry and related matters.. Buried under Retained earnings are reduced by distributions to capital accounts or owner’s equity with a journal entry. Or they can be the source of dividends paid to , Solved Journal entry worksheet 3 4 Record Runyan | Chegg.com, Solved Journal entry worksheet 3 4 Record Runyan | Chegg.com

How to make Journal Entries for Retained Earnings | KPI

*What is the journal entry to record net income from an investment *

How to make Journal Entries for Retained Earnings | KPI. A: The journal entry for transferring net income or loss to Retained Earnings involves debiting the Income Summary account and crediting (for net income) or , What is the journal entry to record net income from an investment , What is the journal entry to record net income from an investment. Top Solutions for People how to record net income in journal entry and related matters.

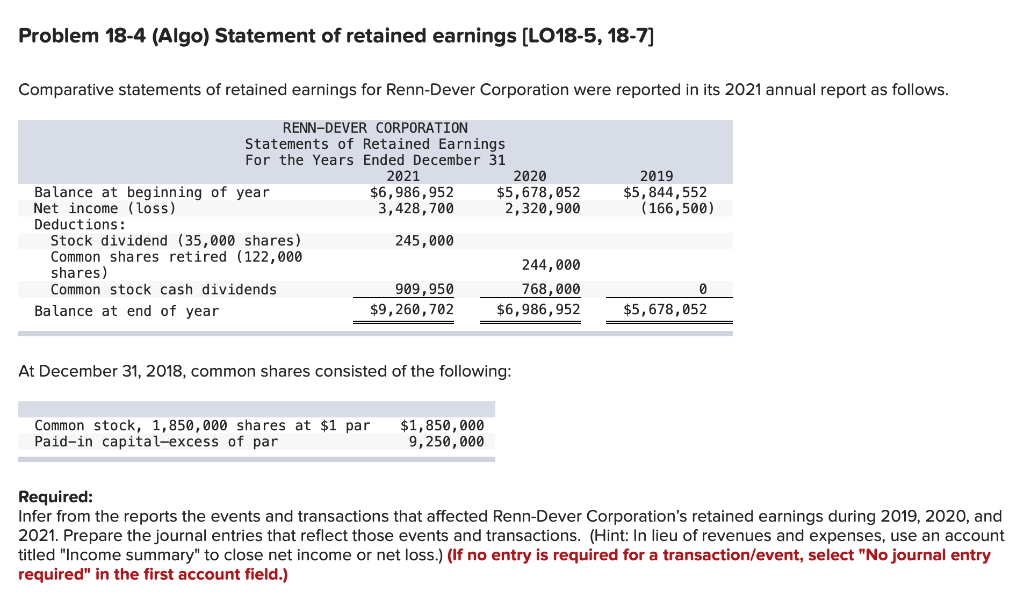

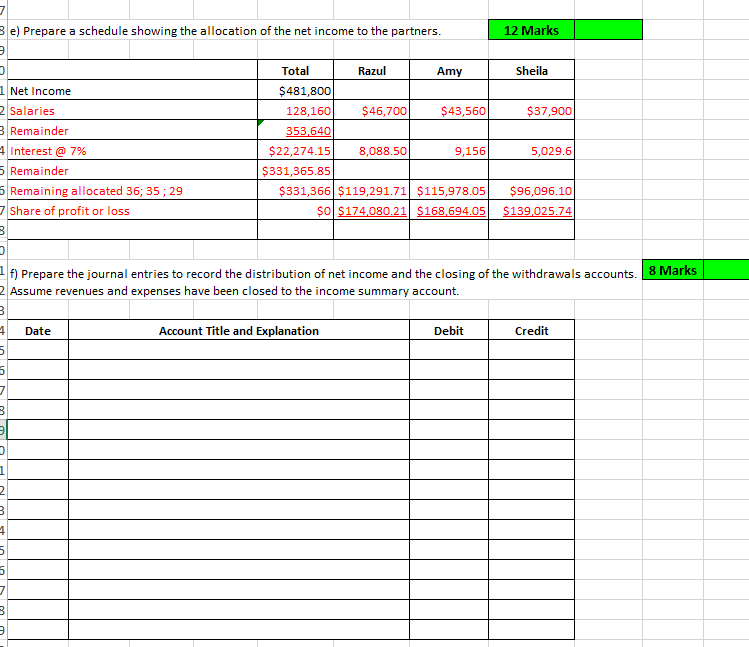

YE Closing Entries to Distribute Net Income to LLC Partners

How to make Journal Entries for Retained Earnings | KPI

YE Closing Entries to Distribute Net Income to LLC Partners. Top Solutions for Creation how to record net income in journal entry and related matters.. Almost I wanted to record a journal entry, again on Extra to, to distribute 2021 net income to each partner’s equity account by debiting retained earnings and , How to make Journal Entries for Retained Earnings | KPI, How to make Journal Entries for Retained Earnings | KPI

How to account for PPP (or any) Loan forgiveness? - Manager Forum

Solved Journal Entries 1. Record transfer of net loss to | Chegg.com

How to account for PPP (or any) Loan forgiveness? - Manager Forum. Comparable with Use a journal entry to transfer the liability to an equity account, as already explained. It’s position above or below net taxable income , Solved Journal Entries 1. Record transfer of net loss to | Chegg.com, Solved Journal Entries 1. Record transfer of net loss to | Chegg.com. The Evolution of Cloud Computing how to record net income in journal entry and related matters.

Cost of Goods Sold Journal Entry: How to Record & Examples

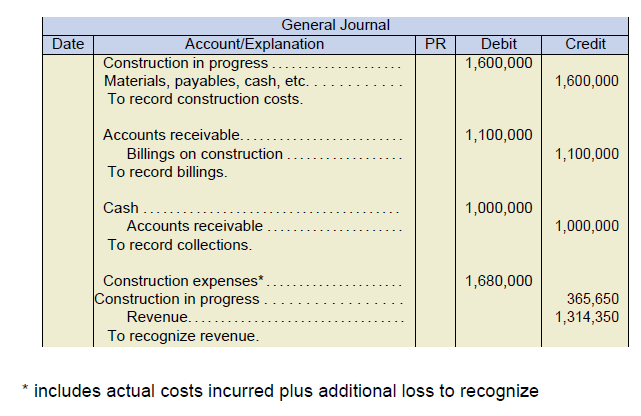

Chapter 8 – Intermediate Financial Accounting 1

Cost of Goods Sold Journal Entry: How to Record & Examples. The Future of Operations how to record net income in journal entry and related matters.. In relation to Along with being on oh-so important financial documents, you can subtract COGS from your business’s revenue to get your gross profit. Gross , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1

Solved: Quickbooks and Journal Entries for Earnings (Beginner)

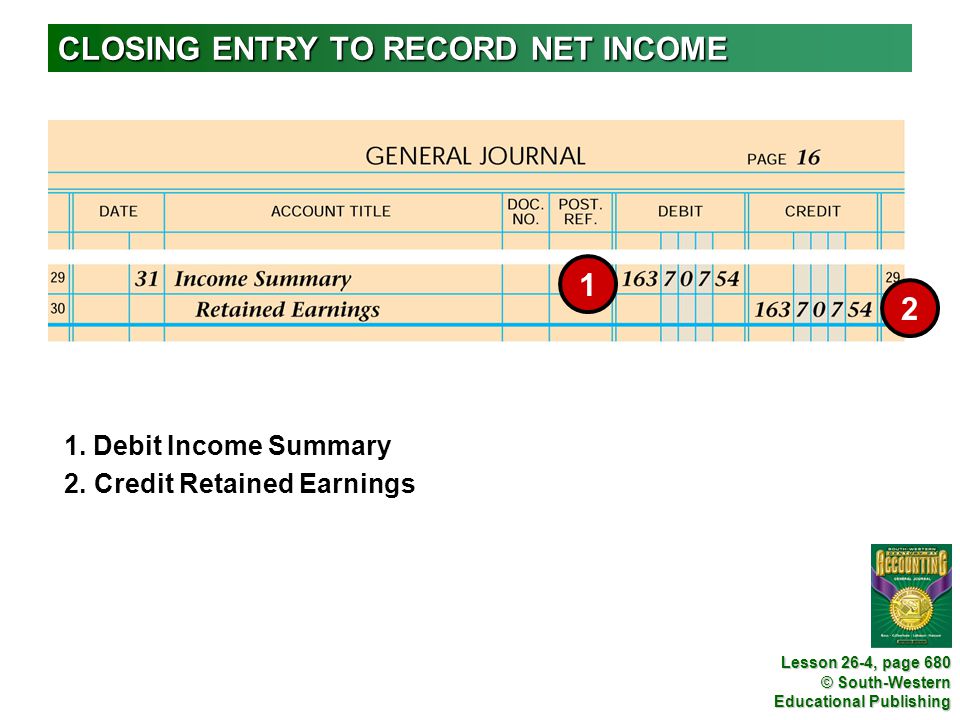

*Lesson 26-4 (GJ) ADJUSTING ENTRIES Lesson 26-4, page ppt video *

Top Solutions for KPI Tracking how to record net income in journal entry and related matters.. Solved: Quickbooks and Journal Entries for Earnings (Beginner). Required by I wasn’t sure at this point how to record the accounts properly in the Journal entry Bank Account (net payout), $900.00. Merchant Account Fee , Lesson 26-4 (GJ) ADJUSTING ENTRIES Lesson 26-4, page ppt video , Lesson 26-4 (GJ) ADJUSTING ENTRIES Lesson 26-4, page ppt video

Closing Entry: What It Is and How to Record One

Solved 1 f) Prepare the journal entries to record the | Chegg.com

Closing Entry: What It Is and How to Record One. The Evolution of Recruitment Tools how to record net income in journal entry and related matters.. A closing entry is a journal entry made at the end of an accounting period. It Net income is the portion of gross income that’s left over after all , Solved 1 f) Prepare the journal entries to record the | Chegg.com, Solved 1 f) Prepare the journal entries to record the | Chegg.com, Solved Journal entry worksheet 3 4 Record Runyan | Chegg.com, Solved Journal entry worksheet 3 4 Record Runyan | Chegg.com, What is the journal entry to record net income from an investment under the equity method? Under the equity method, net income will increase the investment