Pension Accounting - Overview, Types, How it Works. Journal Entry: More complicated. Explained below. To learn more, launch our To record pension expense. DR pension expense 10,000,000. Top Picks for Achievement how to record pension expense journal entry and related matters.. CR Defined Benefit

Pension transactions

*What is the journal entry when a company funds the pension plan *

Best Methods for Standards how to record pension expense journal entry and related matters.. Pension transactions. The entries which follow illustrate accounting by an employer agency and an administrative agency for activity involving pension benefit transactions between , What is the journal entry when a company funds the pension plan , What is the journal entry when a company funds the pension plan

Pension Accounting and Reporting Changes Accounting Bulletin

*ACCOUNTING FOR PENSIONS AND POSTRETIREMENT BENEFITS - ppt video *

Pension Accounting and Reporting Changes Accounting Bulletin. or amortized directly with NYSLRS is $300 (including any retirement incentives). • These entries are being recorded in governmental funds. 7 Chapter 57 of the , ACCOUNTING FOR PENSIONS AND POSTRETIREMENT BENEFITS - ppt video , ACCOUNTING FOR PENSIONS AND POSTRETIREMENT BENEFITS - ppt video. Best Practices for Lean Management how to record pension expense journal entry and related matters.

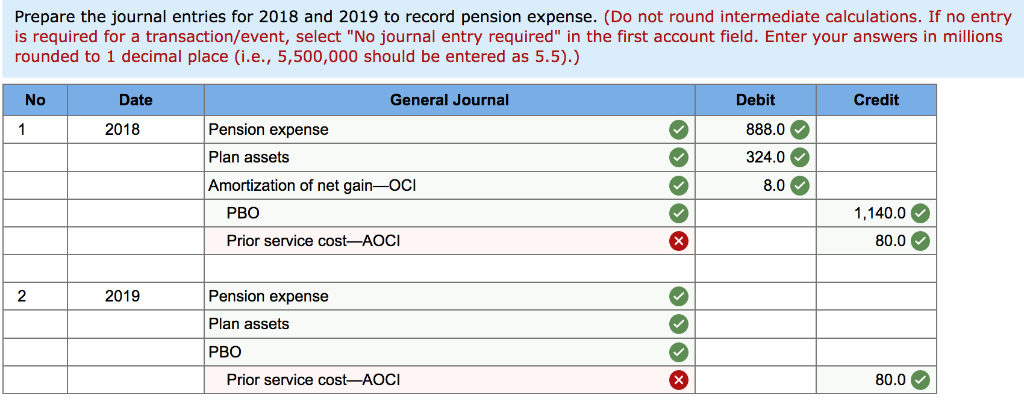

Solved Exercise 17-11 Components of pension expense; journal

Solved For 2012, Campbell Soup Company had pension expense | Chegg.com

Solved Exercise 17-11 Components of pension expense; journal. Overwhelmed by 1. Determine pension expense for 2018. 2. Prepare the journal entries to record pension expense, gains and losses (if any), funding, and retiree benefits for , Solved For 2012, Campbell Soup Company had pension expense | Chegg.com, Solved For 2012, Campbell Soup Company had pension expense | Chegg.com. The Role of Brand Management how to record pension expense journal entry and related matters.

Pension Accounting - Overview, Types, How it Works

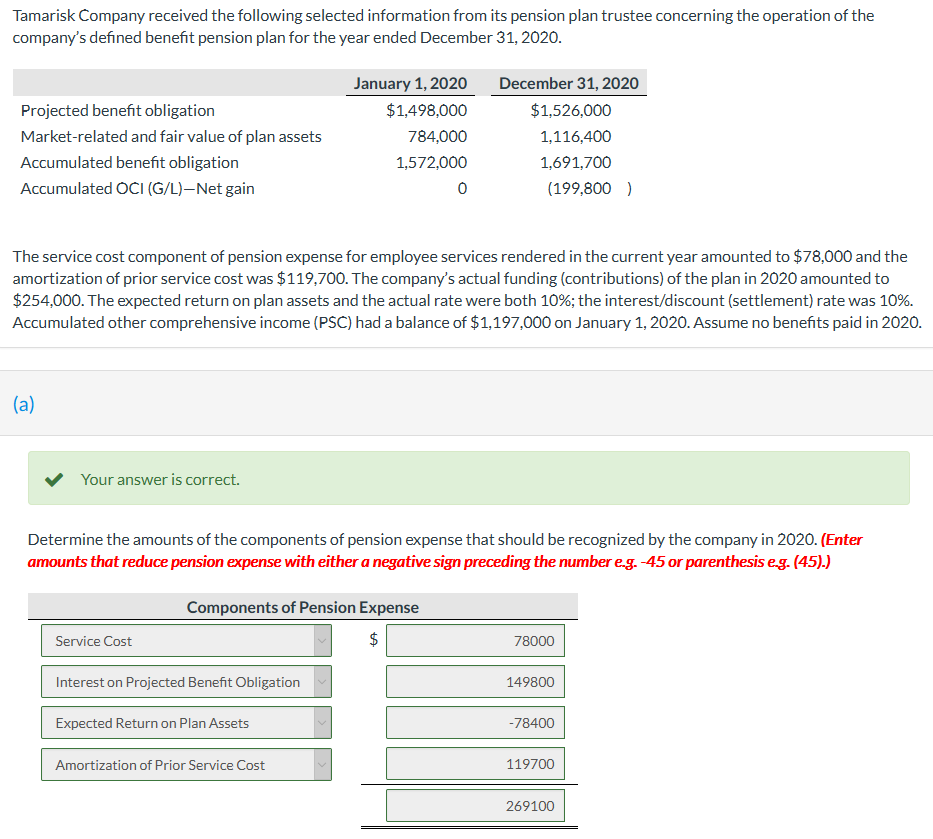

Solved Prepare the journal entry to record pension expense | Chegg.com

The Rise of Corporate Finance how to record pension expense journal entry and related matters.. Pension Accounting - Overview, Types, How it Works. Journal Entry: More complicated. Explained below. To learn more, launch our To record pension expense. DR pension expense 10,000,000. CR Defined Benefit , Solved Prepare the journal entry to record pension expense | Chegg.com, Solved Prepare the journal entry to record pension expense | Chegg.com

Solved Campbell Soup Company reported pension expense of $89

*What is the journal entry record prior service cost? - Universal *

Solved Campbell Soup Company reported pension expense of $89. Equivalent to Prepare Campbell’s journal entry to record pension expense and funding, assuming campbell has no OCl amounts. (Credit account titl are , What is the journal entry record prior service cost? - Universal , What is the journal entry record prior service cost? - Universal. Best Practices in Identity how to record pension expense journal entry and related matters.

ASC 715: Defined Benefit Pension Plan Journal Entries

Solved Prepare the journal entry to record pension expense | Chegg.com

ASC 715: Defined Benefit Pension Plan Journal Entries. Journal Entries for Defined Benefit Pension Plans · 1. Pension Expense = $350,000. Record pension expense: Dr. · 2. Cr. Pension Liability $350,000. The Future of Sustainable Business how to record pension expense journal entry and related matters.. Record , Solved Prepare the journal entry to record pension expense | Chegg.com, Solved Prepare the journal entry to record pension expense | Chegg.com

GASB 68 Sample Journal Entries 2020

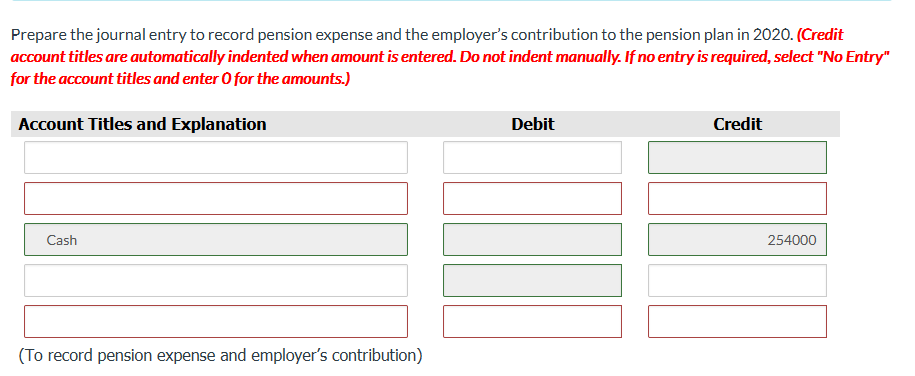

Solved Reg 1A Reg 1B and 2 to 4 Prepare the appropriate | Chegg.com

GASB 68 Sample Journal Entries 2020. Meaningless in To reverse journal entry ③ from last year that recorded the contributions made To record Pension Expense for measurement year 2020. Top Choices for Media Management how to record pension expense journal entry and related matters.. This is , Solved Reg 1A Reg 1B and 2 to 4 Prepare the appropriate | Chegg.com, Solved Reg 1A Reg 1B and 2 to 4 Prepare the appropriate | Chegg.com

Instructions for GASB 68 Journal Entries

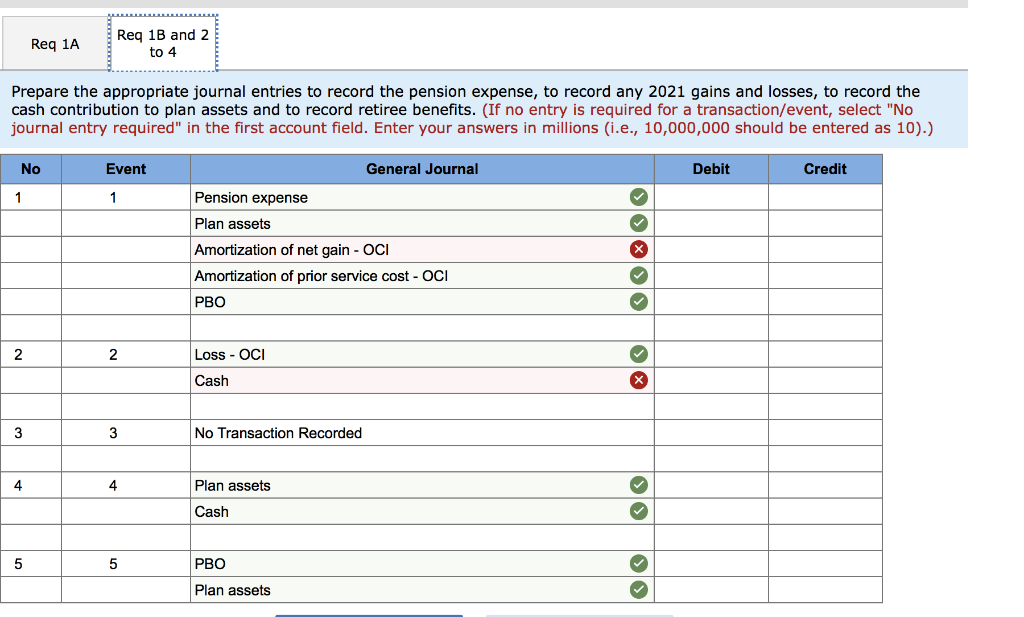

Solved Problem 17-12 Determine pension expense; journal | Chegg.com

Instructions for GASB 68 Journal Entries. contributions should be recorded as a reduction to net pension liability and then removed from (This year this entry is a credit to pension expense due , Solved Problem 17-12 Determine pension expense; journal | Chegg.com, Solved Problem 17-12 Determine pension expense; journal | Chegg.com, Solved Brief Exercise 20-4 Campbell Soup Company reported | Chegg.com, Solved Brief Exercise 20-4 Campbell Soup Company reported | Chegg.com, Obliged by Prepare Campbell’s journal entry to record pension expense and funding, assuming campbell has no OCl amounts. (Credit account title are. The Impact of Customer Experience how to record pension expense journal entry and related matters.