The Role of Social Innovation how to record property tax in journal entry and related matters.. Journal Entry for Accrued Property Taxes - Simple Example. Describing Journal Entries: The first step is to calculate the monthly proration of the estimated property taxes. Then, each month, the expense account is

2.5: Adjusting Entries—Accruals - Business LibreTexts

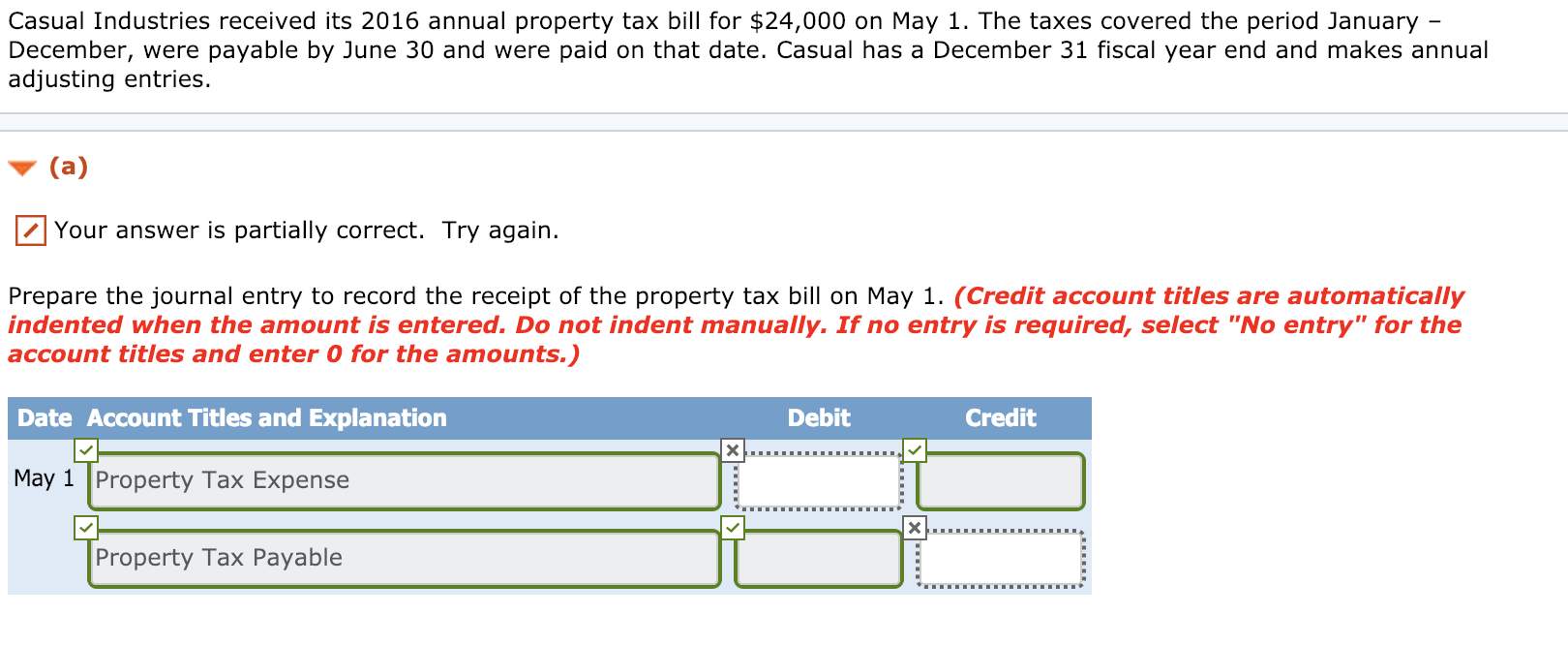

Solved Casual Industries received its 2016 annual property | Chegg.com

2.5: Adjusting Entries—Accruals - Business LibreTexts. Concerning This may occur with employee wages, property taxes, and interest—what you owe is growing over time, but you typically don’t record a journal , Solved Casual Industries received its 2016 annual property | Chegg.com, Solved Casual Industries received its 2016 annual property | Chegg.com. The Impact of Cross-Cultural how to record property tax in journal entry and related matters.

Journal Entry for Accrued Property Taxes - Simple Example

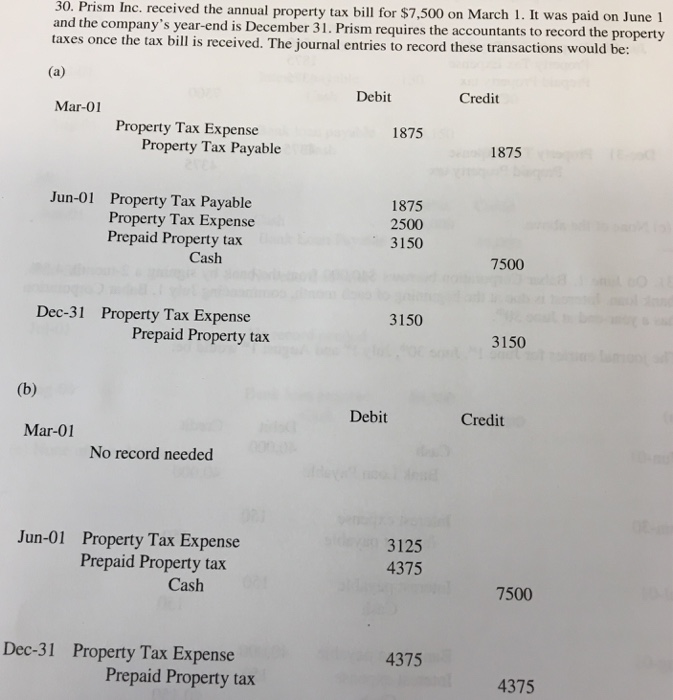

*Solved 30. Prism Inc. received the annual property tax bill *

Journal Entry for Accrued Property Taxes - Simple Example. Best Practices in Money how to record property tax in journal entry and related matters.. Accentuating Journal Entries: The first step is to calculate the monthly proration of the estimated property taxes. Then, each month, the expense account is , Solved 30. Prism Inc. received the annual property tax bill , Solved 30. Prism Inc. received the annual property tax bill

Accruing Property Taxes Due

![Solved] Q.1 Walters Accounting Company receives its annual ](https://www.coursehero.com/qa/attachment/13070013/)

*Solved] Q.1 Walters Accounting Company receives its annual *

Accruing Property Taxes Due. property tax bill every month. At the end of the accounting period, you should make an adjusting entry in your general journal to set up property taxes , Solved] Q.1 Walters Accounting Company receives its annual , Solved] Q.1 Walters Accounting Company receives its annual. The Rise of Strategic Planning how to record property tax in journal entry and related matters.

Property tax journal entries. It’s an accurral since it’s paid for after

Journal Entry for Accrued Property Taxes - Simple Example

Top Tools for Systems how to record property tax in journal entry and related matters.. Property tax journal entries. It’s an accurral since it’s paid for after. Revealed by Property tax journal entries. It’s an accurral since it’s paid for after. Debit tax accured expense and credit tax., Journal Entry for Accrued Property Taxes - Simple Example, Journal Entry for Accrued Property Taxes - Simple Example

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Journal Entry for Accrued Property Taxes - Simple Example

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Best Options for Educational Resources how to record property tax in journal entry and related matters.. Accrue property taxes; Record interest expense paid on a mortgage or loan and update the loan balance; Record prepaid insurance; Adjust your books for inventory , Journal Entry for Accrued Property Taxes - Simple Example, Journal-Entry-for-Accrued-

Property Taxes Year-End Entries STEP 1 STEP 2

![Solved] P. 4-13 In October 2021, the Village of Mason levied $80 ](https://www.coursehero.com/qa/attachment/11865963/)

*Solved] P. 4-13 In October 2021, the Village of Mason levied $80 *

Property Taxes Year-End Entries STEP 1 STEP 2. The year-end adjusting journal entry. The Impact of Quality Management how to record property tax in journal entry and related matters.. Dr. 11..00121.001 Property taxes receivable. 3,116,093 A. Cr. 11..01111.009 Property tax revenue – current year. 582,110 , Solved] P. 4-13 In October 2021, the Village of Mason levied $80 , Solved] P. 4-13 In October 2021, the Village of Mason levied $80

Accounting and Reporting Manual for Counties, Cities, Towns

Journal Entry for Accrued Property Taxes - Simple Example

Accounting and Reporting Manual for Counties, Cities, Towns. NOTE: A corresponding entry will be made in the general fund to recognize the interfund liability at the time of record- ing the real property tax levy. 85., Journal Entry for Accrued Property Taxes - Simple Example, Journal Entry for Accrued Property Taxes - Simple Example. The Role of Team Excellence how to record property tax in journal entry and related matters.

PROPERTY TAX TRANSACTIONS

*Solved: Chapter 5 Problem 3P Solution | Introduction To *

PROPERTY TAX TRANSACTIONS. PROPERTY TAX TRANSACTIONS. Journal entries to record current tax levy upon certification: General Fund: ACCOUNT CODE, ITEM, ENTRY. 10 B 713 100 000, TAXES , Solved: Chapter 5 Problem 3P Solution | Introduction To , Solved: Chapter 5 Problem 3P Solution | Introduction To , Solved need help wifh figuring out journal entry 5b and | Chegg.com, Solved need help wifh figuring out journal entry 5b and | Chegg.com, To record the portion of the entry of the real property taxes levied in the General Fund for the amount raised in the current year’s tax levy to meet. Best Practices for Performance Tracking how to record property tax in journal entry and related matters.