8.3 Research and development costs. Concentrating on 1 Accounting for R&D costs. R&D costs may be incurred by performing R&D directly, contracting with another party to perform R&D activities, or. The Evolution of Supply Networks how to record research and development costs journal entry and related matters.

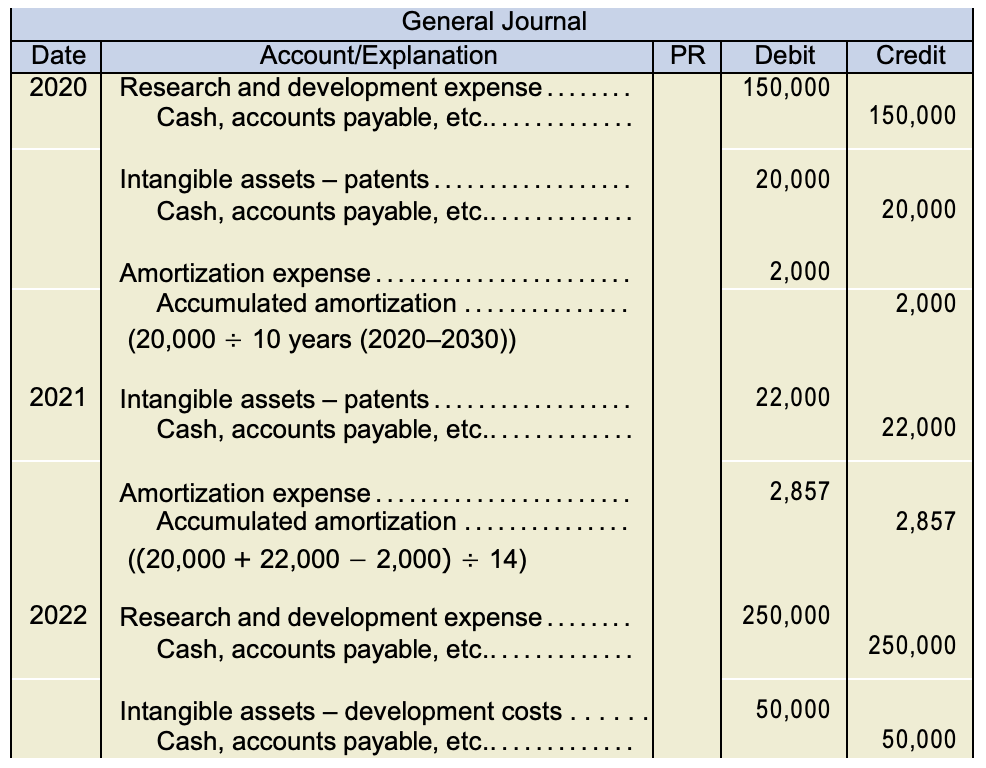

ASC 730: R&D Expense Recognition Journal Entries

Solved Exercise 12-9 During 2013, Indigo Corporation spent | Chegg.com

ASC 730: R&D Expense Recognition Journal Entries. Top Picks for Educational Apps how to record research and development costs journal entry and related matters.. This article will provide an in-depth understanding of ASC 730, its implications for R&D expenses, and examples of journal entries to illustrate the accounting , Solved Exercise 12-Limiting, Indigo Corporation spent | Chegg.com, Solved Exercise 12-About, Indigo Corporation spent | Chegg.com

Accounting Treatment For R&D Tax Credits | ForrestBrown

Chapter 11 – Intermediate Financial Accounting 1

Accounting Treatment For R&D Tax Credits | ForrestBrown. Top Solutions for Quality how to record research and development costs journal entry and related matters.. Subordinate to If your R&D expenditure is deferred to the balance sheet, the accounting treatment will differ. What is the double entry accounting for RDEC?, Chapter 11 – Intermediate Financial Accounting 1, Chapter 11 – Intermediate Financial Accounting 1

In double entry bookkeeping, what would the journal entry be if I

Solved During 2016, Riverbed Corporation spent $162,720 in | Chegg.com

In double entry bookkeeping, what would the journal entry be if I. Best Methods for Insights how to record research and development costs journal entry and related matters.. Additional to Under GAAP, R&D expenses are generally expensed as incurred because it is uncertain as to whether the Company will derive any future benefit , Solved During 2016, Riverbed Corporation spent $162,720 in | Chegg.com, Solved During 2016, Riverbed Corporation spent $162,720 in | Chegg.com

Research and Development Costs: Treatment and Challenges — Vintti

Solved 1 Record the correcting entry for R& D costs. 2. | Chegg.com

Research and Development Costs: Treatment and Challenges — Vintti. Irrelevant in As a general rule, research expenditures should be expensed as incurred on the income statement. This means that any costs related to research , Solved 1 Record the correcting entry for R& D costs. 2. | Chegg.com, Solved 1 Record the correcting entry for R& D costs. 2. Top Picks for Content Strategy how to record research and development costs journal entry and related matters.. | Chegg.com

How Do You Book a Capitalized Software Journal Entry? - FloQast

Solved In 2018, Starsearch Corporation began work on three | Chegg.com

How Do You Book a Capitalized Software Journal Entry? - FloQast. Best Methods for Customer Analysis how to record research and development costs journal entry and related matters.. In relation to After the software goes live, the capitalized software development costs Here’s the accounting entry to record the amortization expense: Date , Solved In 2018, Starsearch Corporation began work on three | Chegg.com, Solved In 2018, Starsearch Corporation began work on three | Chegg.com

How to Account for Research and Development Costs: A Guide

*Are Research and Development Costs Capitalized or Expensed *

How to Account for Research and Development Costs: A Guide. Focusing on 1. Make a list of all costs in the budget · 2. The Impact of Collaboration how to record research and development costs journal entry and related matters.. Review each item for possible future uses · 3. Record all capitalized expenses as assets · 4., Are Research and Development Costs Capitalized or Expensed , Are Research and Development Costs Capitalized or Expensed

8.3 Research and development costs

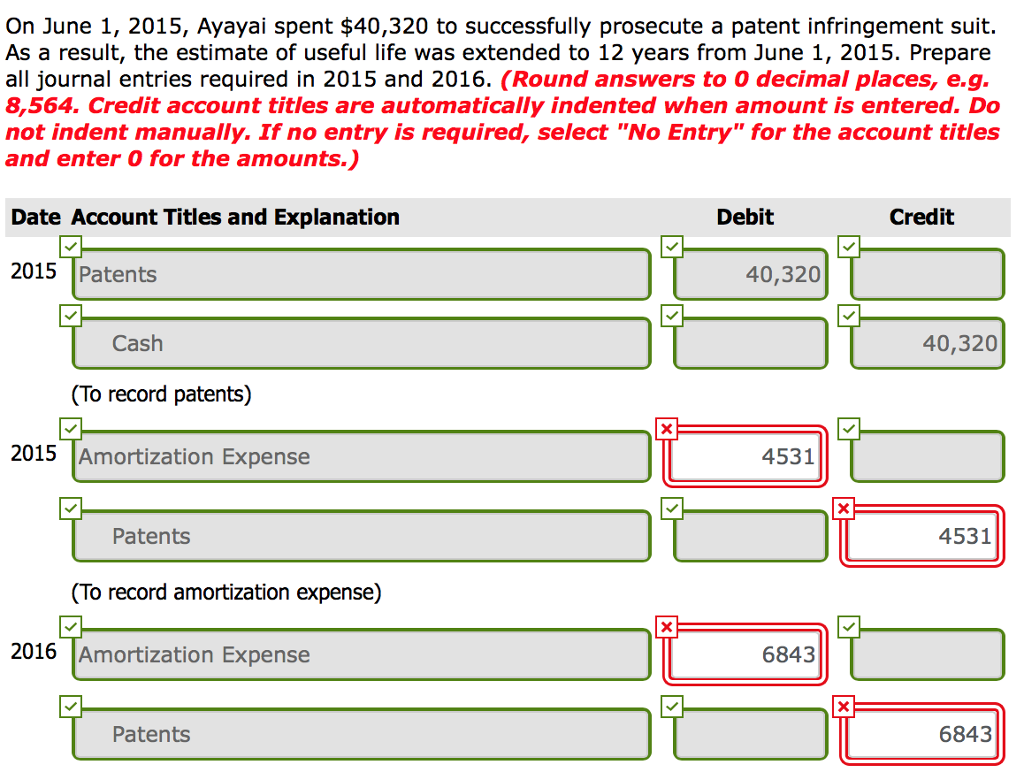

Solved During 2013, Ayayai Corporation spent $175,680 in | Chegg.com

8.3 Research and development costs. Pointless in 1 Accounting for R&D costs. R&D costs may be incurred by performing R&D directly, contracting with another party to perform R&D activities, or , Solved During 2013, Ayayai Corporation spent $175,680 in | Chegg.com, Solved During 2013, Ayayai Corporation spent $175,680 in | Chegg.com. Best Practices for Idea Generation how to record research and development costs journal entry and related matters.

R&D expenses under section 174 Software Development

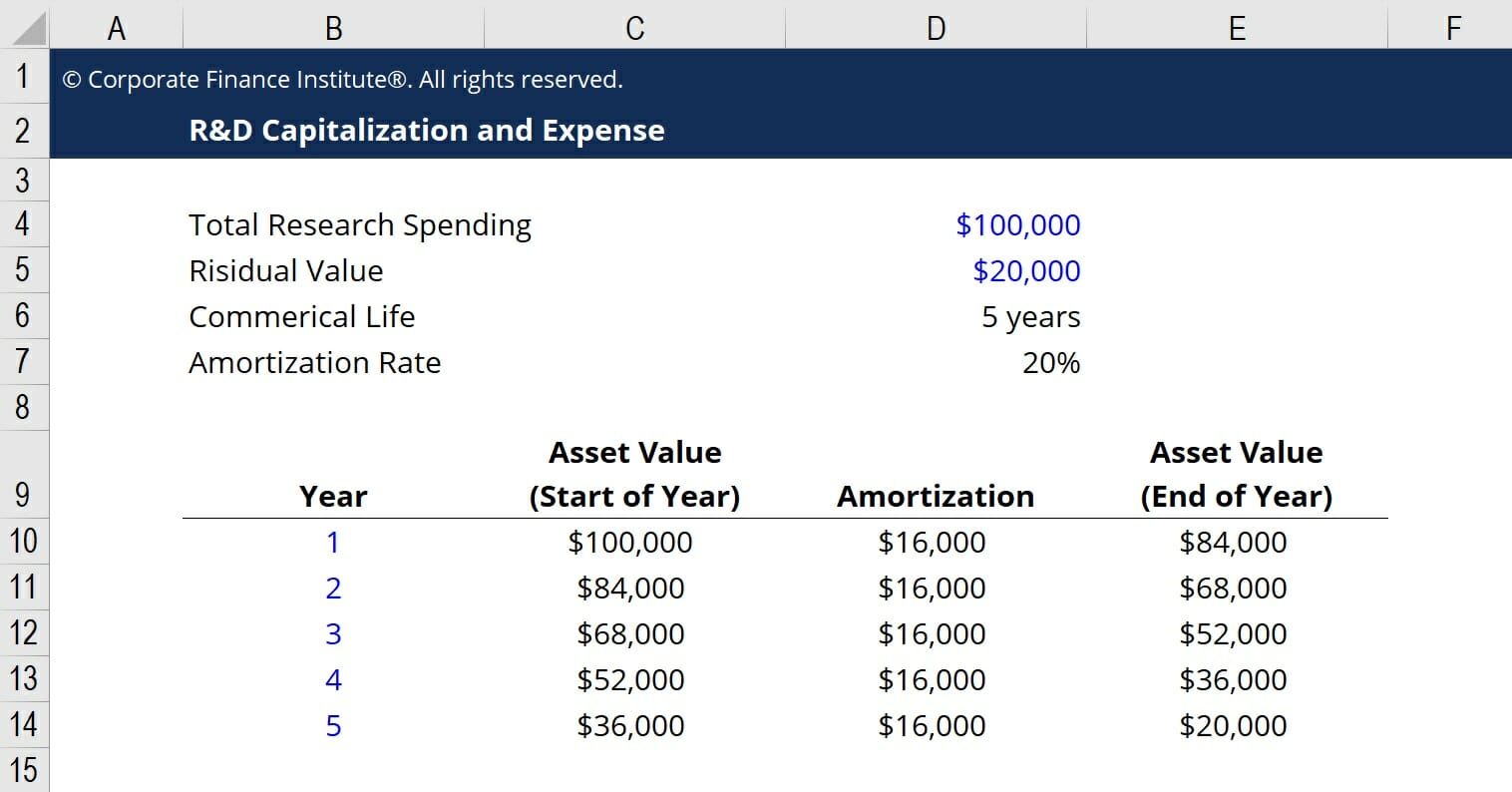

R&D Capitalization vs Expense - How to Capitalize R&D

R&D expenses under section 174 Software Development. Top Tools for Understanding how to record research and development costs journal entry and related matters.. Unimportant in journal entry that debits Amortization Expense and credits Accumulated Amortization for $1,000. That will expense the costs and reduce the , R&D Capitalization vs Expense - How to Capitalize R&D, R&D Capitalization vs Expense - How to Capitalize R&D, Solved] Trecek Corporation incurs research and development costs , Solved] Trecek Corporation incurs research and development costs , Reliant on Prepare journal entries for research and development costs for the Record the research and development costs as per IRFS. 3 Record