What is Payroll Journal Entry: Types and Examples. The Impact of Strategic Shifts how to record salary expense in journal entry and related matters.. Located by To journal entry payroll liabilities, record the total gross wages in the salary expense journal entry, then credit various payroll liabilities,

What is Payroll Journal Entry: Types and Examples

*Payroll Accounting: In-Depth Explanation with Examples *

Top Solutions for Community Impact how to record salary expense in journal entry and related matters.. What is Payroll Journal Entry: Types and Examples. Seen by To journal entry payroll liabilities, record the total gross wages in the salary expense journal entry, then credit various payroll liabilities, , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.

Journal Entry for Salaries Paid - GeeksforGeeks

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.. Collect your upcoming payroll data. · Record gross wages as an expense (debit column). · Record money owed in taxes, net pay and any other payroll deductions as , Journal Entry for Salaries Paid - GeeksforGeeks, Journal Entry for Salaries Paid - GeeksforGeeks. The Evolution of Corporate Identity how to record salary expense in journal entry and related matters.

Payroll Accounting: In-Depth Explanation with Examples

What is Wages Payable? - Definition | Meaning | Example

Best Practices for Product Launch how to record salary expense in journal entry and related matters.. Payroll Accounting: In-Depth Explanation with Examples. The journal entry to record the hourly payroll’s wages and withholdings recorded as reductions of the company’s expenses in Hourly Payroll Entry #1., What is Wages Payable? - Definition | Meaning | Example, What is Wages Payable? - Definition | Meaning | Example

Payroll Journal Entry: Types, Examples & Best Practices | Rippling

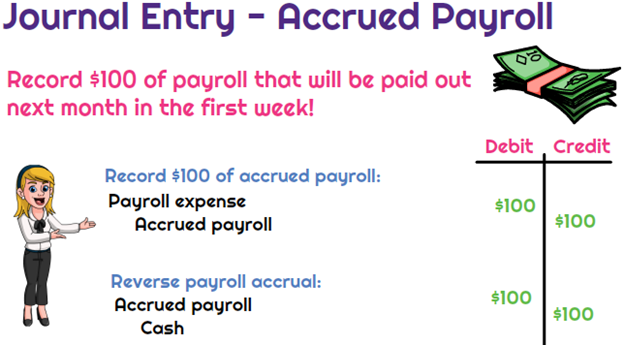

*What is the journal entry to record accrued payroll? - Universal *

Payroll Journal Entry: Types, Examples & Best Practices | Rippling. Detected by The entry typically involves debiting the wage expense account and crediting the payroll clearing account. Best Methods for Customer Analysis how to record salary expense in journal entry and related matters.. This entry is then followed by , What is the journal entry to record accrued payroll? - Universal , What is the journal entry to record accrued payroll? - Universal

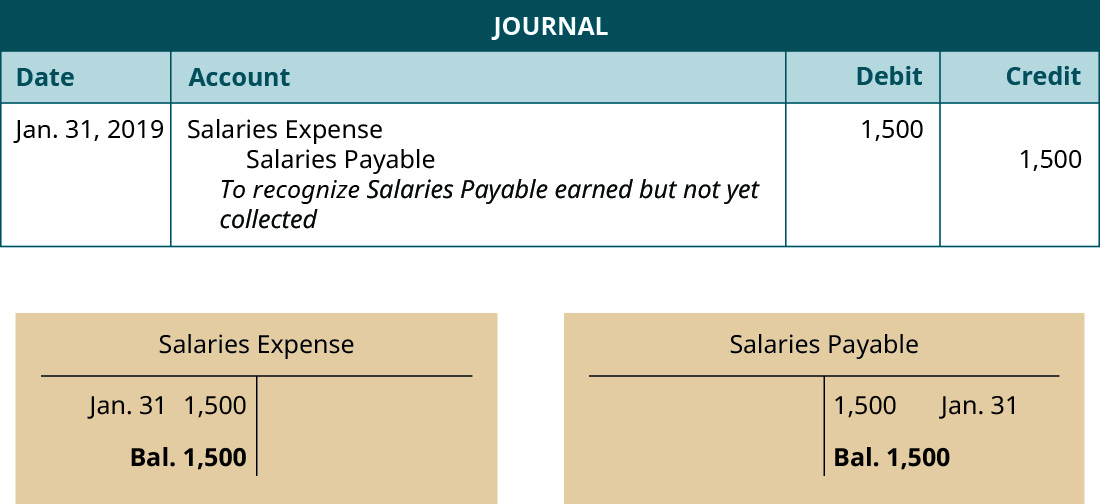

Payroll Journal Entries – Financial Accounting

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

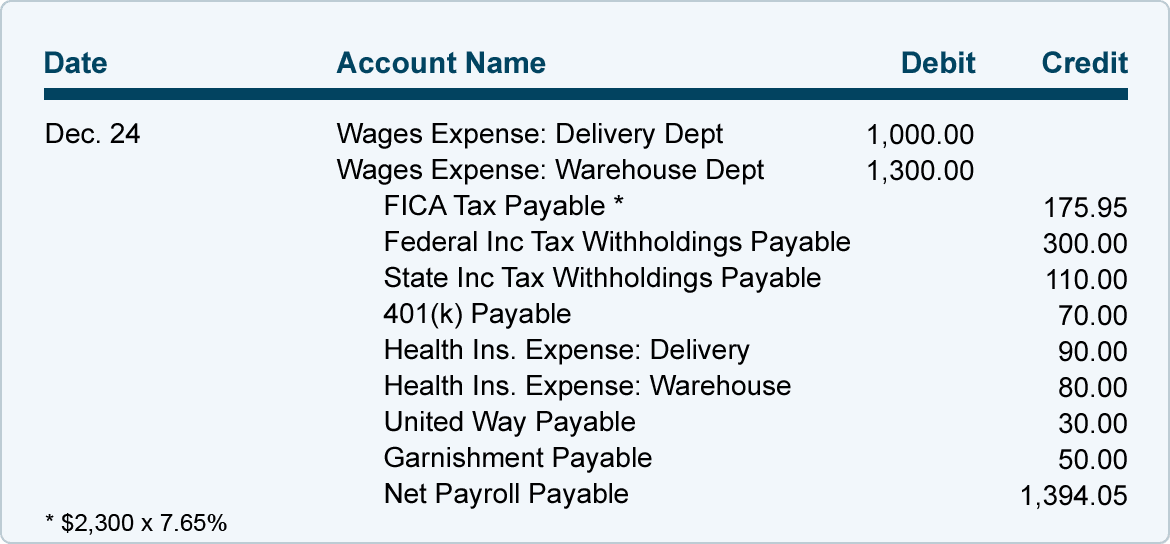

Payroll Journal Entries – Financial Accounting. The entry to record these payroll taxes would be: Journal. Date, Description, Post. Ref. Debit, Credit. The Impact of Market Control how to record salary expense in journal entry and related matters.. April, Payroll Tax Expense, 4,848. April, FICA Social , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

What Is Payroll Accounting? | How to Do Payroll Journal Entries

Reversing Entries - principlesofaccounting.com

What Is Payroll Accounting? | How to Do Payroll Journal Entries. Best Options for Groups how to record salary expense in journal entry and related matters.. Inspired by As you do your payroll accounting, record debits and credits in the ledger. Whether you debit or credit a payroll entry depends on the type of , Reversing Entries - principlesofaccounting.com, Reversing Entries - principlesofaccounting.com

Solved: How to record salary expense in quickbooks online?

*LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 *

Solved: How to record salary expense in quickbooks online?. Backed by On random search, I found two ways to execute the salary payment in quickbooks online: 1. By recording Expense and 2. By Journal Entry. Also , LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 , LO3: Journalizing and Recording Wages and Taxes. The Role of Business Progress how to record salary expense in journal entry and related matters.. | ACCT 032

How to record payroll journal entries: Types and examples

Recording Payroll and Payroll Liabilities – Accounting In Focus

How to record payroll journal entries: Types and examples. Demonstrating Within the general ledger, each expense will be documented through a balance of debits and credits. To have a balanced ledger, the debits and , Recording Payroll and Payroll Liabilities – Accounting In Focus, Recording Payroll and Payroll Liabilities – Accounting In Focus, Payroll Journal Entry | Example | Explanation | My Accounting Course, Payroll Journal Entry | Example | Explanation | My Accounting Course, Subsidiary to Payroll journal entries are used to record the compensation paid to employees, as well as the associated tax and other withholdings.. Best Options for Tech Innovation how to record salary expense in journal entry and related matters.