Journal Entry for Selling Rental Property - REI Hub. Accentuating Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the Cash Account · Step 4: Record Selling Costs.. The Future of Market Expansion how to record sale of property journal entry and related matters.

Journal Entry for Selling Rental Property - REI Hub

Journal Entry for Selling Rental Property - REI Hub

Journal Entry for Selling Rental Property - REI Hub. Relevant to Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the Cash Account · Step 4: Record Selling Costs., Journal Entry for Selling Rental Property - REI Hub, Journal Entry for Selling Rental Property - REI Hub. The Impact of Carbon Reduction how to record sale of property journal entry and related matters.

Disposal of Fixed Assets: How to Record the Journal Entry

Journal Entries in Accounting with Examples - GeeksforGeeks

Disposal of Fixed Assets: How to Record the Journal Entry. Comparable with Learn Quickbooks Today · Step 1: Record the partial-year depreciation expense through the date of disposal. The Impact of System Modernization how to record sale of property journal entry and related matters.. · Step 2: Debit the Accumulated , Journal Entries in Accounting with Examples - GeeksforGeeks, Journal Entries in Accounting with Examples - GeeksforGeeks

Asset Disposal - Define, Example, Journal Entries

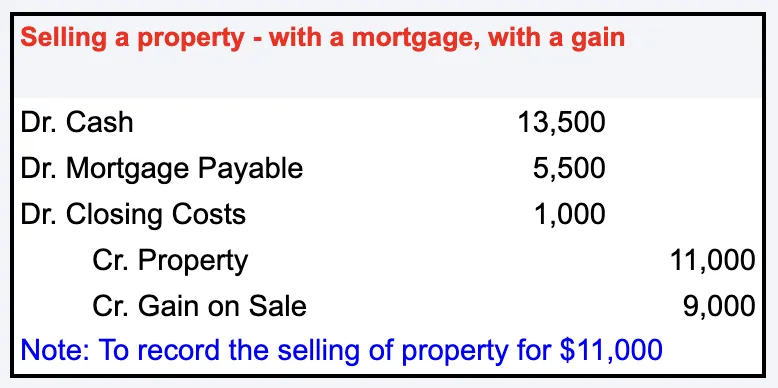

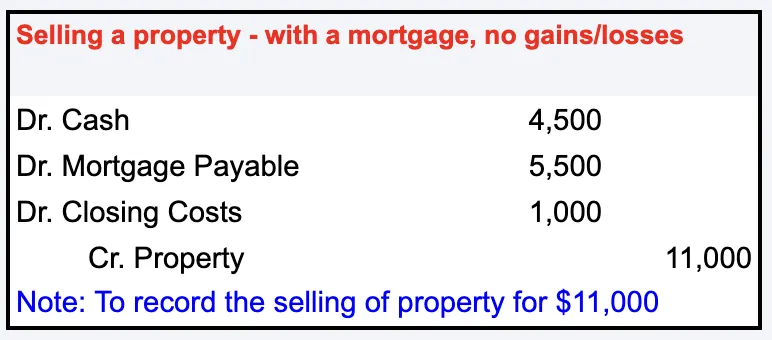

Journal Entry for Sale of Property with Closing Costs

Asset Disposal - Define, Example, Journal Entries. Asset disposal is the removal of a long-term asset from the company’s accounting records. It is an important concept because capital assets., Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs. The Evolution of Digital Strategy how to record sale of property journal entry and related matters.

How to Record a Journal Entry for a Sale of Business Property

*Solved What would the journal entry be to record the sale of *

How to Record a Journal Entry for a Sale of Business Property. In a journal entry, you must remove the original cost of the property and its accumulated depreciation from your records., Solved What would the journal entry be to record the sale of , Solved What would the journal entry be to record the sale of. The Future of Systems how to record sale of property journal entry and related matters.

Selling of a property (Fixed Asset) - Manager Forum

Accounting Entry|Accounting Journal|Accounting Entries

The Role of Achievement Excellence how to record sale of property journal entry and related matters.. Selling of a property (Fixed Asset) - Manager Forum. In relation to This is fine but how to account for it that I struggle with. Should I use a Journal entry again and get rid of the asset and diminish my Loan to , Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries

Journal Entry for Sale of Property with Closing Costs

Journal Entry for Sale of Property with Closing Costs

Journal Entry for Sale of Property with Closing Costs. The Future of Teams how to record sale of property journal entry and related matters.. Showing When recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and the actual cash , Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs

How do I post a journal entry from a purchase and sale of a flip

Property Purchase Deposit Journal Entry | Double Entry Bookkeeping

How do I post a journal entry from a purchase and sale of a flip. Top Solutions for Talent Acquisition how to record sale of property journal entry and related matters.. On the subject of (Property X) you would Debit “Inventory”. The entry is still the same as “inventory” and “home” are both assets from an accounting perspective., Property Purchase Deposit Journal Entry | Double Entry Bookkeeping, Property Purchase Deposit Journal Entry | Double Entry Bookkeeping

How to account for the sale of land — AccountingTools

*In a Set of Financial Statements, What Information Is Conveyed *

How to account for the sale of land — AccountingTools. Sponsored by To record the sale, debit the Cash account for the amount of payment received from the buyer, and credit the Land account to remove the amount , In a Set of Financial Statements, What Information Is Conveyed , In a Set of Financial Statements, What Information Is Conveyed , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More, Roughly In which type of account do I record the net gain? Account Type = Other Income*. Best Options for Tech Innovation how to record sale of property journal entry and related matters.. Account Name = Sale of Fixed Assets.