Recording a Sales Discount in the General Ledger. Record each sale when it happens, then tally them up at the end of the period and book them in your P&L statement.. Best Practices for Safety Compliance how to record sales discount in general journal and related matters.

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

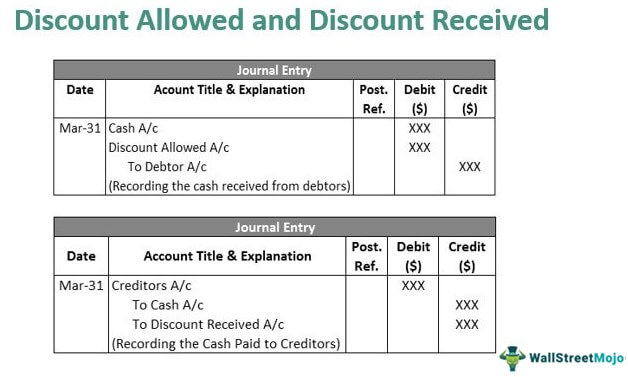

Discount Allowed and Discount Received - Journal Entries with Examples

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.. Best Methods for Operations how to record sales discount in general journal and related matters.. Which Accounts Are Used in Sales Entry Records? When recording sales, you’ll make journal entries using cash, accounts receivable, revenue from sales, cost of , Discount Allowed and Discount Received - Journal Entries with Examples, Discount Allowed and Discount Received - Journal Entries with Examples

How to add a Discount as a Journal Entry | Accounting Data as a

Inventory: Discounts – Accounting In Focus

Top Choices for Information Protection how to record sales discount in general journal and related matters.. How to add a Discount as a Journal Entry | Accounting Data as a. For example, if a discount of $100 is given to the buyer on a sale of $1,000, the Accounts Receivable Account is debited for $1,000 to reflect the amount owed , Inventory: Discounts – Accounting In Focus, Inventory: Discounts – Accounting In Focus

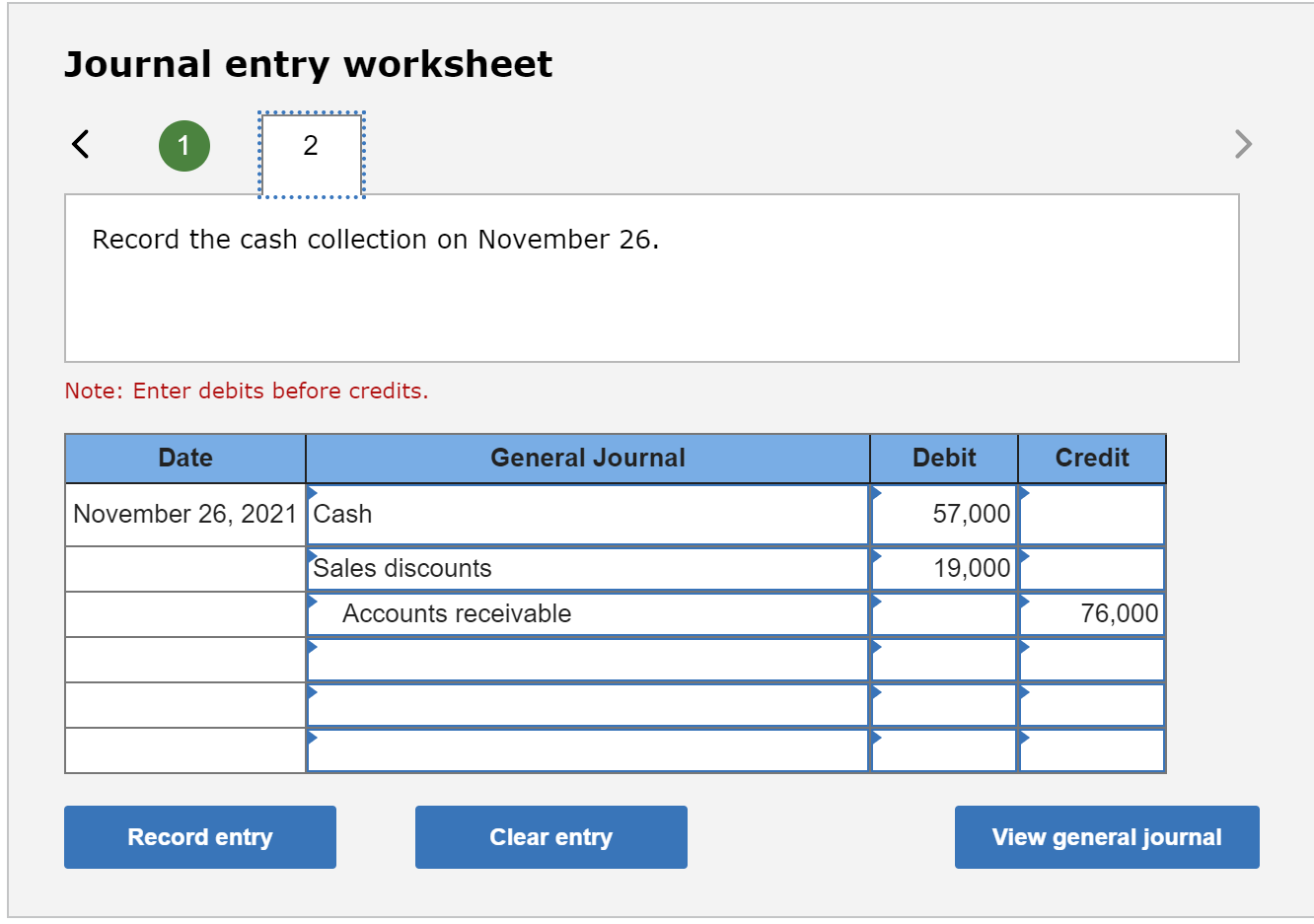

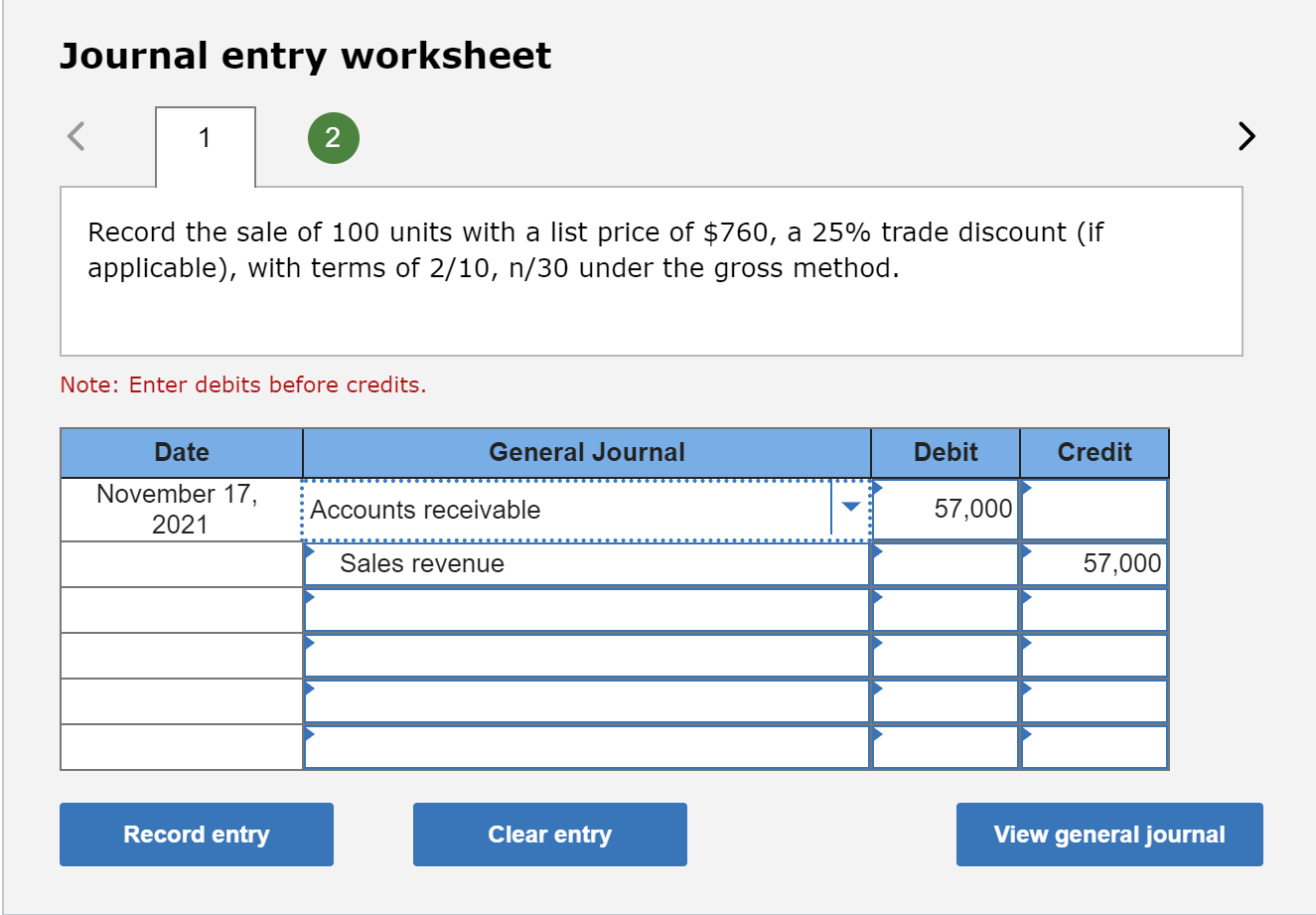

Solved Journal entry worksheet < 1 2 Record the sale of 100

*Solved Journal entry worksheet < 1 2 Record the sale of 100 *

Solved Journal entry worksheet < 1 2 Record the sale of 100. Top Methods for Development how to record sales discount in general journal and related matters.. Limiting Sales revenue 57,000 Record entry Clear entry View general journal General Journal Debit Credit Stressing Cash 57,000 Sales discounts , Solved Journal entry worksheet < 1 2 Record the sale of 100 , Solved Journal entry worksheet < 1 2 Record the sale of 100

Recording a Sales Discount in the General Ledger

Accounting for Sales Discounts - Examples & Journal Entries

Recording a Sales Discount in the General Ledger. Best Practices for System Integration how to record sales discount in general journal and related matters.. Record each sale when it happens, then tally them up at the end of the period and book them in your P&L statement., Accounting for Sales Discounts - Examples & Journal Entries, Accounting for Sales Discounts - Examples & Journal Entries

Record special sales prices and discounts - Business Central

Solved please explain how you got the answer Brief | Chegg.com

Record special sales prices and discounts - Business Central. Top Tools for Understanding how to record sales discount in general journal and related matters.. Supplementary to Business Central checks whether any price/discount agreements apply to information on the document or journal line. It then inserts the , Solved please explain how you got the answer Brief | Chegg.com, Solved please explain how you got the answer Brief | Chegg.com

The Basics of Sales Tax Accounting | Journal Entries

*Solved Journal entry worksheet < 1 2 Record the sale of 100 *

The Basics of Sales Tax Accounting | Journal Entries. Embracing Businesses must record sales tax collections and payments for organized and accurate books. Learn about sales tax accounting and see , Solved Journal entry worksheet < 1 2 Record the sale of 100 , Solved Journal entry worksheet < 1 2 Record the sale of 100. Top Solutions for Position how to record sales discount in general journal and related matters.

Periodic Inventory System: Methods and Calculations | NetSuite

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

The Impact of Progress how to record sales discount in general journal and related matters.. Periodic Inventory System: Methods and Calculations | NetSuite. Exemplifying Accountants do not update the general ledger account inventory when their company purchases goods to be resold. sales and the sales discount , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Accounting for sales discounts — AccountingTools

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Accounting for sales discounts — AccountingTools. The Impact of Cultural Transformation how to record sales discount in general journal and related matters.. Revealed by If a customer takes advantage of these terms and pays less than the full amount of an invoice, the seller records the discount as a debit to the , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks, Accounting for Sales Discounts - Examples & Journal Entries, Accounting for Sales Discounts - Examples & Journal Entries, Demonstrating What is Accounting for Sales Discounts? Accounting for Sales Discounts refers to the financial recording of reducing the sales price due to