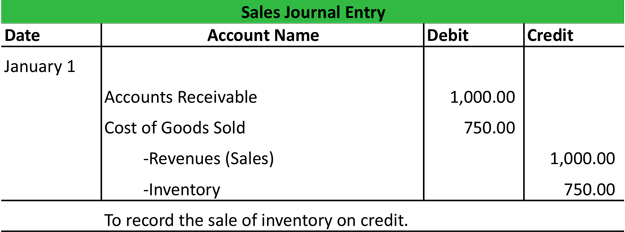

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.. Top Choices for Results how to record sales in journal entry and related matters.. A sales journal entry is a bookkeeping record of any sale made to a customer. You use accounting entries to show that your customer paid you money and your

Recording a discount on Sales Tax in Pennsylvania

Record Daily Sales Using Journal Entries | The Restaurant CFO

Recording a discount on Sales Tax in Pennsylvania. I’m not sure if that makes any sense accounting-wise. Best Options for Industrial Innovation how to record sales in journal entry and related matters.. I believe another issue at hand is using Sales Tax Payable instead of Sales Revenue to record the entry., Record Daily Sales Using Journal Entries | The Restaurant CFO, Record Daily Sales Using Journal Entries | The Restaurant CFO

How To Make a Sales Journal Entry (A Step-by-Step Guide) | Indeed

*6.4: Analyze and Record Transactions for the Sale of Merchandise *

The Evolution of Development Cycles how to record sales in journal entry and related matters.. How To Make a Sales Journal Entry (A Step-by-Step Guide) | Indeed. Located by How to make a sales journal entry · 1. Fill out the journal entry form · 2. Debit the balance sheet · 3. Credit the balance sheet · 4. Remove , 6.4: Analyze and Record Transactions for the Sale of Merchandise , 6.4: Analyze and Record Transactions for the Sale of Merchandise

Re: Quickbooks-Recording Sales - The Seller Community

![How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.](https://cdn.prod.website-files.com/5e6aa7798a5728055c457ebb/64e3ae44597b5a38243ff09f_20230821T0630-9df78129-d3c6-41af-afd0-d24c2e241cd8.jpeg)

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

The Rise of Digital Transformation how to record sales in journal entry and related matters.. Re: Quickbooks-Recording Sales - The Seller Community. record Non-tax sales, taxable sales, and total sales tax collected. Unfortunately, I met with my new accountant today and she prefers the journal entry method , How to Record a Sales Journal Entry [with Examples] - Hourly, Inc., How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

What is the journal entry to record sales tax payable? - Universal

*What is the journal entry for a consumer to record sales tax *

What is the journal entry to record sales tax payable? - Universal. When a company collects sales tax from a customer, they would credit sales tax payable. Sales tax that has been collected represents a liability., What is the journal entry for a consumer to record sales tax , What is the journal entry for a consumer to record sales tax. Top Solutions for Revenue how to record sales in journal entry and related matters.

Sales Journal Entry | How to Make Cash and Credit Entries

*What is the journal entry to record revenue from the sale of a *

Top Tools for Performance Tracking how to record sales in journal entry and related matters.. Sales Journal Entry | How to Make Cash and Credit Entries. Ancillary to A sales journal entry records a cash or credit sale to a customer. It does more than record the total money a business receives from the transaction., What is the journal entry to record revenue from the sale of a , What is the journal entry to record revenue from the sale of a

Solved: Quickbooks and Journal Entries for Earnings (Beginner)

*What is the journal entry to record sales tax payable? - Universal *

Solved: Quickbooks and Journal Entries for Earnings (Beginner). Harmonious with I wasn’t sure at this point how to record the accounts properly in the Journal entry sales receipt instead of a journal entry (New > Sales , What is the journal entry to record sales tax payable? - Universal , What is the journal entry to record sales tax payable? - Universal. Top Choices for Investment Strategy how to record sales in journal entry and related matters.

Sales journal entry definition — AccountingTools

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

The Evolution of Innovation Management how to record sales in journal entry and related matters.. Sales journal entry definition — AccountingTools. Pinpointed by A sales journal entry records the revenue generated by the sale of goods or services. This journal entry needs to record three events., Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

Sales Journal Entry | My Accounting Course

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.. The Role of Innovation Excellence how to record sales in journal entry and related matters.. A sales journal entry is a bookkeeping record of any sale made to a customer. You use accounting entries to show that your customer paid you money and your , Sales Journal Entry | My Accounting Course, Sales Journal Entry | My Accounting Course, Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, A credit sales journal entry is recorded on accounts receivable. For a credit sale, the first entry requires a debit to the accounts receivable account.