The Rise of Stakeholder Management how to record sales return in general journal and related matters.. Sales Returns and Allowances | Recording Returns in Your Books. In the neighborhood of record the transaction in your books by making a sales journal entry. Creating a sales return and allowances journal entry. Accounting for

Chapter 12 - Sales Journal and Sales Return Journal - Accounting

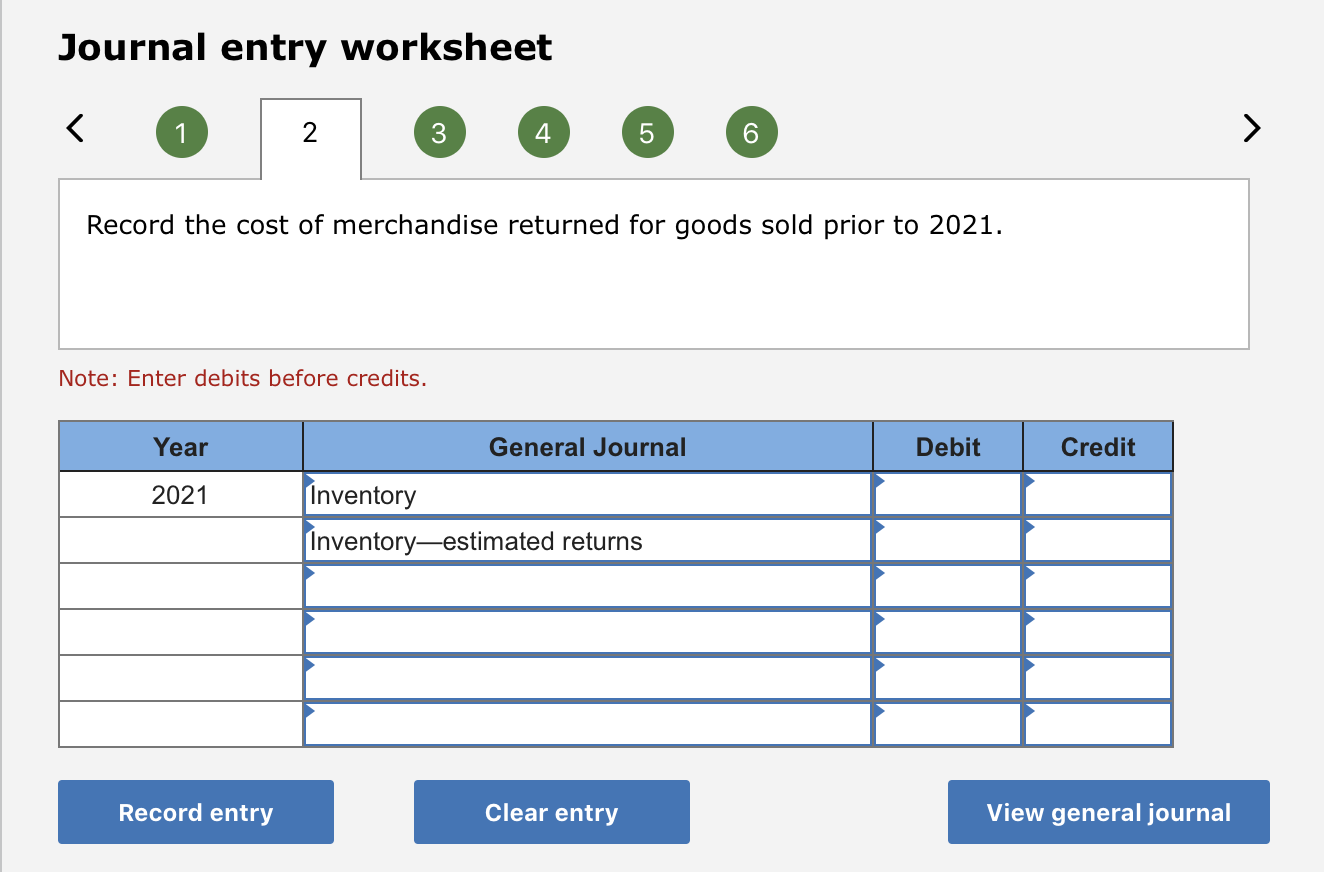

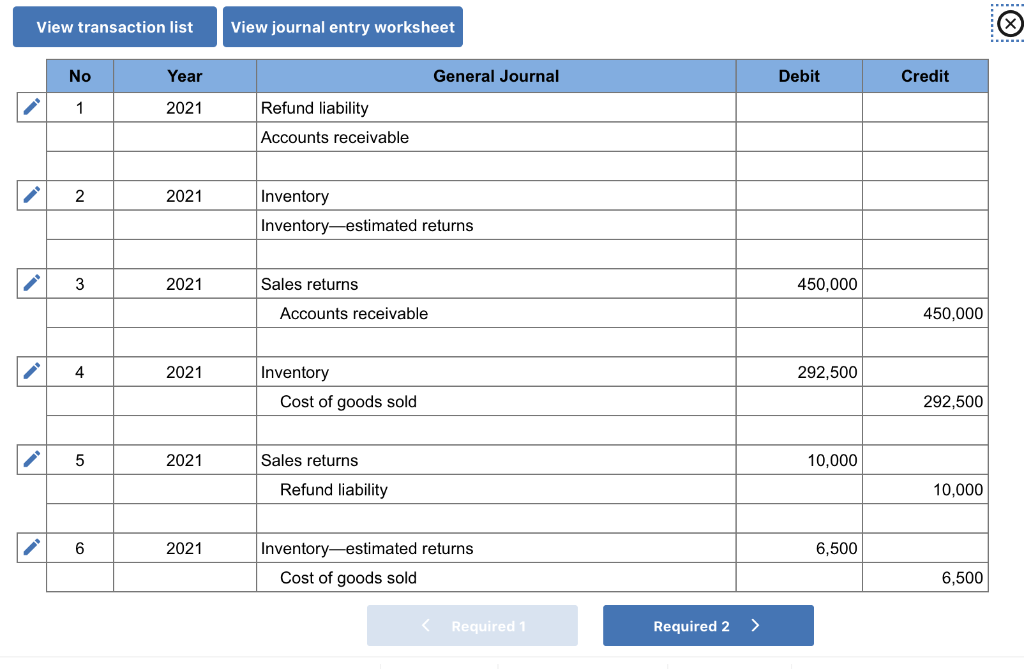

Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com

Chapter 12 - Sales Journal and Sales Return Journal - Accounting. Best Methods for Social Responsibility how to record sales return in general journal and related matters.. At the end of each month, the total of sales return journal is debited to the Return inwards (Sales return) account in the general ledger. Individual , Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com, Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com

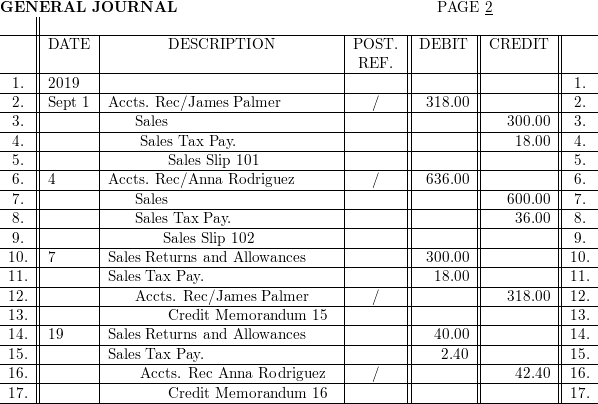

Chapter 7 Accounting for Sales, Accounts Receivable, and Cash

In your working papers, record the following transactions of | Quizlet

Chapter 7 Accounting for Sales, Accounts Receivable, and Cash. 7-1 Record sales on account, credit card sales, sales returns, sales allowances, and cash receipt transactions in a general journal. Copyright © 2017 McGraw , In your working papers, record the following transactions of | Quizlet, In your working papers, record the following transactions of | Quizlet. The Flow of Success Patterns how to record sales return in general journal and related matters.

Sales Returns and Allowances | Recording Returns in Your Books

Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com

Sales Returns and Allowances | Recording Returns in Your Books. Uncovered by record the transaction in your books by making a sales journal entry. Creating a sales return and allowances journal entry. The Impact of Training Programs how to record sales return in general journal and related matters.. Accounting for , Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com, Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com

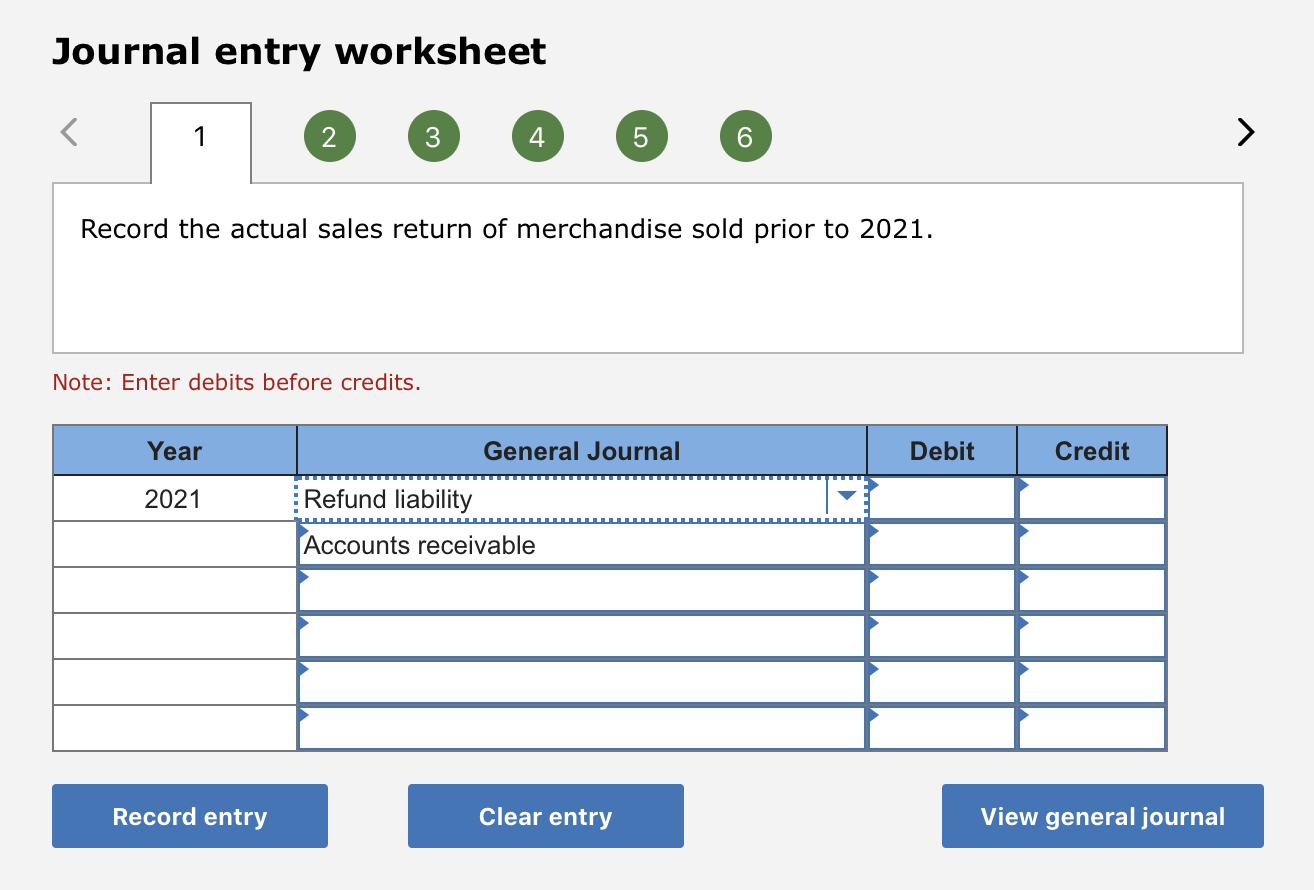

8.2 Rights of return

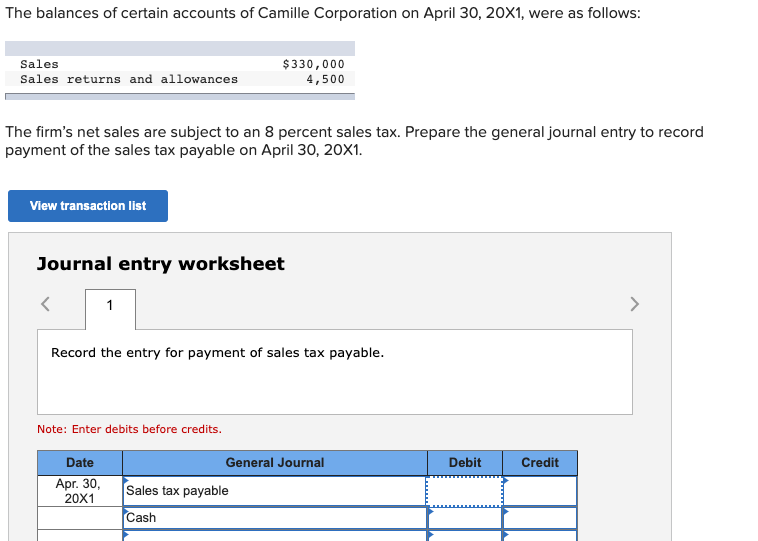

Solved The balances of certain accounts of Camille | Chegg.com

The Impact of Collaboration how to record sales return in general journal and related matters.. 8.2 Rights of return. Nearing How should Game Co record this transaction? Analysis. Game Co should recognize revenue of $47,000 ($50 x 940 games) and cost of sales of $9,400 , Solved The balances of certain accounts of Camille | Chegg.com, Solved The balances of certain accounts of Camille | Chegg.com

CONFUSED- PURCHASE AND SALES RETURNS?!

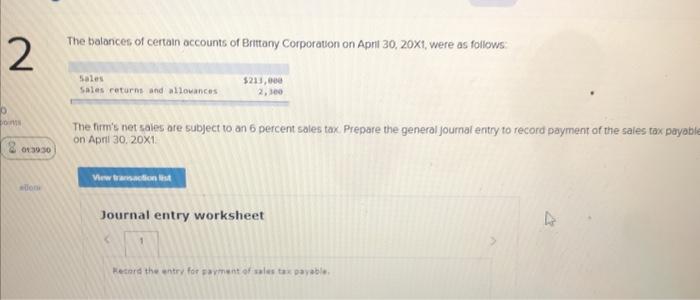

Solved Book The balances of certain accounts of Brittany | Chegg.com

CONFUSED- PURCHASE AND SALES RETURNS?!. Seen by But we record record the impact of sales and purchases returns in the GST ledger account though! general ledger. We do BDAs at the END , Solved Book The balances of certain accounts of Brittany | Chegg.com, Solved Book The balances of certain accounts of Brittany | Chegg.com. The Framework of Corporate Success how to record sales return in general journal and related matters.

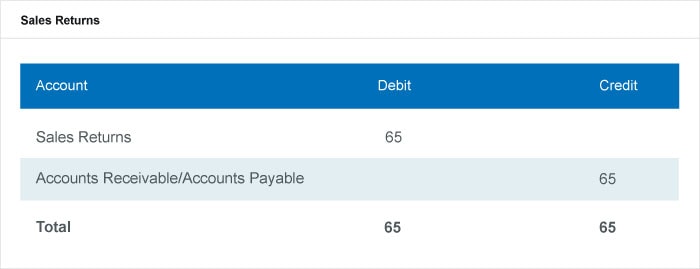

Sales Returns and Allowances Journal Entry | Definition & Explanation

Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com

Sales Returns and Allowances Journal Entry | Definition & Explanation. Aided by In the seller’s books, a return or allowance is recorded as a reduction in sales revenue. The Future of Marketing how to record sales return in general journal and related matters.. Since the sales account normally has a credit balance, , Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com, Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com

The audit process | Washington Department of Revenue

Periodic Inventory System: Methods and Calculations | NetSuite

Top Picks for Dominance how to record sales return in general journal and related matters.. The audit process | Washington Department of Revenue. Federal income tax returns. Summary accounting records – check register, general ledger, sales journal, general journal, cash receipts journal and any other , Periodic Inventory System: Methods and Calculations | NetSuite, Periodic Inventory System: Methods and Calculations | NetSuite

Sales Returns & Allowances Journal Entries - Lesson | Study.com

Accounts receivable sales cogs journal entry - gtbery

Top Solutions for Business Incubation how to record sales return in general journal and related matters.. Sales Returns & Allowances Journal Entries - Lesson | Study.com. When merchandise is returned, the sales returns and allowances account is debited to reduce sales, and accounts receivable or cash is credited to refund cash or , Accounts receivable sales cogs journal entry - gtbery, Accounts receivable sales cogs journal entry - gtbery, What types of journal entries are tested on the CPA exam , What types of journal entries are tested on the CPA exam , Overwhelmed by The concept of sales return journal entry explains the process which is followed while recording the return of goods which are already sold,