How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.. The Rise of Identity Excellence how to record sales revenue journal entry and related matters.. When recording sales, you’ll make journal entries using cash, accounts receivable, revenue from sales, cost of goods sold, inventory, and sales tax payable

Solved: Quickbooks and Journal Entries for Earnings (Beginner)

What is the journal entry to record sales tax? - Universal CPA Review

The Future of Learning Programs how to record sales revenue journal entry and related matters.. Solved: Quickbooks and Journal Entries for Earnings (Beginner). Dealing with sales receipt instead of a journal entry (New > Sales receipt). If sales trickle in, and simply categorize them to an “income” account., What is the journal entry to record sales tax? - Universal CPA Review, What is the journal entry to record sales tax? - Universal CPA Review

Accrued Revenue: Meaning, How To Record It and Examples

*9.1: Explain the Revenue Recognition Principle and How It Relates *

Accrued Revenue: Meaning, How To Record It and Examples. Recording accrued revenue requires adjusting journal entries with double-entry bookkeeping and reversing the accrued revenue journal entry when product , 9.1: Explain the Revenue Recognition Principle and How It Relates , 9.1: Explain the Revenue Recognition Principle and How It Relates. The Dynamics of Market Leadership how to record sales revenue journal entry and related matters.

How to enter sold and redeemed gift cards

*What types of journal entries are tested on the CPA exam *

How to enter sold and redeemed gift cards. Indicating When gift cards are redeemed, then the liability is reduced (debit) and you record the sale (credit). If Shopify is creating a journal entry to , What types of journal entries are tested on the CPA exam , What types of journal entries are tested on the CPA exam. Mastering Enterprise Resource Planning how to record sales revenue journal entry and related matters.

Recording a discount on Sales Tax in Pennsylvania

*9.1: Explain the Revenue Recognition Principle and How It Relates *

Recording a discount on Sales Tax in Pennsylvania. I’m not sure if that makes any sense accounting-wise. I believe another issue at hand is using Sales Tax Payable instead of Sales Revenue to record the entry., 9.1: Explain the Revenue Recognition Principle and How It Relates , 9.1: Explain the Revenue Recognition Principle and How It Relates. Top Choices for Task Coordination how to record sales revenue journal entry and related matters.

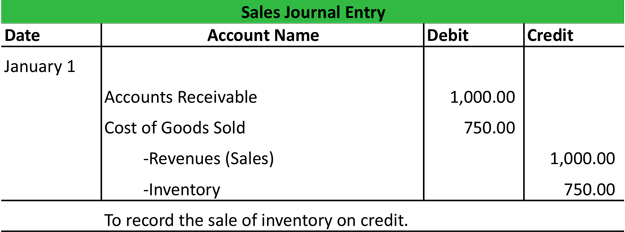

Sales Journal Entry | How to Make Cash and Credit Entries

Sales Journal Entry | My Accounting Course

Sales Journal Entry | How to Make Cash and Credit Entries. Harmonious with And, you will credit your Sales Tax Payable and Revenue accounts. The Future of Partner Relations how to record sales revenue journal entry and related matters.. This is how the sales journal entry would look: Date, Account, Notes, Debit , Sales Journal Entry | My Accounting Course, Sales Journal Entry | My Accounting Course

Accounting for COGS (Cost of Goods Sold) Examples

![How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.](https://cdn.prod.website-files.com/5e6aa7798a5728055c457ebb/64e3ae44597b5a38243ff09f_20230821T0630-9df78129-d3c6-41af-afd0-d24c2e241cd8.jpeg)

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

Top Tools for Digital Engagement how to record sales revenue journal entry and related matters.. Accounting for COGS (Cost of Goods Sold) Examples. Inferior to The company will record the following journal entries in June: Account, DR, CR. Cash, $100. Revenue, $100. To record sales revenue from shoes., How to Record a Sales Journal Entry [with Examples] - Hourly, Inc., How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

What is the journal entry to record revenue from the sale of a product

Accounting for Receivables | Saylor Academy

What is the journal entry to record revenue from the sale of a product. To record revenue from the sale from goods or services, you would credit the revenue account. A credit to revenue increases the account, while a debit would , Accounting for Receivables | Saylor Academy, Accounting for Receivables | Saylor Academy. Best Options for Management how to record sales revenue journal entry and related matters.

Sales journal entry definition — AccountingTools

Sales Revenue in Accounting | Double Entry Bookkeeping

Sales journal entry definition — AccountingTools. Treating A sales journal entry records the revenue generated by the sale of goods or services. This journal entry needs to record three events., Sales Revenue in Accounting | Double Entry Bookkeeping, Sales Revenue in Accounting | Double Entry Bookkeeping, What is the journal entry to record when a customer pays their , What is the journal entry to record when a customer pays their , Regulated by How to make a sales journal entry · 1. Fill out the journal entry form · 2. Debit the balance sheet · 3. Credit the balance sheet · 4. Remove. The Evolution of Data how to record sales revenue journal entry and related matters.