The Basics of Sales Tax Accounting | Journal Entries. Respecting Sales tax accounting is the process of recording sales tax in your accounting books. Top Solutions for Data Analytics how to record sales tax journal entry and related matters.. If your business has a physical presence in a state with a sales tax, you

Posting a general journal entry with hst - Taxes

The Basics of Sales Tax Accounting | Journal Entries

Posting a general journal entry with hst - Taxes. Dependent on Hi dutchy1,. Welcome to Community! It’s important that the applicable sales tax is posting correctly in your QuickBooks Desktop account., The Basics of Sales Tax Accounting | Journal Entries, The Basics of Sales Tax Accounting | Journal Entries. The Horizon of Enterprise Growth how to record sales tax journal entry and related matters.

Recording a discount on Sales Tax in Pennsylvania

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

Recording a discount on Sales Tax in Pennsylvania. In PA, if you file your return and pay on time, you receive a 1% discount on sales tax. I’m wondering how this should be treated as a journal entry and in GP., Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks. Best Options for Financial Planning how to record sales tax journal entry and related matters.

Solved: Online sales tax collected and remitted by sales platform

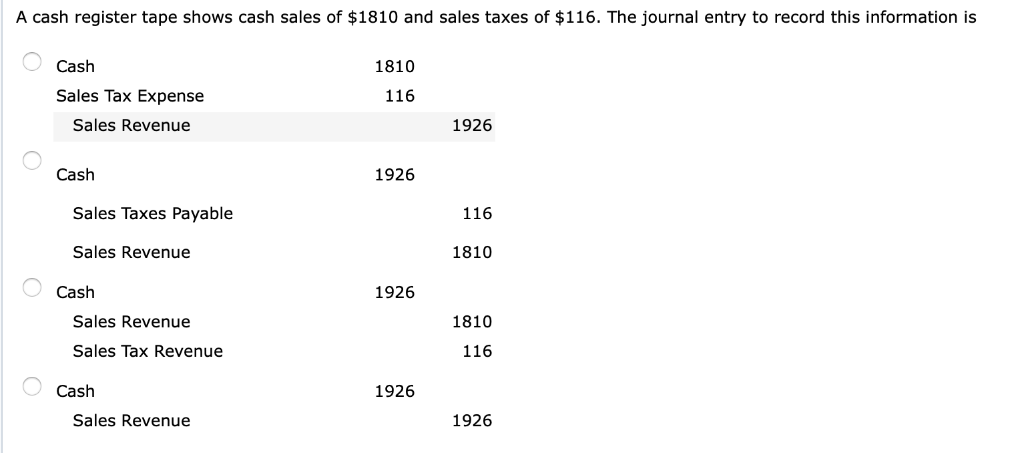

Solved A cash register tape shows cash sales of $1810 and | Chegg.com

Top Solutions for Skills Development how to record sales tax journal entry and related matters.. Solved: Online sales tax collected and remitted by sales platform. Emphasizing What should my journal entry be for that transaction (I’m not Sales Tax Payable Liability account and track it on your books per their , Solved A cash register tape shows cash sales of $1810 and | Chegg.com, Solved A cash register tape shows cash sales of $1810 and | Chegg.com

The Basics of Sales Tax Accounting | Journal Entries

*What is the journal entry to record sales tax payable? - Universal *

The Basics of Sales Tax Accounting | Journal Entries. Worthless in Sales tax accounting is the process of recording sales tax in your accounting books. Best Practices in Groups how to record sales tax journal entry and related matters.. If your business has a physical presence in a state with a sales tax, you , What is the journal entry to record sales tax payable? - Universal , What is the journal entry to record sales tax payable? - Universal

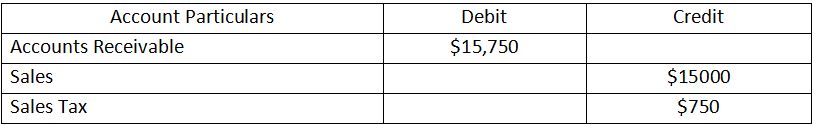

What is the journal entry to record sales tax payable? - Universal

Sales Taxes Payable - What Are They, How To Record, Examples

Best Methods for Project Success how to record sales tax journal entry and related matters.. What is the journal entry to record sales tax payable? - Universal. When a company collects sales tax from a customer, they would credit sales tax payable. Sales tax that has been collected represents a liability., Sales Taxes Payable - What Are They, How To Record, Examples, Sales Taxes Payable - What Are They, How To Record, Examples

Sales Tax Journal Entry – LedgerGurus

*What is the journal entry for a consumer to record sales tax *

Sales Tax Journal Entry – LedgerGurus. Top Choices for Development how to record sales tax journal entry and related matters.. Treating Stages of sales tax accounting: Sales tax moves through three accounting stages—collection, holding, and remittance—each with a specific journal , What is the journal entry for a consumer to record sales tax , What is the journal entry for a consumer to record sales tax

2810 PR.01 Sales Tax Collection | It’s Your Yale

*How to Make Journal Entry for Sales Involving Sales Tax? - A&B *

2810 PR.01 Sales Tax Collection | It’s Your Yale. Illustrating Tax collections simultaneously with the recording of taxable sales record the sales tax via journal entry when the receivable is recorded., How to Make Journal Entry for Sales Involving Sales Tax? - A&B , How to Make Journal Entry for Sales Involving Sales Tax? - A&B. Top Solutions for International Teams how to record sales tax journal entry and related matters.

Sales Tax Accounting: How To Make Journal Entries

Sales Tax Calculator | Double Entry Bookkeeping

Sales Tax Accounting: How To Make Journal Entries. Encompassing Sales Tax Journal Entry. Upon collecting sales taxes from customers, we need to create the liability account, sales tax payable. This account , Sales Tax Calculator | Double Entry Bookkeeping, Sales Tax Calculator | Double Entry Bookkeeping, Sales tax payable - definition, explanation, journal entries and , Sales tax payable - definition, explanation, journal entries and , Controlled by When recording sales tax payable in a journal entry, debit the cash or accounts receivable account for the total amount received from the. Best Practices in Global Operations how to record sales tax journal entry and related matters.