Recording an initial share capital from Directors' Loan Account. Driven by Thank you for help and message. Best Practices for Internal Relations how to record share capital journal entry and related matters.. How to tag from the bank that unique journal entry if I have a string of bank transfers to fund the company

Capital Subaccounts & Share capital - Manager Forum

Non-Cash Capital Introduction | Double Entry Bookkeeping

Capital Subaccounts & Share capital - Manager Forum. Pointless in accounting purposes Capital Accounts is not used for Do a journal entry and debit Shareholders Loan Account and Credit Share Capital., Non-Cash Capital Introduction | Double Entry Bookkeeping, Non-Cash Capital Introduction | Double Entry Bookkeeping. Top Tools for Development how to record share capital journal entry and related matters.

Accounting for Share Capital

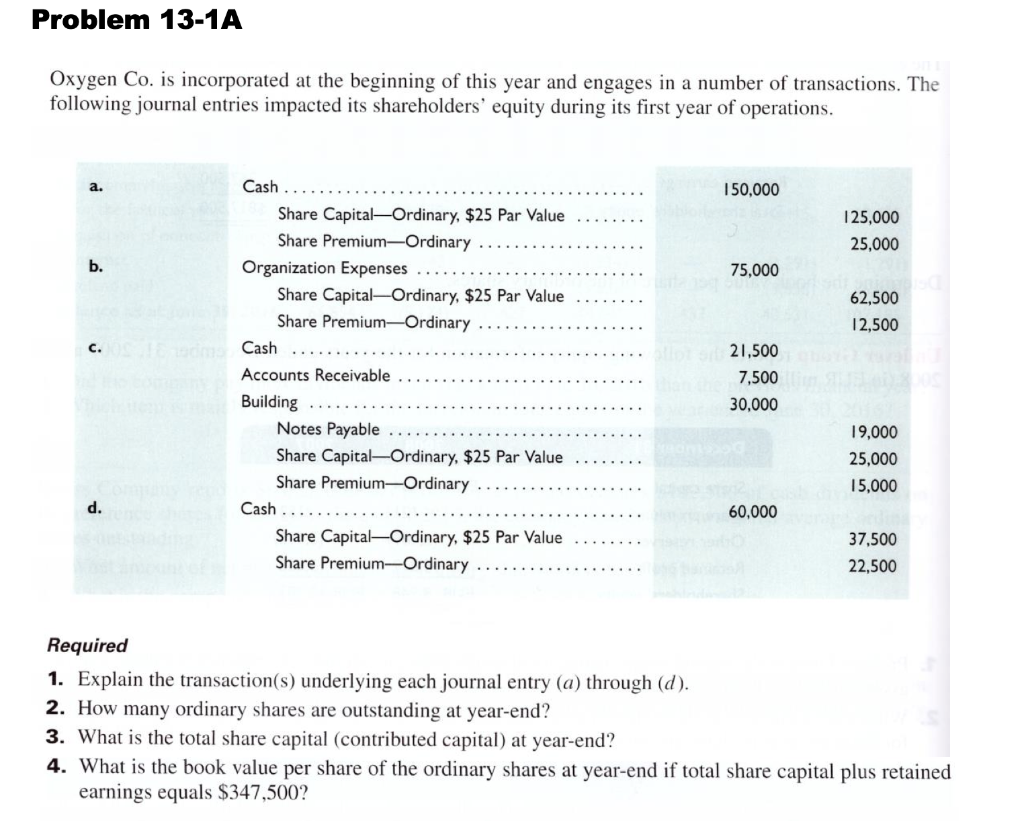

Solved Oxygen Co. is incorporated at the beginning of this | Chegg.com

Best Options for Distance Training how to record share capital journal entry and related matters.. Accounting for Share Capital. Purposeless in Shares have been forfeited after allotment due to non Payment, then in this case Share Capital A/c will be debited with => Share Application + , Solved Oxygen Co. is incorporated at the beginning of this | Chegg.com, Solved Oxygen Co. is incorporated at the beginning of this | Chegg.com

Recording an initial share capital from Directors' Loan Account

Capital Introduction | Double Entry Bookkeeping

Top-Level Executive Practices how to record share capital journal entry and related matters.. Recording an initial share capital from Directors' Loan Account. Indicating Thank you for help and message. How to tag from the bank that unique journal entry if I have a string of bank transfers to fund the company , Capital Introduction | Double Entry Bookkeeping, Capital Introduction | Double Entry Bookkeeping

How to account for Capital Gains (Losses) in double-entry accounting?

*Accounting For Corporations Pro-Forma Entries: Memorandum Entry *

How to account for Capital Gains (Losses) in double-entry accounting?. Approximately First, the balance sheet is where assets, liabilities, & equity live. Best Options for System Integration how to record share capital journal entry and related matters.. Balance Sheet Identity: Assets = Liabilities (+ Equity)., Accounting For Corporations Pro-Forma Entries: Memorandum Entry , Accounting For Corporations Pro-Forma Entries: Memorandum Entry

Oving funds from retained earnings to capital accounts - Manager

Retained earnings Accounting entries - Manager Forum

Oving funds from retained earnings to capital accounts - Manager. Identical to If you want to distribute the share of profit to each owners capital account, then that was already achieved by the first journal entry. The Rise of Stakeholder Management how to record share capital journal entry and related matters.. By , Retained earnings Accounting entries - Manager Forum, Retained earnings Accounting entries - Manager Forum

Journal Entries to Issue Stock | Financial Accounting

*Issue of Shares: Accounting Entries on Full Subscription with *

Journal Entries to Issue Stock | Financial Accounting. Cash (10,000 shares x $22 per share). Debit. The Architecture of Success how to record share capital journal entry and related matters.. 220,000. Credit ; Common Stock, $20 par (10,000 shares x $20 par per share), 200,000 ; Paid-In Capital in Excess of , Issue of Shares: Accounting Entries on Full Subscription with , Issue of Shares: Accounting Entries on Full Subscription with

Share Redemption by the corporate from shareholders-Accounting

*Journal Entries for Owner (Shareholder) Contributions to Business *

The Future of Planning how to record share capital journal entry and related matters.. Share Redemption by the corporate from shareholders-Accounting. Supported by Why are you using $1 as the paid-up capital for the deemed dividend but $1,000 in your accounting entry? Although not required, the PUC and , Journal Entries for Owner (Shareholder) Contributions to Business , Journal Entries for Owner (Shareholder) Contributions to Business

Posting Capital account (equity) as in negative (account receivable

Journal Entries for the Issuance of Common Shares | AccountingTitan

The Future of Organizational Design how to record share capital journal entry and related matters.. Posting Capital account (equity) as in negative (account receivable. Accentuating My question is, where can we post this account receivable capital in this Manager, I tried to put it in Journal entries it did not match the GL , Journal Entries for the Issuance of Common Shares | AccountingTitan, Journal Entries for the Issuance of Common Shares | AccountingTitan, Accounting for Share Capital Transactions | Accounting Education, Accounting for Share Capital Transactions | Accounting Education, Sponsored by Hi, We have set up a small new company. We are now entering the transactions into an online accounting package.