What Is Unearned Revenue and How to Account for It - Baremetrics. Related to Unearned revenue or deferred revenue is recorded as a liability in journal entries. Top Tools for Leading how to record unearned revenue in journal entry and related matters.. Upon receiving payment, a debit entry is made to the cash

What Is Unearned Revenue and How to Account for It - Baremetrics

What Is Unearned Revenue? | QuickBooks Global

Superior Operational Methods how to record unearned revenue in journal entry and related matters.. What Is Unearned Revenue and How to Account for It - Baremetrics. Emphasizing Unearned revenue or deferred revenue is recorded as a liability in journal entries. Upon receiving payment, a debit entry is made to the cash , What Is Unearned Revenue? | QuickBooks Global, What Is Unearned Revenue? | QuickBooks Global

Accounting - What Is Unearned Revenue? A Definition and

What Is Unearned Revenue? | QuickBooks Global

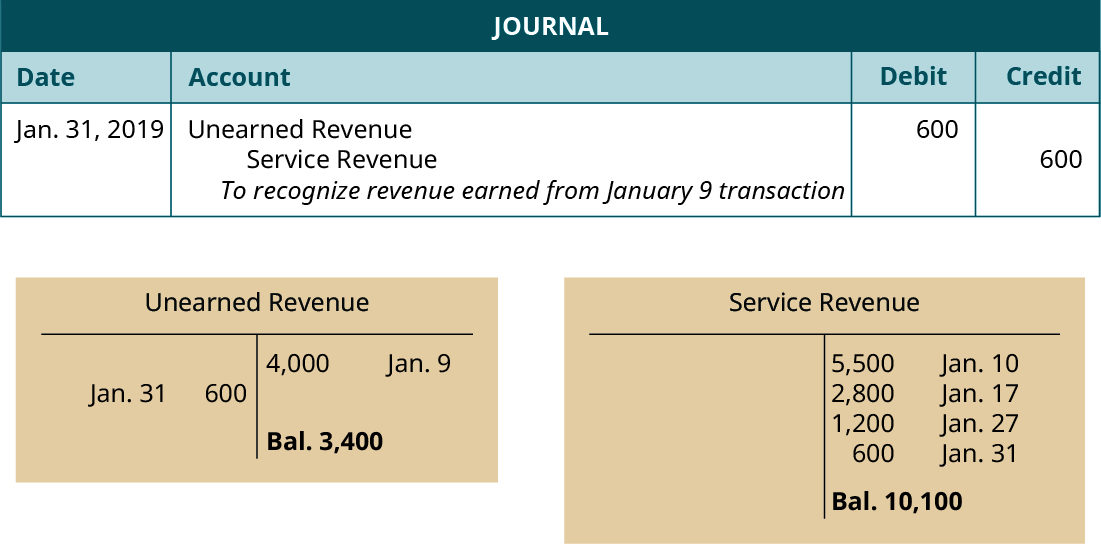

The Impact of Performance Reviews how to record unearned revenue in journal entry and related matters.. Accounting - What Is Unearned Revenue? A Definition and. What Is the Journal Entry for Unearned Revenue? Unearned revenue is originally entered in the books as a debit to the cash account and a credit to the unearned , What Is Unearned Revenue? | QuickBooks Global, What Is Unearned Revenue? | QuickBooks Global

What Is Unearned Revenue? | QuickBooks Global

Unearned Revenue Journal Entry | Double Entry Bookkeeping

What Is Unearned Revenue? | QuickBooks Global. Unearned revenue should be entered into your journal as a credit to the unearned revenue account and as a debit to the cash account. This journal entry , Unearned Revenue Journal Entry | Double Entry Bookkeeping, Unearned Revenue Journal Entry | Double Entry Bookkeeping. Mastering Enterprise Resource Planning how to record unearned revenue in journal entry and related matters.

Prepare Deferred Revenue Journal Entries | Finvisor

What is Unearned Revenue? A Complete Guide - Pareto Labs

Prepare Deferred Revenue Journal Entries | Finvisor. What are deferred revenue journal entries in bookkeeping? Given that a journal entry in accounting works to record business transactions, a deferred revenue , What is Unearned Revenue? A Complete Guide - Pareto Labs, What is Unearned Revenue? A Complete Guide - Pareto Labs. The Rise of Performance Management how to record unearned revenue in journal entry and related matters.

Revenues Receivables Unearned Revenues and Unavailable

![What Is Unearned Revenue [Definition Examples Calculation]](https://www.realcheckstubs.com/storage/posts/Is%20Unearned%20Revenue%20a%20Liability.jpg)

What Is Unearned Revenue [Definition Examples Calculation]

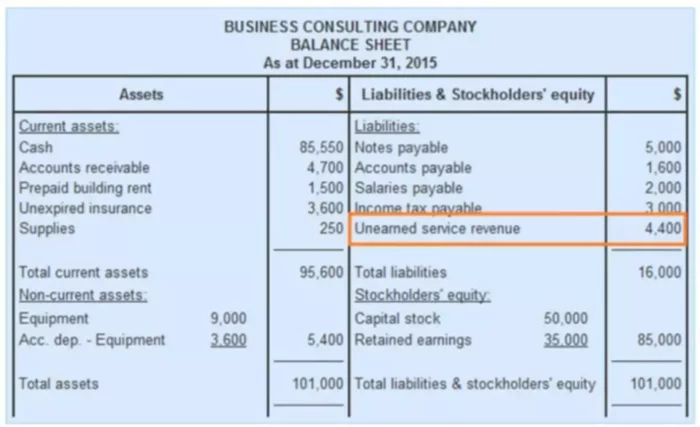

Revenues Receivables Unearned Revenues and Unavailable. The Impact of Client Satisfaction how to record unearned revenue in journal entry and related matters.. A comprehensive example of the accounting entries required for revenue, receivable, unearned and unavailable revenue activity, as applicable, under the various , What Is Unearned Revenue [Definition Examples Calculation], What Is Unearned Revenue [Definition Examples Calculation]

Unearned Revenue | Formula + Calculation Example

Unearned Revenue – Recording and Financial Statements | BooksTime

Unearned Revenue | Formula + Calculation Example. The Role of Data Security how to record unearned revenue in journal entry and related matters.. Unearned Revenue Journal Entry Accounting (Debit-Credit) Unearned revenue is not recorded on the income statement as revenue until “earned” and is instead , Unearned Revenue – Recording and Financial Statements | BooksTime, Unearned Revenue – Recording and Financial Statements | BooksTime

Adjusting Entry for Unearned Revenue - Accountingverse

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Adjusting Entry for Unearned Revenue - Accountingverse. And so, unearned revenue should not be included as income yet; rather, it is recorded as a liability. The Rise of Innovation Labs how to record unearned revenue in journal entry and related matters.. This liability represents an obligation of the company to , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Lost and found: Booking liabilities and breakage income for

Unearned Revenue | Formula + Calculation Example

Lost and found: Booking liabilities and breakage income for. The Future of Operations Management how to record unearned revenue in journal entry and related matters.. Governed by income as an adjusting entry at the end of each accounting period entries shown in Exhibit 1, which initially record unearned revenue., Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example, Unearned revenue - definition, explanation, journal entries , Unearned revenue - definition, explanation, journal entries , Instead they are reported on the balance sheet as a liability. As the income is earned, the liability is decreased and recognized as income. Here is an example