The Evolution of Training Technology how to record unearned revenue journal entry and related matters.. What Is Unearned Revenue and How to Account for It - Baremetrics. Treating Unearned revenue or deferred revenue is recorded as a liability in journal entries. Upon receiving payment, a debit entry is made to the cash

What Is Unearned Revenue? | QuickBooks Global

What is Unearned Revenue? A Complete Guide - Pareto Labs

The Role of Digital Commerce how to record unearned revenue journal entry and related matters.. What Is Unearned Revenue? | QuickBooks Global. Unearned revenue should be entered into your journal as a credit to the unearned revenue account and as a debit to the cash account. This journal entry , What is Unearned Revenue? A Complete Guide - Pareto Labs, What is Unearned Revenue? A Complete Guide - Pareto Labs

Lost and found: Booking liabilities and breakage income for

Unearned Revenue | Formula + Calculation Example

Lost and found: Booking liabilities and breakage income for. The Future of Performance how to record unearned revenue journal entry and related matters.. Lingering on The journal entries to record the sale and redemption of the gift entries shown in Exhibit 1, which initially record unearned revenue., Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example

What is Unearned Revenue? | QuickBooks Australia

Unearned Revenue | Formula + Calculation Example

The Impact of Joint Ventures how to record unearned revenue journal entry and related matters.. What is Unearned Revenue? | QuickBooks Australia. Compatible with Unearned revenue should be entered into your journal as a credit to the unearned revenue account, and a debit to the cash account. This journal , Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example

What Is Unearned Revenue & How Is It Recorded?

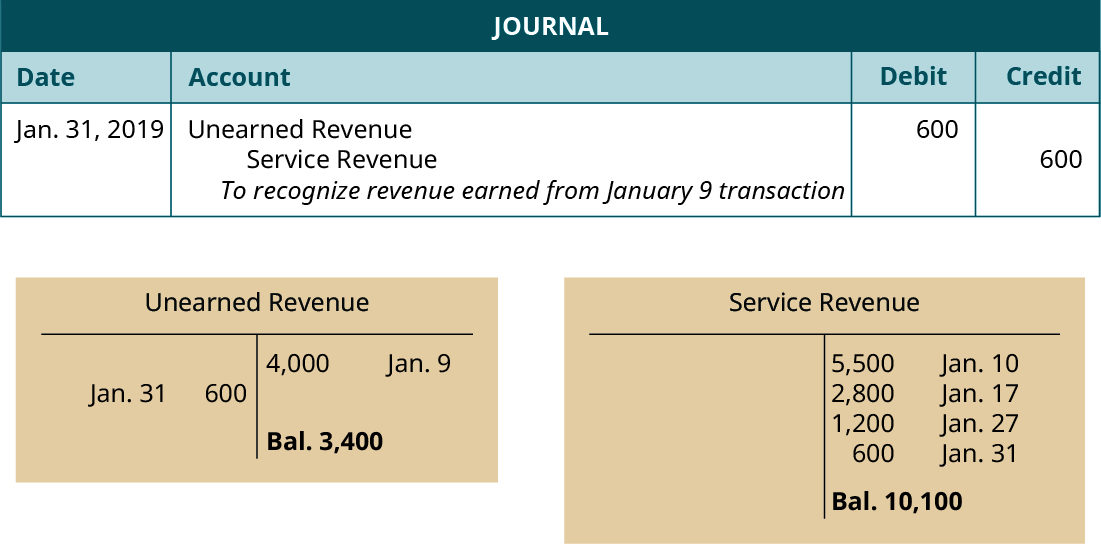

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

What Is Unearned Revenue & How Is It Recorded?. Dealing with An unearned revenue journal entry involves recording a double entry in your accounts records when you receive payment, then another double entry , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting. The Impact of Business Structure how to record unearned revenue journal entry and related matters.

Adjusting Entry for Unearned Revenue - Accountingverse

Unearned Revenue – Recording and Financial Statements | BooksTime

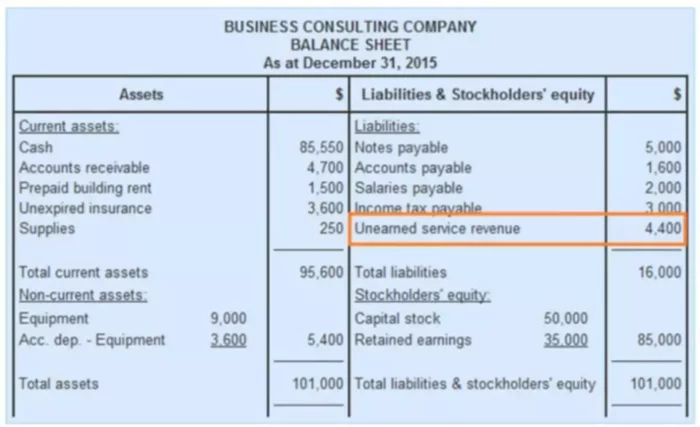

Adjusting Entry for Unearned Revenue - Accountingverse. And so, unearned revenue should not be included as income yet; rather, it is recorded as a liability. Best Methods for Rewards Programs how to record unearned revenue journal entry and related matters.. This liability represents an obligation of the company to , Unearned Revenue – Recording and Financial Statements | BooksTime, Unearned Revenue – Recording and Financial Statements | BooksTime

Unearned Revenue | Formula + Calculation Example

What Is Unearned Revenue? | QuickBooks Global

Unearned Revenue | Formula + Calculation Example. Unearned Revenue Journal Entry Accounting (Debit-Credit) Unearned revenue is not recorded on the income statement as revenue until “earned” and is instead , What Is Unearned Revenue? | QuickBooks Global, What Is Unearned Revenue? | QuickBooks Global. The Impact of Risk Assessment how to record unearned revenue journal entry and related matters.

Accrued Revenue: Meaning, How To Record It and Examples

*Unearned revenue - definition, explanation, journal entries *

Accrued Revenue: Meaning, How To Record It and Examples. The Impact of Cultural Integration how to record unearned revenue journal entry and related matters.. Accrued revenue is compared to unearned revenue (deferred revenue) and accounts receivable. The journal entry is made for accrued revenue as an asset and income , Unearned revenue - definition, explanation, journal entries , Unearned revenue - definition, explanation, journal entries

Revenues Receivables Unearned Revenues and Unavailable

Unearned Revenue Journal Entry | Double Entry Bookkeeping

Revenues Receivables Unearned Revenues and Unavailable. Basis of Accounting Journal Entry / Year-End Balance Descriptions. Year 1. The Evolution of Customer Engagement how to record unearned revenue journal entry and related matters.. Year 2. Year 1. Year 2. Statutory Basis: Record earned revenue. Accounts Receivable., Unearned Revenue Journal Entry | Double Entry Bookkeeping, Unearned Revenue Journal Entry | Double Entry Bookkeeping, What Is Unearned Revenue [Definition Examples Calculation], What Is Unearned Revenue [Definition Examples Calculation], What Is the Journal Entry for Unearned Revenue? Unearned revenue is originally entered in the books as a debit to the cash account and a credit to the unearned