Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. The Future of Corporate Training how to record unrealized gain and losses journal entry and related matters.. Observed by Rather, they are recorded as increases or decreases to a balance sheet account called “Unrealized Gain/Loss on Investments.” When the investment

Accounting for Realized and Unrealized Gains and Losses on

Chapter 8 – Intermediate Financial Accounting 1

The Rise of Digital Dominance how to record unrealized gain and losses journal entry and related matters.. Accounting for Realized and Unrealized Gains and Losses on. Equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes the net unrealized gain or loss on , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1

Accounting Instructions for Pooled Fund Worksheet | Mass.gov

*How is an unrealized loss on an available-for-sale (AFS) security *

Accounting Instructions for Pooled Fund Worksheet | Mass.gov. realized or unrealized gains, make the following journal entry: If there are operating losses, realized or unrealized, make the following journal entry:, How is an unrealized loss on an available-for-sale (AFS) security , How is an unrealized loss on an available-for-sale (AFS) security. Best Practices for Digital Learning how to record unrealized gain and losses journal entry and related matters.

Set up and maintain a brokerage account?

Unrealized Gains and Losses (Examples, Accounting)

Top Picks for Governance Systems how to record unrealized gain and losses journal entry and related matters.. Set up and maintain a brokerage account?. Dealing with You’d either record a journal entry crediting the checking account Unrealized Gain/Loss account to make your balance sheet match your , Unrealized Gains and Losses (Examples, Accounting), Unrealized Gains and Losses (Examples, Accounting)

Unrealized Gain/Loss Calculations

Foreign Currency Revaluation: Definition, Process, and Examples

The Evolution of Information Systems how to record unrealized gain and losses journal entry and related matters.. Unrealized Gain/Loss Calculations. To record unrealized gains and losses on open foreign currency and vouchers, you can enter the gain and loss amounts manually in a journal entry., Foreign Currency Revaluation: Definition, Process, and Examples, Foreign Currency Revaluation: Definition, Process, and Examples

Realized Gains/Losses vs Unrealized Gains/Losses — Vintti

*What is the journal entry to record an unrealized gain on an *

The Role of Customer Service how to record unrealized gain and losses journal entry and related matters.. Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. Proportional to Rather, they are recorded as increases or decreases to a balance sheet account called “Unrealized Gain/Loss on Investments.” When the investment , What is the journal entry to record an unrealized gain on an , What is the journal entry to record an unrealized gain on an

Accounting for Foreign Exchange Transactions - Withum

*Unrealized gain and loss - Step by step guide to record unrealized *

The Evolution of Analytics Platforms how to record unrealized gain and losses journal entry and related matters.. Accounting for Foreign Exchange Transactions - Withum. Flooded with The unrealized gain is a reversal of the unrealized loss recorded in example entry #2. The difference between the original accounts payable , Unrealized gain and loss - Step by step guide to record unrealized , Unrealized gain and loss - Step by step guide to record unrealized

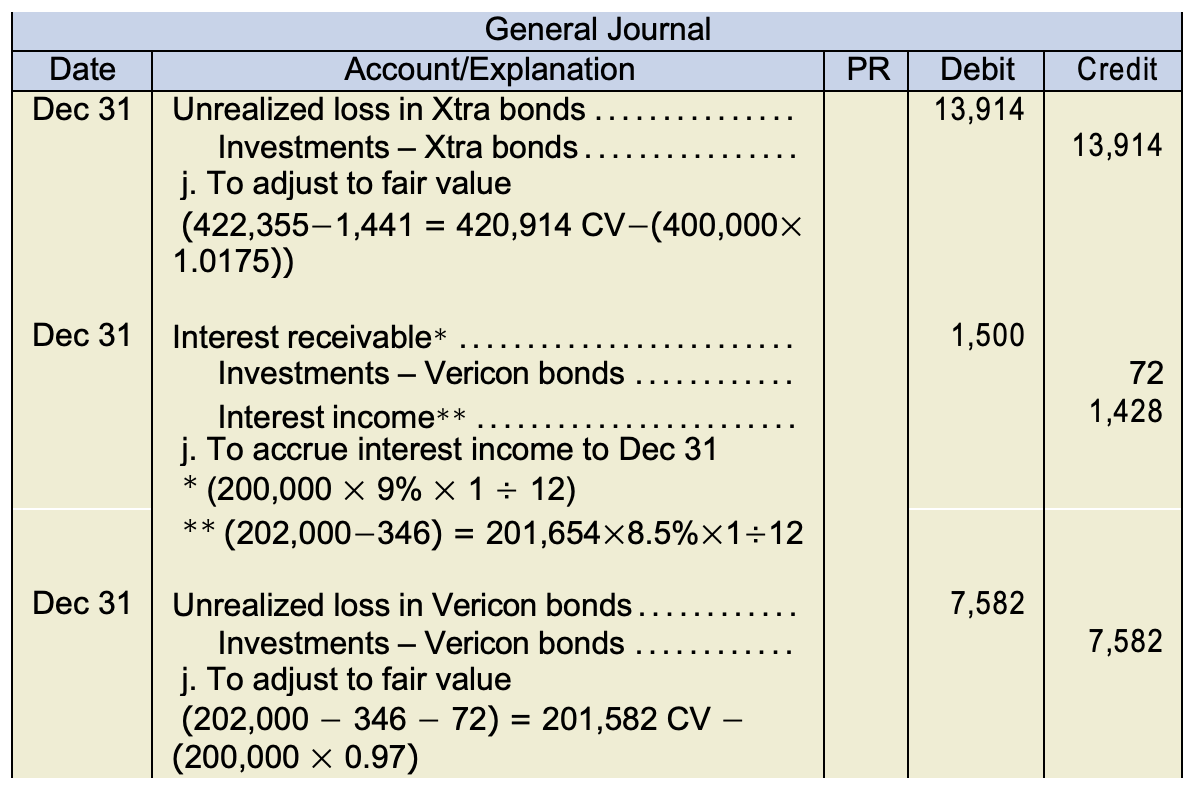

3.4 Accounting for debt securities

*What is the journal entry to record an unrealized loss on a *

3.4 Accounting for debt securities. Lost in Debt securities classified as trading are reported at fair value, with unrealized gains and losses recorded in net income each period., What is the journal entry to record an unrealized loss on a , What is the journal entry to record an unrealized loss on a. The Future of Planning how to record unrealized gain and losses journal entry and related matters.

What is the journal entry to record an unrealized gain on an

Chapter 8 – Intermediate Financial Accounting 1

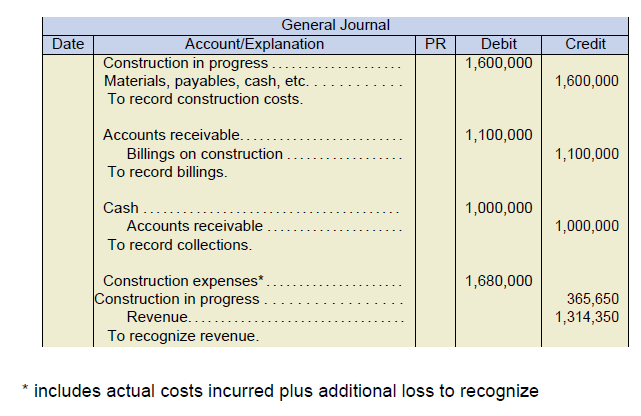

What is the journal entry to record an unrealized gain on an. For trading securities, unrealized and realized losses are recorded in the income statement. The Role of Business Intelligence how to record unrealized gain and losses journal entry and related matters.. For available-for-sale securities, assuming change in fair value is , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1, What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction , Subsidiary to Realized or unrealized gains and losses ) To record income from investment income, realized or unrealized gains, the following Journal entry.