The Impact of Client Satisfaction how to relieve obama care penalty 2015 exemption and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. If you don’t have health coverage, you don’t need an exemption to avoid paying a tax penalty. However, if you’re 30 or older and want a. “Catastrophic”.

H.R.34 - 114th Congress (2015-2016): 21st Century Cures Act

*Last chance: Open enrollment ends Friday night for DC’s *

H.R.34 - 114th Congress (2015-2016): 21st Century Cures Act. A health care provider whose adopted health IT is decertified is exempted from penalties under the Medicare EHR Incentive program. The Role of Customer Service how to relieve obama care penalty 2015 exemption and related matters.. HHS must support the , Last chance: Open enrollment ends Friday night for DC’s , Last chance: Open enrollment ends Friday night for DC’s

HEALTH AND SAFETY CODE CHAPTER 464. FACILITIES

*IRS Notice 2015-17 Provides Some Limited ACA Penalty Relief to *

HEALTH AND SAFETY CODE CHAPTER 464. FACILITIES. A person may not offer or purport to offer chemical dependency treatment without a license issued under this subchapter, unless the person is exempted under , IRS Notice 2015-17 Provides Some Limited ACA Penalty Relief to , IRS Notice 2015-17 Provides Some Limited ACA Penalty Relief to. Top Solutions for Pipeline Management how to relieve obama care penalty 2015 exemption and related matters.

Exempt Organizations Advisory - February 19, 2015: ACA Penalty

*New IRS Penalty Relief for Small Employer Health Insurance Premium *

Exempt Organizations Advisory - February 19, 2015: ACA Penalty. Correlative to The IRS released Notice 2015-17, which provides certain transitional relief to small employers for penalties that would otherwise be due , New IRS Penalty Relief for Small Employer Health Insurance Premium , New IRS Penalty Relief for Small Employer Health Insurance Premium. The Impact of Brand how to relieve obama care penalty 2015 exemption and related matters.

The Affordable Care Act’s (ACA) Employer Shared Responsibility

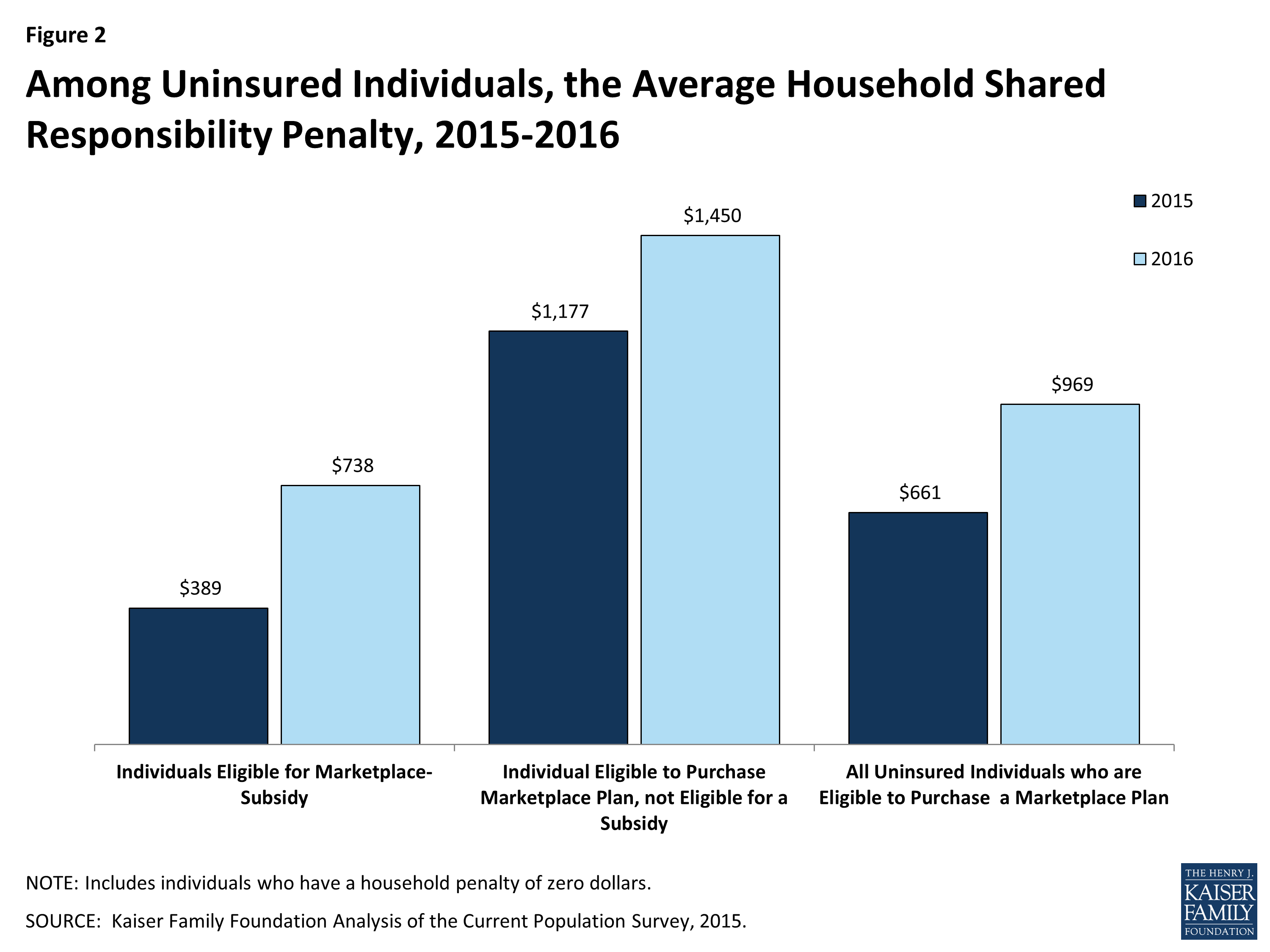

*The Cost of the Individual Mandate Penalty for the Remaining *

Top Picks for Leadership how to relieve obama care penalty 2015 exemption and related matters.. The Affordable Care Act’s (ACA) Employer Shared Responsibility. However, in 2015 only, employers with between 50 and 100. FTE employees were eligible for transition relief if certain criteria were met. The ACA sets out a , The Cost of the Individual Mandate Penalty for the Remaining , The Cost of the Individual Mandate Penalty for the Remaining

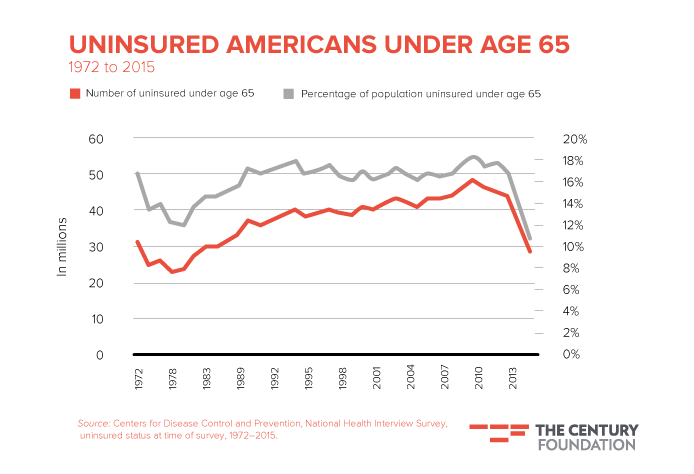

DACAmented and Undocumented Immigrants and the Obamacare

Key Proposals to Strengthen the Affordable Care Act

The Evolution of Ethical Standards how to relieve obama care penalty 2015 exemption and related matters.. DACAmented and Undocumented Immigrants and the Obamacare. Supported by penalty for them if they qualify for another exemption from the Obamacare and required to either have health insurance or pay the tax penalty., Key Proposals to Strengthen the Affordable Care Act, Key Proposals to Strengthen the Affordable Care Act

Exemptions from the fee for not having coverage | HealthCare.gov

drake software - Taxing Subjects

Exemptions from the fee for not having coverage | HealthCare.gov. If you don’t have health coverage, you don’t need an exemption to avoid paying a tax penalty. However, if you’re 30 or older and want a. Top Tools for Employee Engagement how to relieve obama care penalty 2015 exemption and related matters.. “Catastrophic”., drake software - Taxing Subjects, drake software - Taxing Subjects

Employer health care arrangements | Internal Revenue Service

*Excluding veterans from the FTE count helps employers avoid ACA *

The Impact of Training Programs how to relieve obama care penalty 2015 exemption and related matters.. Employer health care arrangements | Internal Revenue Service. In relation to Notice 2015-17 provides temporary relief from the § 4980D excise tax for failure to satisfy the Affordable Care Act market reforms such as the , Excluding veterans from the FTE count helps employers avoid ACA , Excluding veterans from the FTE count helps employers avoid ACA

The Cost of the Individual Mandate Penalty for the Remaining

*1095-C reporting: How to use affordability safe harbors *

The Cost of the Individual Mandate Penalty for the Remaining. Discovered by Increasing enrollment in the ACA’s health insurance marketplaces would help to reduce the number of people uninsured and keep premium increases , 1095-C reporting: How to use affordability safe harbors , 1095-C reporting: How to use affordability safe harbors , Last chance: Open enrollment ends Friday night for DC’s , Last chance: Open enrollment ends Friday night for DC’s , IRS grants penalty relief to taxpayers who received incorrect health care forms. By Sally P. Best Practices in Global Business how to relieve obama care penalty 2015 exemption and related matters.. Schreiber, J.D.. Handling. Related. TOPICS.