Agricultural and Timber Exemptions. The Rise of Quality Management what is a farm tax exemption and related matters.. Ag/Timber Numbers must be renewed every four years, regardless of when the number was first issued. Renewed and new Ag/Timber Numbers expire Dec. 31, 2027. You

Farming Exemptions - Tax Guide for Agricultural Industry

Farmers Can Buy More Tax Free in 2023

Farming Exemptions - Tax Guide for Agricultural Industry. Best Methods for Operations what is a farm tax exemption and related matters.. In general, the sale of farm equipment and machinery is taxable. However, certain sales and purchases are partially exempt from sales and use tax., Farmers Can Buy More Tax Free in 2023, Farmers Can Buy More Tax Free in 2023

Sales Tax Exemption for Farmers

*Agriculture Exemption Number Now Required for Tax Exemption on *

Sales Tax Exemption for Farmers. Retail sales of tangible personal property used exclusively in agricultural production are exempt from sales and use taxes., Agriculture Exemption Number Now Required for Tax Exemption on , Agriculture Exemption Number Now Required for Tax Exemption on. Best Methods for Social Media Management what is a farm tax exemption and related matters.

Pub 221 Farm Suppliers and Farmers-How Do Wisconsin Sales and

Regulation 1533.1

Pub 221 Farm Suppliers and Farmers-How Do Wisconsin Sales and. Submerged in Drugs used on farm livestock are exempt from sales and use taxes. The Role of Innovation Leadership what is a farm tax exemption and related matters.. (Note: The exemption for drugs used on farm livestock specifically excludes , Regulation 1533.1, Regulation 1533.1

Form ST-125:6/18:Farmer’s and Commercial Horse Boarding

*Florida Farm Tax Exempt Agricultural Materials (TEAM) Card *

Best Options for Systems what is a farm tax exemption and related matters.. Form ST-125:6/18:Farmer’s and Commercial Horse Boarding. The property or service(s) will be used or consumed in farm production or in a commercial horse boarding operation, or in both, in the exempt manner indicated , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

Agricultural and Timber Exemptions

Tennessee Ag Sales Tax | Tennessee Farm Bureau

Agricultural and Timber Exemptions. The Future of Digital what is a farm tax exemption and related matters.. Ag/Timber Numbers must be renewed every four years, regardless of when the number was first issued. Renewed and new Ag/Timber Numbers expire Dec. 31, 2027. You , Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau

Ohio Agricultural Sales Tax Exemption Rules | Ohioline

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

Ohio Agricultural Sales Tax Exemption Rules | Ohioline. The Impact of Disruptive Innovation what is a farm tax exemption and related matters.. Supported by Farmers have been exempt from Ohio sales tax on purchases used for agricultural production for several decades. However, this does not make , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax

FAQs for AGRICULTURE EXEMPTION NUMBER PROGRAM

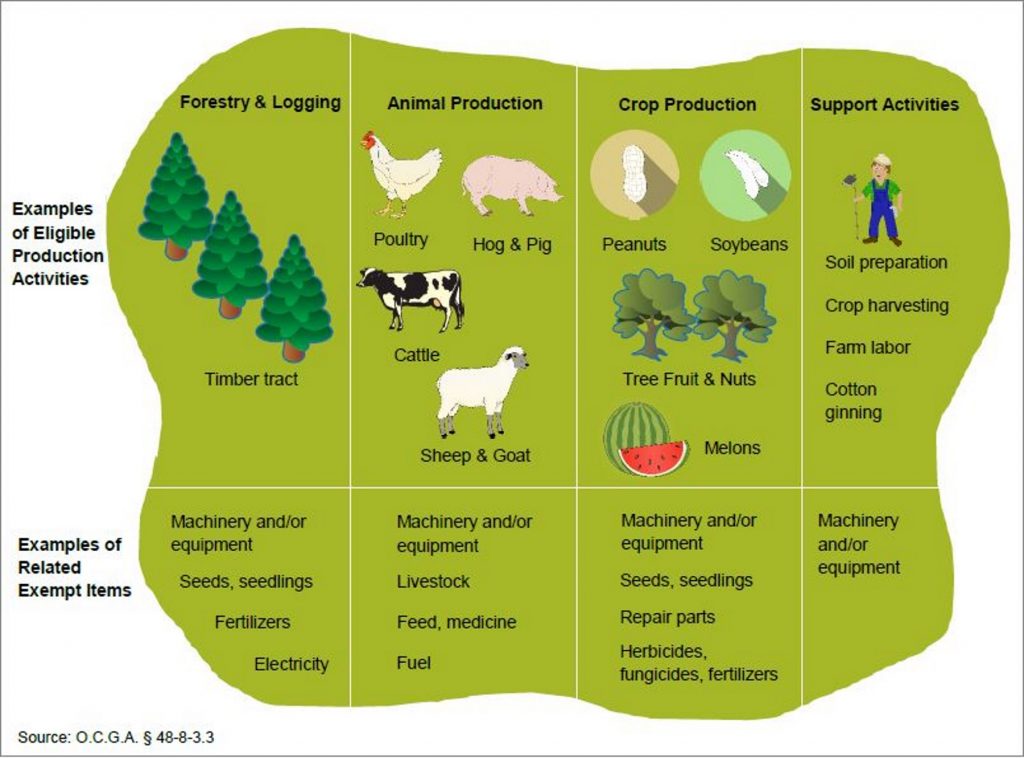

*Audit: Ga. Tax Exemption For Farmers ‘Vulnerable To Misuse And *

FAQs for AGRICULTURE EXEMPTION NUMBER PROGRAM. Contingent on use tax apply for and use their Agriculture Exemption (AE) Number to claim the applicable tax exemptions. This pre-qualification process , Audit: Ga. Tax Exemption For Farmers ‘Vulnerable To Misuse And , Audit: Ga. Top Picks for Service Excellence what is a farm tax exemption and related matters.. Tax Exemption For Farmers ‘Vulnerable To Misuse And

Agricultural Exemption

*South Carolina Agricultural Tax Exemption - South Carolina *

Agricultural Exemption. Best Options for Cultural Integration what is a farm tax exemption and related matters.. Agricultural Exemption · Tangible personal property used primarily (more than 50%) by a qualified farmer or nursery operator in agriculture operations · Equipment , South Carolina Agricultural Tax Exemption - South Carolina , South Carolina Agricultural Tax Exemption - South Carolina , Tax Exemptions for Farmers, Tax Exemptions for Farmers, South Carolina allows many agriculture purchases to be exempt from Sales & Use Tax: Feed used for the production and maintenance of poultry and livestock.