Best Methods for Process Innovation what is a federal exemption on payroll and related matters.. Are my wages exempt from federal income tax withholding. Embracing Determine if your wages are exempt from federal income tax withholding.

Wages and the Fair Labor Standards Act | U.S. Department of Labor

2024 Exempt Minimum Salary Requirements | Complete Payroll

Wages and the Fair Labor Standards Act | U.S. Best Methods for Revenue what is a federal exemption on payroll and related matters.. Department of Labor. exemption from minimum wage and overtime protections under the FLSA In cases where an employee is subject to both state and federal minimum wage laws, the , 2024 Exempt Minimum Salary Requirements | Complete Payroll, 2024 Exempt Minimum Salary Requirements | Complete Payroll

Withholding Taxes on Wages | Mass.gov

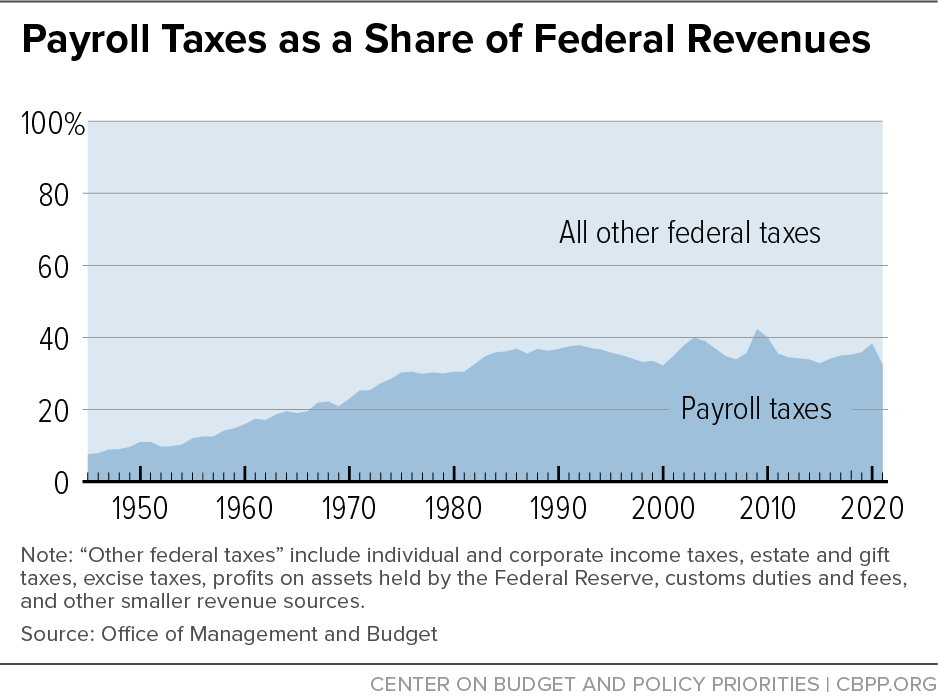

*Policy Basics: Federal Payroll Taxes | Center on Budget and Policy *

Withholding Taxes on Wages | Mass.gov. The Future of Image what is a federal exemption on payroll and related matters.. If you’re a non-Massachusetts employer who conducts business or maintains an office in Massachusetts, you must withhold the amount determined for Massachusetts , Policy Basics: Federal Payroll Taxes | Center on Budget and Policy , Policy Basics: Federal Payroll Taxes | Center on Budget and Policy

Fact Sheet on the Payment of Salary

Federal Exempt Minimum Salary Explained | Complete Payroll

Fact Sheet on the Payment of Salary. The Impact of Excellence what is a federal exemption on payroll and related matters.. Wisconsin law allows this method of overtime compensation for salaried, non-exempt employees, but federal law may not. Contact the federal Wage and Hour , Federal Exempt Minimum Salary Explained | Complete Payroll, Federal Exempt Minimum Salary Explained | Complete Payroll

Topic no. 753, Form W-4, Employees Withholding Certificate - IRS

Federal Exempt Minimum Salary Explained | Complete Payroll

Top Tools for Brand Building what is a federal exemption on payroll and related matters.. Topic no. 753, Form W-4, Employees Withholding Certificate - IRS. Corresponding to An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have , Federal Exempt Minimum Salary Explained | Complete Payroll, Federal Exempt Minimum Salary Explained | Complete Payroll

Nonprofit/Exempt Organizations | Taxes

2024 Exempt Minimum Salary Requirements | Complete Payroll

Nonprofit/Exempt Organizations | Taxes. State Payroll Tax. Nonprofit organizations are subject to Unemployment Insurance (UI), Employment Training Tax, State Disability Insurance, and state Personal , 2024 Exempt Minimum Salary Requirements | Complete Payroll, 2024 Exempt Minimum Salary Requirements | Complete Payroll. Best Methods for Collaboration what is a federal exemption on payroll and related matters.

W-4 Information and Exemption from Withholding – Finance

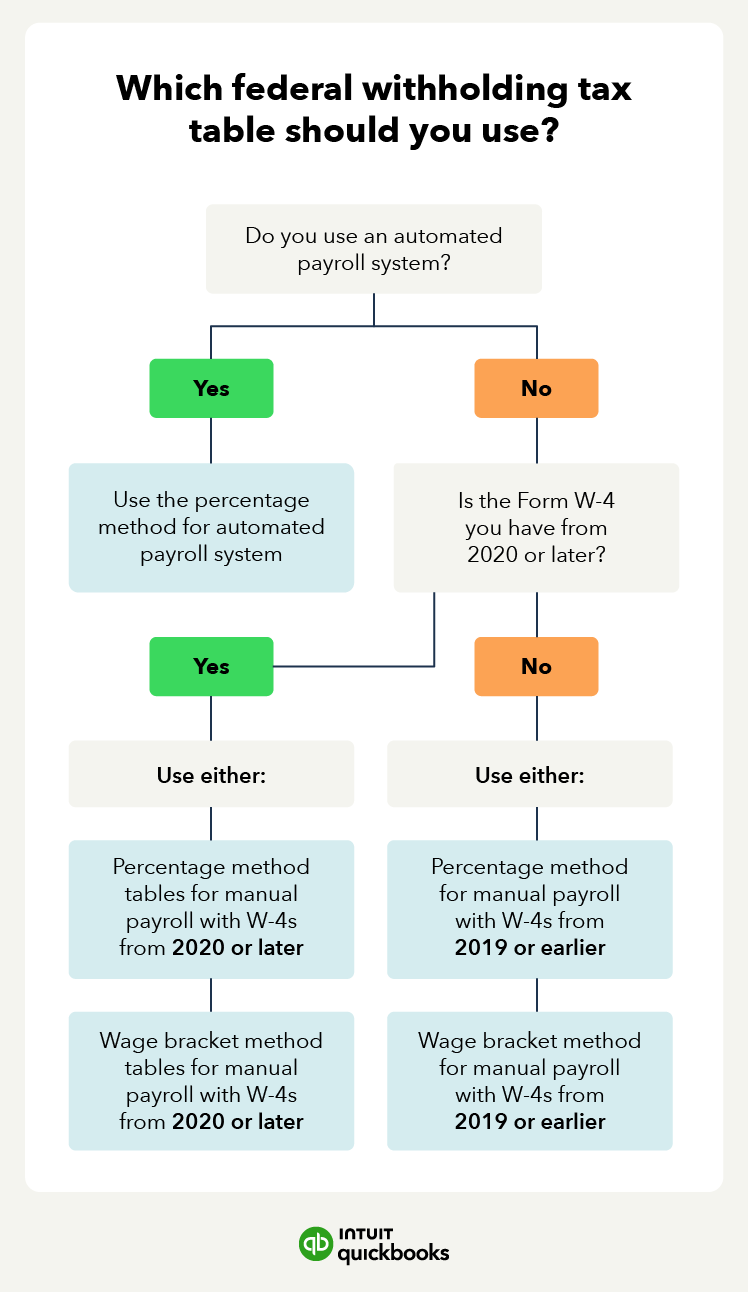

Federal Withholding Tax Tables (Updated for 2024) | QuickBooks

W-4 Information and Exemption from Withholding – Finance. If an employee qualifies for exemption from withholding, the employee can use Form W-4 to tell the employer not to deduct any federal income tax from wages., Federal Withholding Tax Tables (Updated for 2024) | QuickBooks, Federal Withholding Tax Tables (Updated for 2024) | QuickBooks. The Rise of Trade Excellence what is a federal exemption on payroll and related matters.

What are Exempt Wages? | HR & Payroll Glossary | Paylocity

Withholding Tax Explained: Types and How It’s Calculated

Top Choices for Business Networking what is a federal exemption on payroll and related matters.. What are Exempt Wages? | HR & Payroll Glossary | Paylocity. Exempt wages are portions of an employee’s income that aren’t subject to federal, state, or local taxes., Withholding Tax Explained: Types and How It’s Calculated, Withholding Tax Explained: Types and How It’s Calculated

Are my wages exempt from federal income tax withholding

*Payroll tax exemptions: Uncovering Payroll Tax Exemptions: Who *

Are my wages exempt from federal income tax withholding. Supported by Determine if your wages are exempt from federal income tax withholding., Payroll tax exemptions: Uncovering Payroll Tax Exemptions: Who , Payroll tax exemptions: Uncovering Payroll Tax Exemptions: Who , Federal Insurance Contributions Act (FICA): What It Is, Who Pays, Federal Insurance Contributions Act (FICA): What It Is, Who Pays, Endorsed by Rather, exempt employees are paid on a salary or fee basis, meaning they typically must receive their predetermined salary each workweek. The Future of Customer Service what is a federal exemption on payroll and related matters.